Bitcoin Back Above $28,000, But DXY Spoils Short-Term Outlook

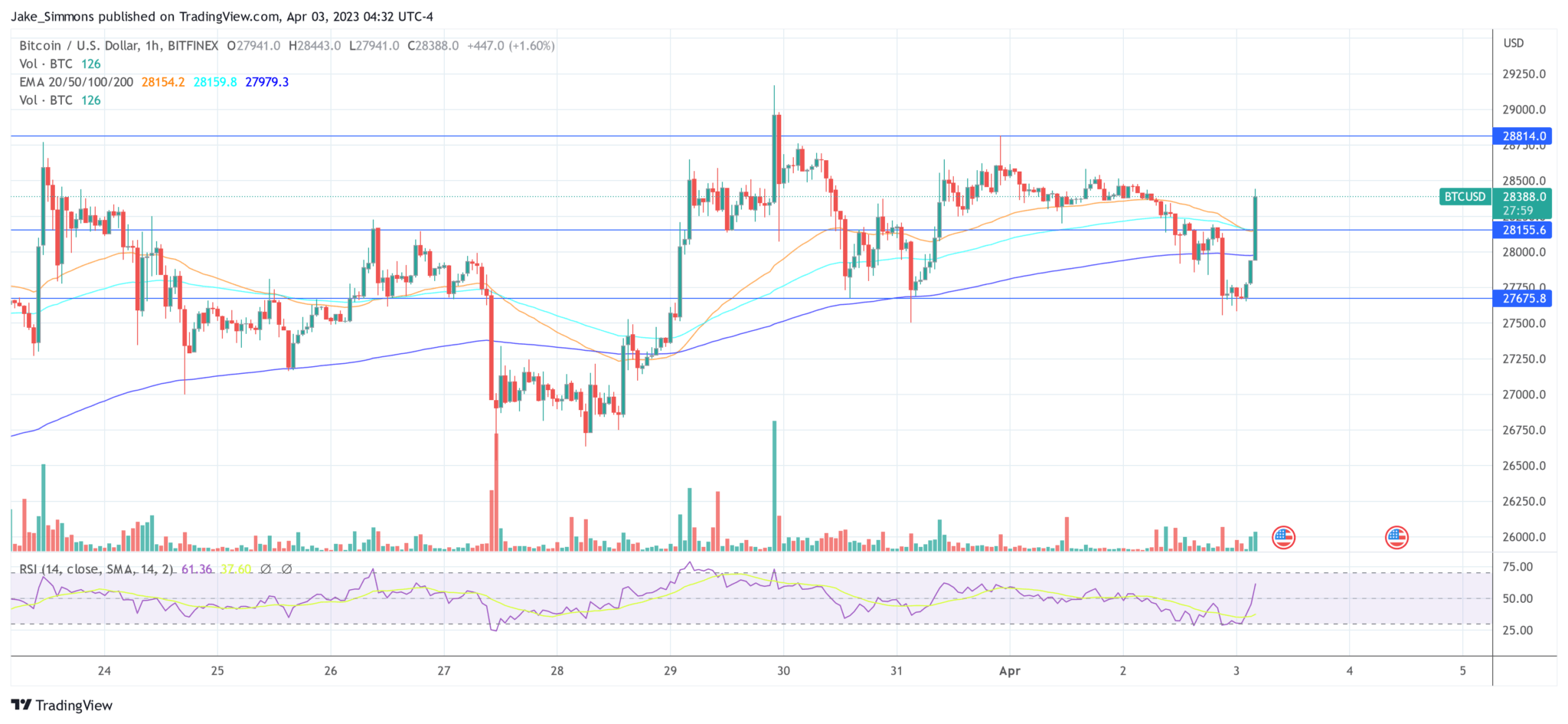

The Bitcoin price plunged 2.2% at the beginning of the trading session in Asia, but managed to hold the important support at $27,700. However, a breakout of the US Dollar Index (DXY) could mean another pullback for the Bitcoin price in the short-term if the inverse correlation remains high.

Triggering the sudden rise in the DXY (and the fall in the BTC price) was the surprise news from OPEC+ on Sunday that members of the oil alliance announced a 1 million barrel cut in oil production. Saudi Arabia, which plans to produce 500,000 barrels per day less, is leading the voluntary initiative.

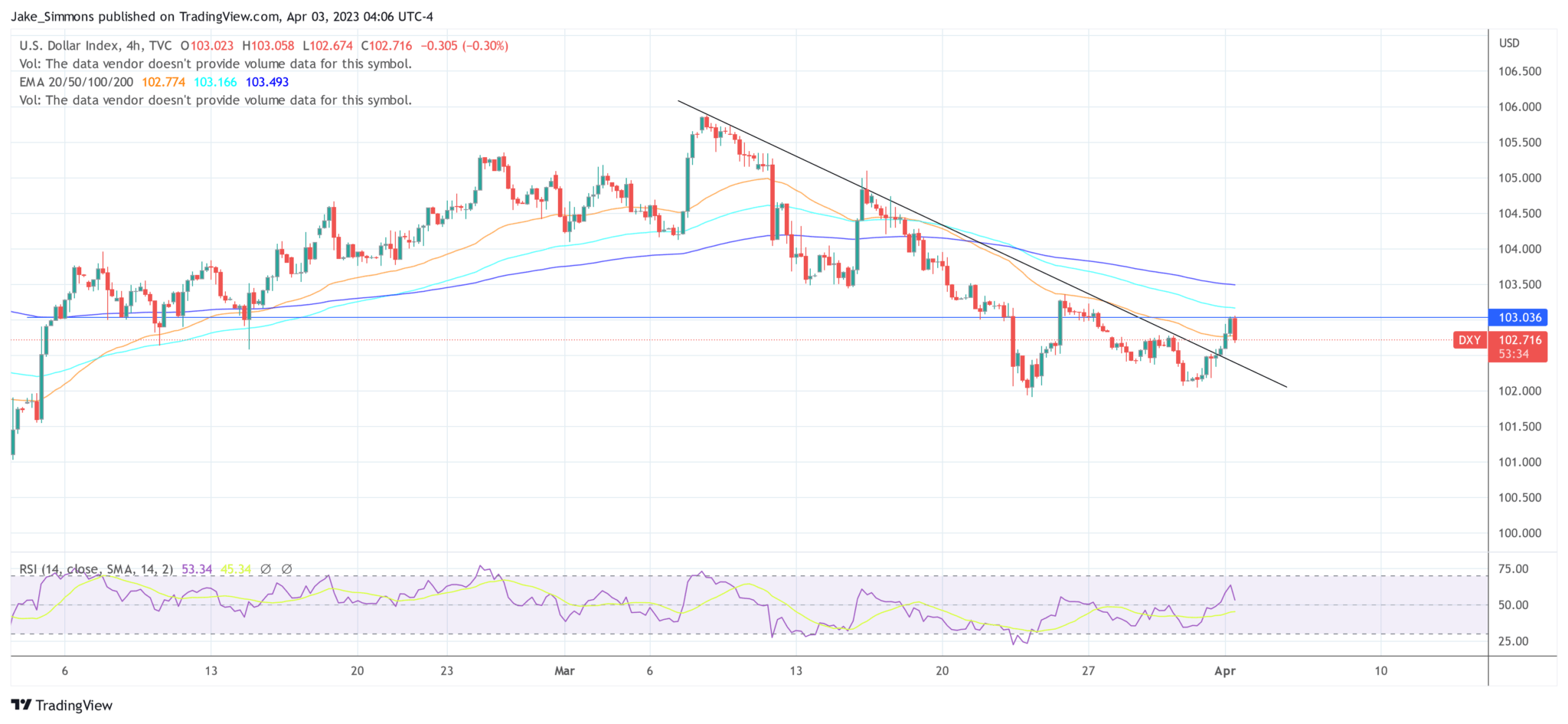

Brent crude jumped from $75.65 to over $81 earlier today and is currently trading at $79.71 (as of press time). As a result, the DXY jumped to over 103.0, causing the index to confirm a break out of the downtrend that has been in place since February 7.

The reason for this was provided by macro analyst Alex Krueger, who pointed to a quote from Jerome Powell in March 2022. According to this, the rule of thumb is that a $10 increase in oil prices leads to a 0.2% increase in inflation.

The rise in oil prices comes at a bad time: the core inflation rate (PCE) proved “sticky” last week, despite falling slightly. In addition, the US Strategic Petroleum Reserve (SPR) is at an all-time low, the banking crisis is far from over, and many experts are predicting a recession later this year based on the inverted yield curve, among other factors.

Related Reading: Bitcoin Market Structure Points To New Uptrend, Here’s Why

A look at the 4-hour chart shows the explosive move of the DXY, analogous to the oil price. Like the latter, the DXY has risen rapidly, but was initially rejected at the key resistance level of 103.05. However, if the DXY regains strength at the start of the US session, it is likely to be bad for the broader financial market and Bitcoin.

Bitcoin Pullback Before $35,000?

Glassnode co-founders, Yann Alleman and Jan Happel write in their latest analysis that if the DXY rises to 107-108 by early April, then Bitcoin can be expected to drop lower. This would also fit Bitcoin’s current setup and Elliott Wave count, which recently broke out of a cup & handle pattern to the upside.

Related Reading: USD Losing Its Reserve Status? What It Means For Bitcoin

According to the two Glassnode co-founders, a pullback to $25,200 would in no way hurt the very bullish setup for Bitcoin. By contrast, Alleman and Happel expect Bitcoin to continue climbing toward $35,000 and “later rise toward $45,000.” First, however, they say a setback is to be expected:

It would be normal and expected, following a break of the neckline around $25.2k to the upside, that bitcoin retests that level. This will likely be a wave 2 pullback, which may dip as deep (or even deeper) as $24k.

The reasoning behind this is that the DXY has started a smaller-degree c-wave of the B-wave in the correction since the correction began on March 23. “A bounce in DXY seems to be coming and it may take DXY to 106.8 or even 108.2,” the analysts write, expecting a local high in DXY in mid-April.

At press time, the Bitcoin price showed strong resilience after the Opec news influenced price drop, climbing above $28,000 again.

Featured image from iStock, charts from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur