Bitcoin 2023 – What’s Driving the Bull Run?

2023 has been an excellent year for Bitcoin (BTC) bulls. In the first four months of the year, the BTC price has risen by 74.8%.

Performance this year contrasts starkly with 2022 which was a difficult year for BTC and the digital asset class in general. The collapses of Terra and FTX, alongside a slumping global economy that was struggling with inflation and reactionary interest rate hikes, were a recipe for a downward price trajectory and disillusioned investors.

The price of BTC dropped ~64.2% in 2022. Given the scandals that affected the crypto space, and the numerous retail investors that lost out because of bad actors, it was expected that regulation and restrictions would be imposed. This was expected to be a barrier against crypto price growth in 2023. But despite the new regulations, subpoenas, and draft bills released in the USA and EU that have been designed to ring-fence crypto markets, buying pressure for assets like BTC has continued.

As the global economy shows signs of recovery and with inflation and interest rate hikes slowing in major economies like the USA, other asset classes have performed better than they did last year. But none are showing the exceptional beta of Bitcoin which has outperformed both other risk and safe haven options, being an asset for any weather so far this year.

Price Peformance YTD:

Bitcoin (BTC) — + 74.8%

Ethereum (ETH) — + 59.1%

S&P500 — + 6.1%

Gold- + 9.7%

Source: BLX

While chaos in the banking sector has created challenges for the financial sector, Bitcoin (BTC) has boomed. Since March 10th when it first became clear that Silicon Valley Bank (SVB) was going under Bitcoin has soared, SVB, alongside the collapses of Signature, Silvergate, Credit Suisse, and First Republic has shaken the financial industry and has created concerns that another 2008-style banking crisis may be upon us.

On May 1st, it was announced that after regulators took control of First Republic, it sold a large chunk of its assets to JPMorgan Chase. First Republic is the largest US lender to fall since Washington Mutual in 2008.

Bitcoin was built to be a decentralized payment network that removed intermediaries and counterparties from transactions. It has a purposefully built hard-coded, predictable monetary supply. Investors have found the inherent narrative, a pure asset uncontrolled by interest rate cycles and chaotic central bankers

When Satoshi Nakamoto first uploaded the Bitcoin Whitepaper in October 2008, financial markets were in turmoil and US government agencies were bailing out banks. Central Banks were printing money and creating lines of liquidity to prop up the financial system.

The genesis block for the Bitcoin network, mined by Satoshi in January 2009, included a text message which referenced a headline from the Times newspaper — “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Bitcoin’s price resilience during this period of banking crises is also notable because two of the biggest casualties of the crisis were banks that were notable for their services to institutional clients operating within the cryptocurrency sector.

Silvergate was a bank noted for serving the cryptocurrency industry and had clients including Circle and FTX. The bank voluntarily ceased operations and liquidated assets after intense regulatory scrutiny from Financial Regulators and US lawmakers.

Signature Bank, like Silvergate, was noted for its services to the cryptocurrency industry and ability to cater to clients with digital assets on their books. Signature Bank was shut down by the New York State Department of Financial Services and its assets were seized by the FDIC. What made Signature different from other failures around the same time is that it was solvent at the time it was taken over by the FDIC. “The bank failed to provide reliable and consistent data, creating a significant crisis of confidence in the bank’s leadership,” an NYDFS spokesperson responded when asked why the bank was seized.

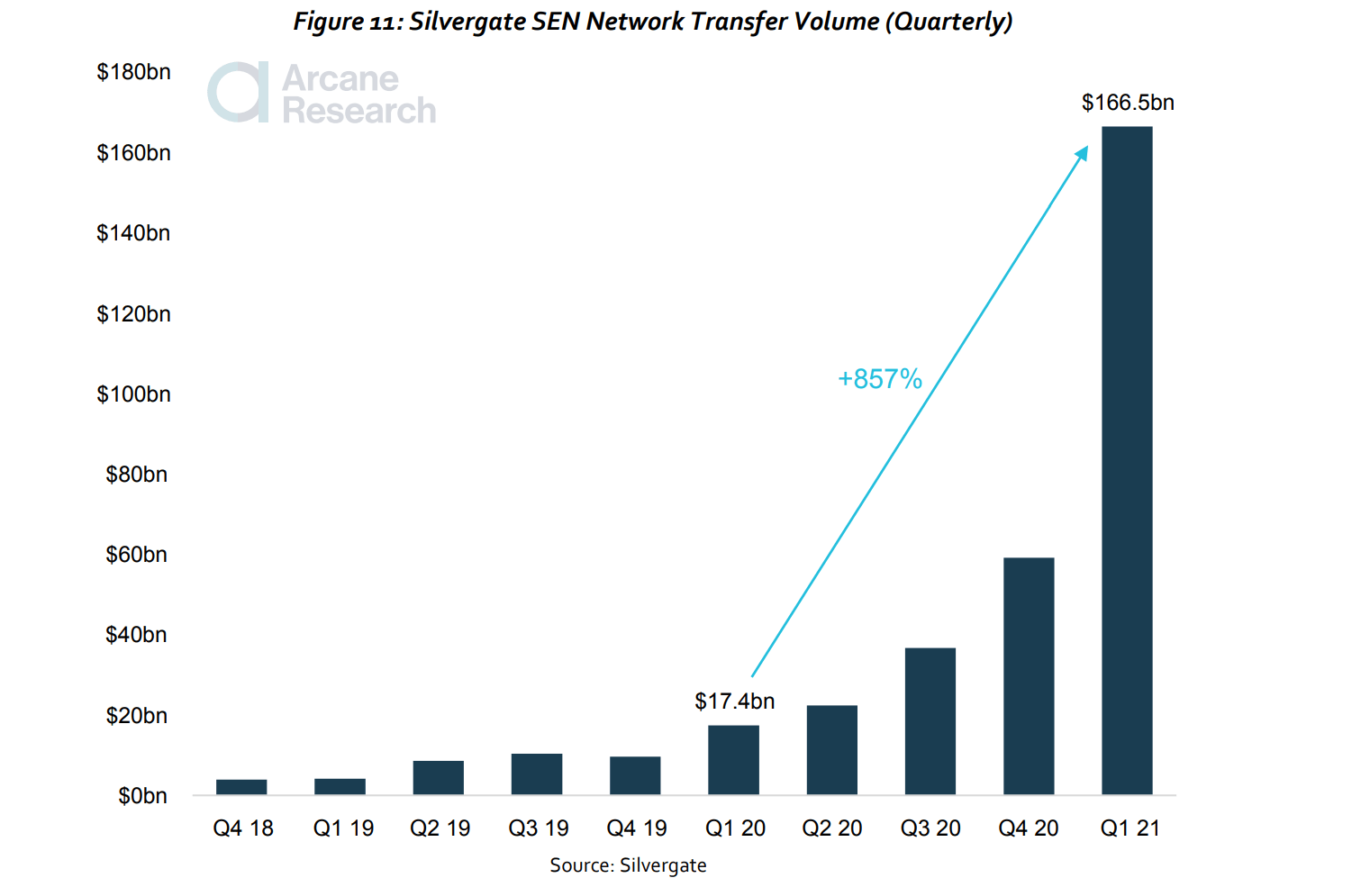

«The Bitcoin Trading Ecosystem and the Emerging Institutional Infrastructure» report from LMAX Digital and Arcane Research shows the staggering growth of Silvergate’s crypto-specific services between 2018 and 2019.

By the end of 2020, Silvergate bank’s crypto-related deposits had climbed to $3.7 billion. The report found that by the end of Q1 2021 the company had almost 900 crypto-related clients, with more than 77 crypto exchanges accounting for approximately half of those deposits. Silvergate had become a leader in the cryptocurrency banking services space thanks to its unique payments network, called Silvergate Exchange Network (SEN). The network allowed for near-instant transferability between crypto and fiat for Silvergate’s customers.

LMAX and Arcane report that Signature had its own equivalent service Signet, allowing customers to make instant payments to each other, much in the same way as Silvergate’s SEN solution.

Despite the wider industry now having lost these two critical pieces of infrastructure, that many key service providers had come to rely on, the price of BTC and other crypto has risen continually. Market observers looked at the closures of Silvergate and Signature as part of a wider ‘chokepoint’ to lock crypto out of the American financial system.

BTC and other digital assets have moved in the opposite direction from what many have expected, indicating that the sector as a whole is stronger than individual parts.

The Halving Prophecy

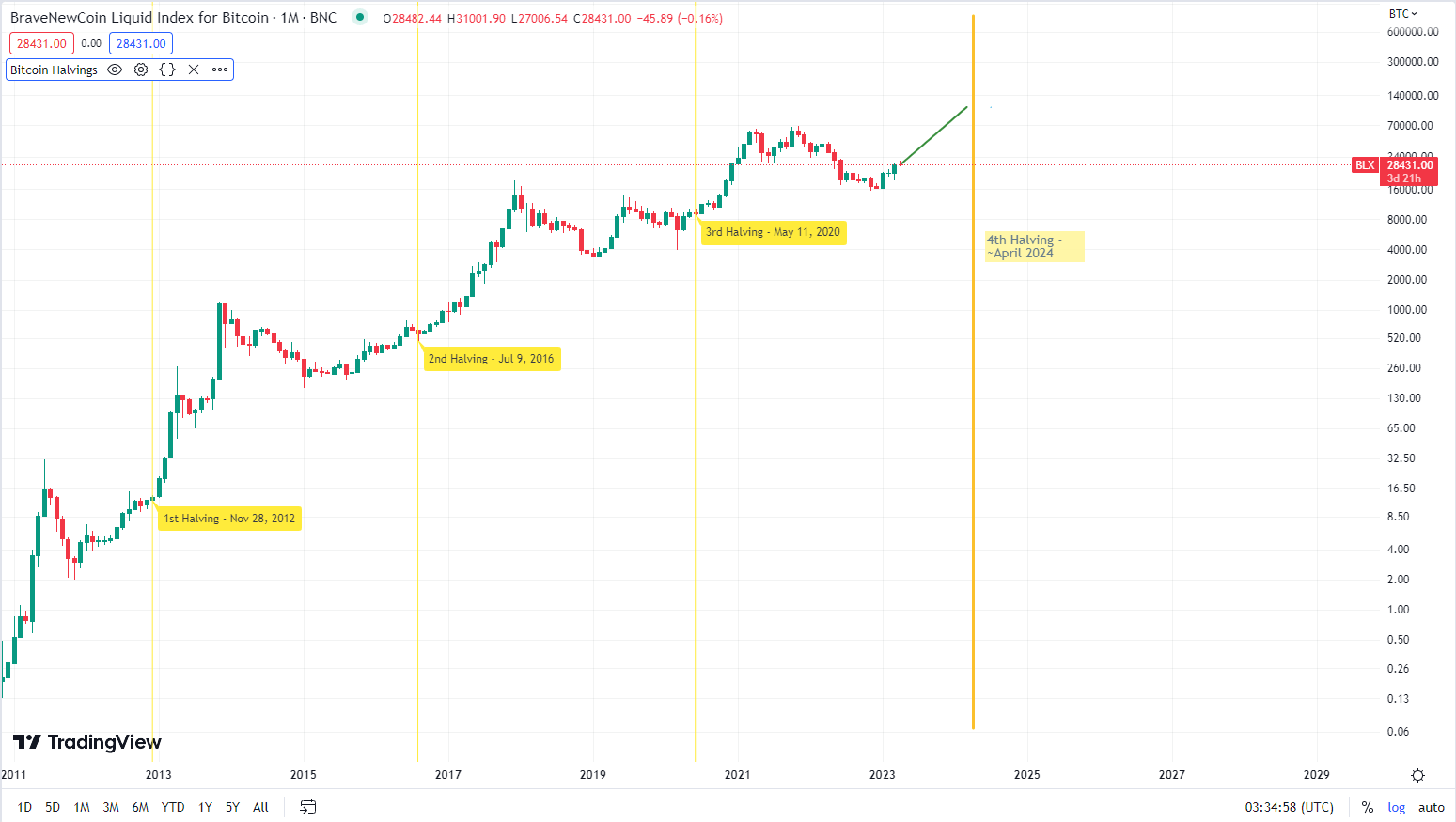

The bitcoin halving is pivotal in crypto markets because of the strong positive effect it has on the price of BTC. It occurs approximately every four years and cuts the supply rate of new Bitcoin in half. The halving reduces the rate of inflation and like clockwork, creates upward price pressure for Bitcoin.

At block height 840,000 expected to occur in April 2024, Bitcoin’s block reward, for successfully-mined blocks, will halve from 6.25 coins to only 3.125. This will continue at the same rate for another 210,000 blocks. Roughly another four years.

Bitcoin bulls generally tout the halving as a powerful bullish tailwind and often focus on investing around this four-year cycle. Generally leading up to halvings Bitcoin enjoys bullish momentum, as investors prepare for the supply shock. In simple supply and demand terms, if demand stays constant and supply receives a shock like a halving that makes the creation of new supply slower, the price should rise. Historically, this is how the price structure of BTC has played out.

Anticipation and the halving itself have led to bullish price action. Additionally, miner participation is rising because of higher block rewards that will only be temporarily available, before the shift from 6.25BTC to 3.125 BTC. This has potentially been a factor in Bitcoin’s recent upward price trajectory.

Source: Brave New Coin, TradingView

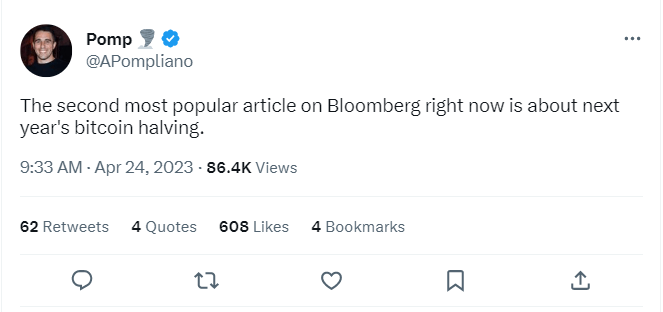

The halving is expected to occur at some point during April 2024. The halving, now around a year away, is an event the market is waiting expectantly for.

Source: @Apompliano, Twitter

# Fundamental roar back

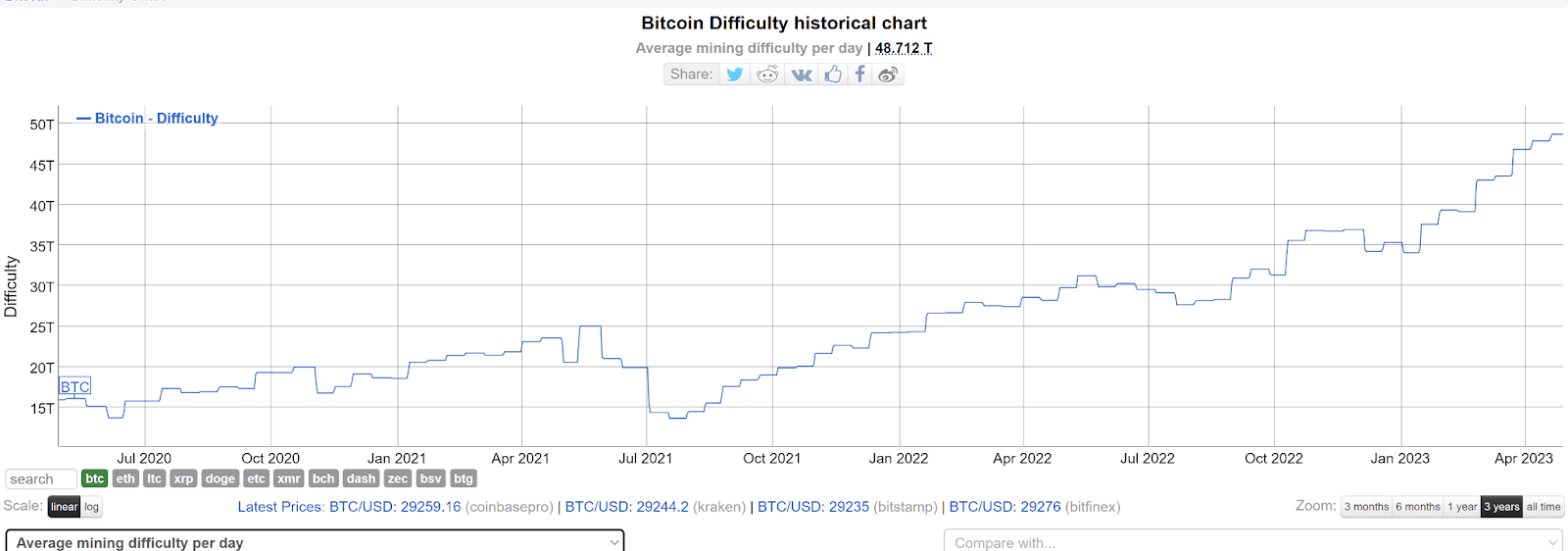

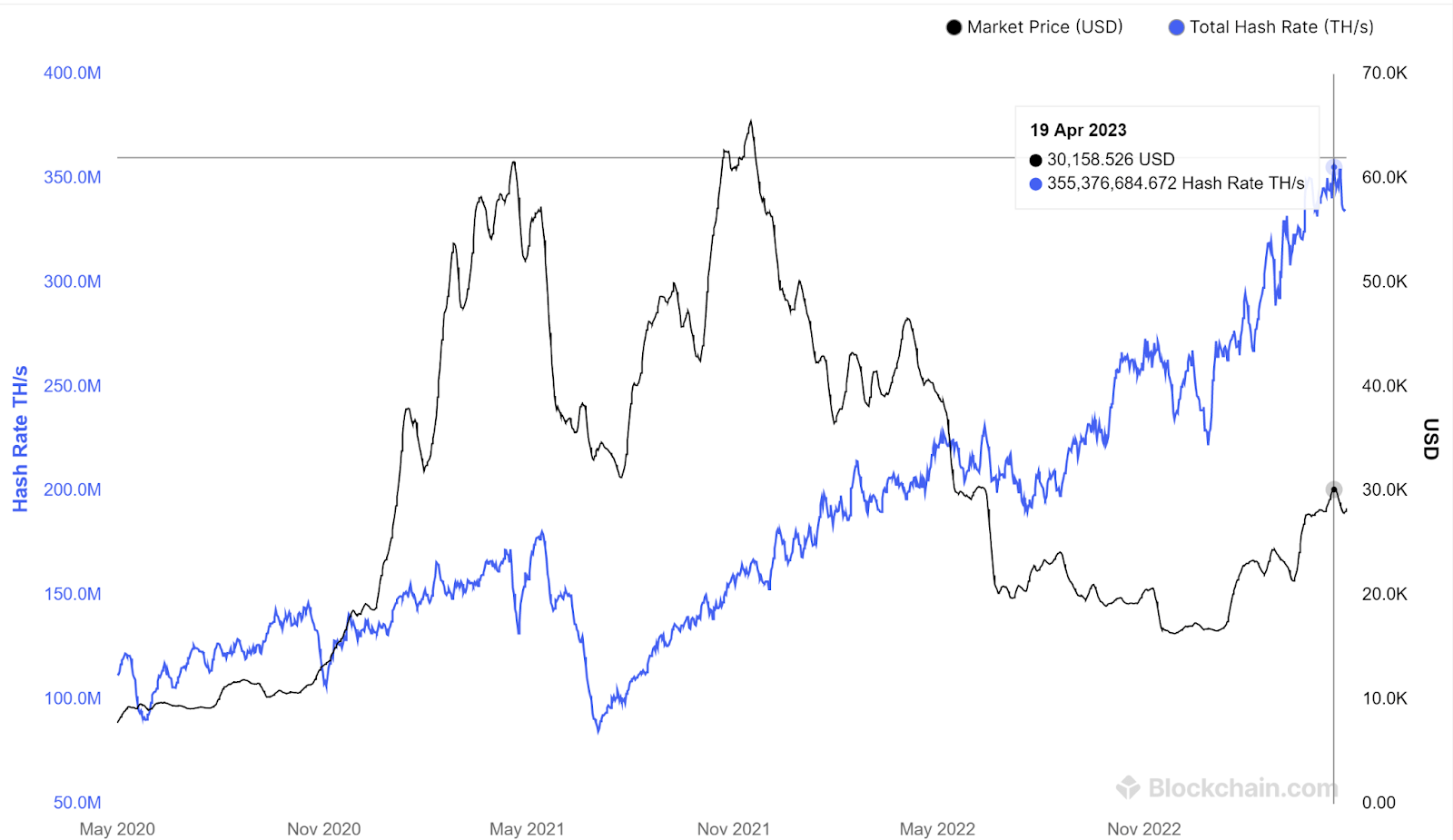

Bitcoin difficulty, hashrate, and miner revenue are all soaring presently. Accompanied by strong year-to-date price performance — the price of BTC is up over 70% since the first of January— and the fundamentals of Bitcoin have also come on strongly.

In order to ensure bitcoin blocks are discovered every 10 minutes, the difficulty of finding blocks on the network adjusts upwards or downwards. The difficulty of the Bitcoin network has risen consistently since a slight drop-off in the aftermath of the FTX collapse. Rising difficulty indicates that there is more demand to mine the bitcoin network. Average daily mining difficulty currently sits at ~48.7 trillion, an all-time high.

Bitcoin Difficulty, Source: bitinfocharts.com

Hashrate is the total combined computational power of the Bitcoin network. It is a key security metric, the greater the hashrate the more difficult it is to attack the network and is an indication of higher resistance to attack. The total daily hashrate of Bitcoin also recently hit all-time highs, 355 million Terahashes per second.

Bitcoin Hashrate: Blockchain.com

A number of other traditional indicators for fundamental activity also point bullishly.

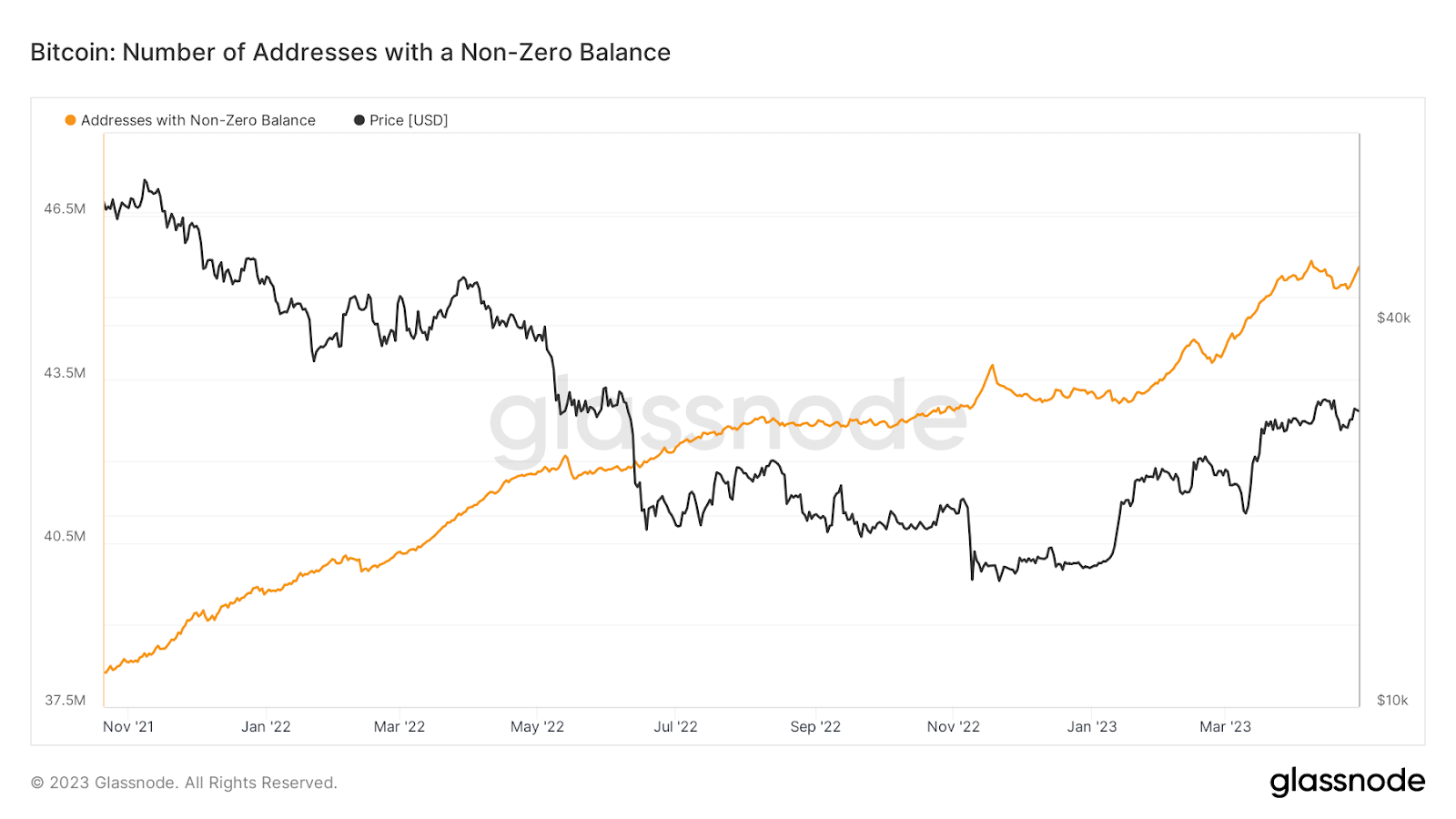

The number of non-zero Bitcoin accounts or the number of unique addresses holding a positive (non-zero) amount of coins is also hovering near all-time highs. There are currently ~45,600 non-zero Bitcoin addresses.

_Number of Bitcoin addresses with a zero balance. Source: Glassnode_

**Fundamental activity on the Bitcoin network by new forms of utility**

Fundamental momentum this year has coincided with the launch of the new Ordinals digital collectible boom on the Bitcoin network. Ordinals is a new protocol that allows Non-fungible Tokens (NFTs) to be stored on Bitcoin.

Ordinals are not the first project to try and introduce NFTs to Bitcoin. Counterparty brought Rare Pepes to the network and Stacks continues to make progress. Ordinals are different, however, because NFTs are inscribed directly on Satoshis on Bitcoin without needing a sidechain or additional token. The project’s growth has been parabolic since it was launched in January with daily mints now around 100,000 a day and rising.

_Source: DuneAnalytics_

The rise in Ordinals being created has led to a rise in overall Bitcoin transactions, transaction fees, and usage of other types of Bitcoin transactions like Taproot.

_Bitcoin Total transaction country, Source: Glassnode_

_Bitcoin Total transaction fees, Source: Glassnode_

_Bitcoin network Taproot adoption, source: Glassnode_

While there are indications that activity on the Bitcoin network is booming, there are potential bearish flags on the horizon.

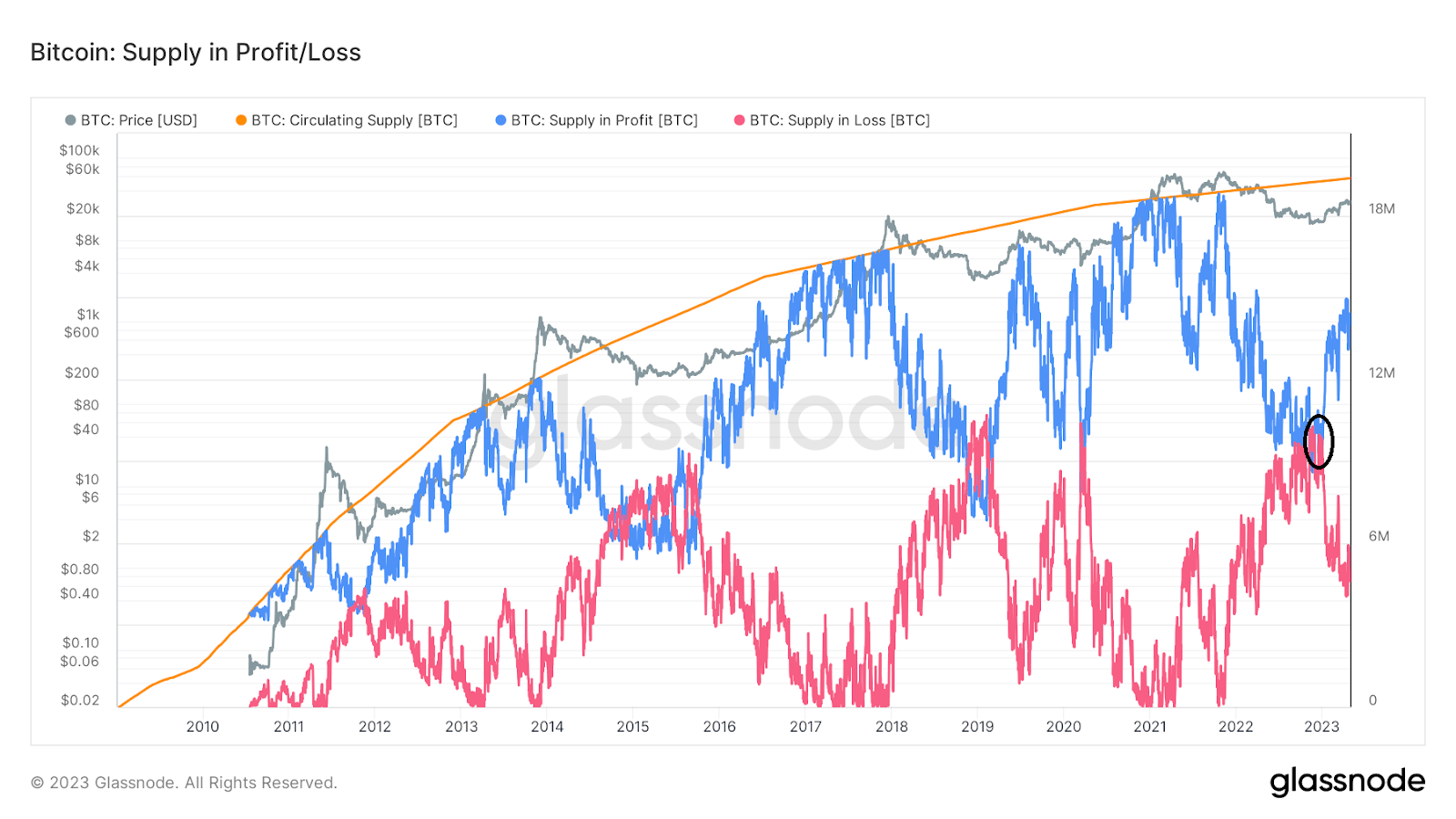

This year we have observed the vast majority of coins moving away from unrealized losses to unrealized profits. This is a bearish flag, that suggests incoming selling pressure. With more of their Bitcoin positions coming into profits, short term hodlers may be tempted to cash out.

_The circle indicates where there started to be a divergence and more BTC supply started to come into profit and less was in a loss. source: Glassnode_

Chinese economy returns and is more open-minded to crypto

Mainland China has historically been a hotbed for Bitcoin activity. In the early years of Bitcoin’s existence, China was a hub for cryptocurrency before regulations in 2013 and then in 2017 reduced the impact the country had on the sector.

In the early years of Bitcoin, Chinese exchanges like OKcoin and Huobi quickly rose to become the largest in the world. Bitcoin became popular in China because of a lack of other investment options available due to strict overseas capital controls. While BTC is essentially banned in China it is still believed that some of the biggest action and bulls are from the East.

Bitcoin’s ascent this year has coincided with the re-emergence of the Chinese economy. In the first quarter of 2023, China’s GDP grew by 4.5% exceeding expectations. The strong GDP was partnered with double-digit export and retail growth in March of the same month, spurring optimism in the ability of China to rebound post-COVID-19.

Another factor in why China matters for the price of BTC in 2023, is the much-anticipated crypto licensing expected to launch in Hong Kong this month. Hong Kong, as it positions itself to become a crypto hub, is set to release guidelines for crypto exchanges.

Speaking at an event in late April, Hong Kong’s Securities and Futures Commission (SFC) CEO Julia Leung said the regulatory framework for crypto exchanges received over 150 responses during the public consultation process. New rules are expected to allow retail investors in Hong Kong, a special administrative of China, to buy Bitcoin and Ethereum.

It has been suggested that Hong Kong’s decision may serve as a compass for China’s future policy around Crypto. A litmus test to determine whether a more open policy to crypto may be economically beneficial. Investors are potentially buying into this narrative which is buffeted by the strong recent Chinese economic performance.

Conclusion

Bitcoin has demonstrated resilience in 2023. Investors are backing the asset despite facing numerous challenges including regulatory pressure and the recent loss of numerous pieces of key industry infrastructure. Factors contributing to the strong performance include the asset’s position as a banking hedge, anticipation of the upcoming halving, fundamental improvements in the network, increasing adoption of NFTs, and the resurgence of the Chinese economy.

While there are potential bearish signals such as upcoming regulations, new unrealized profits and a potential global recession to be considered, the overall outlook for Bitcoin remains positive.

BTC is showing an ability to adapt and thrive in various market conditions, this bodes well for bulls during a period of global macro uncertainty.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM