Bitcоin

Bitcoin Balance on Exchange Sees Macro Decline

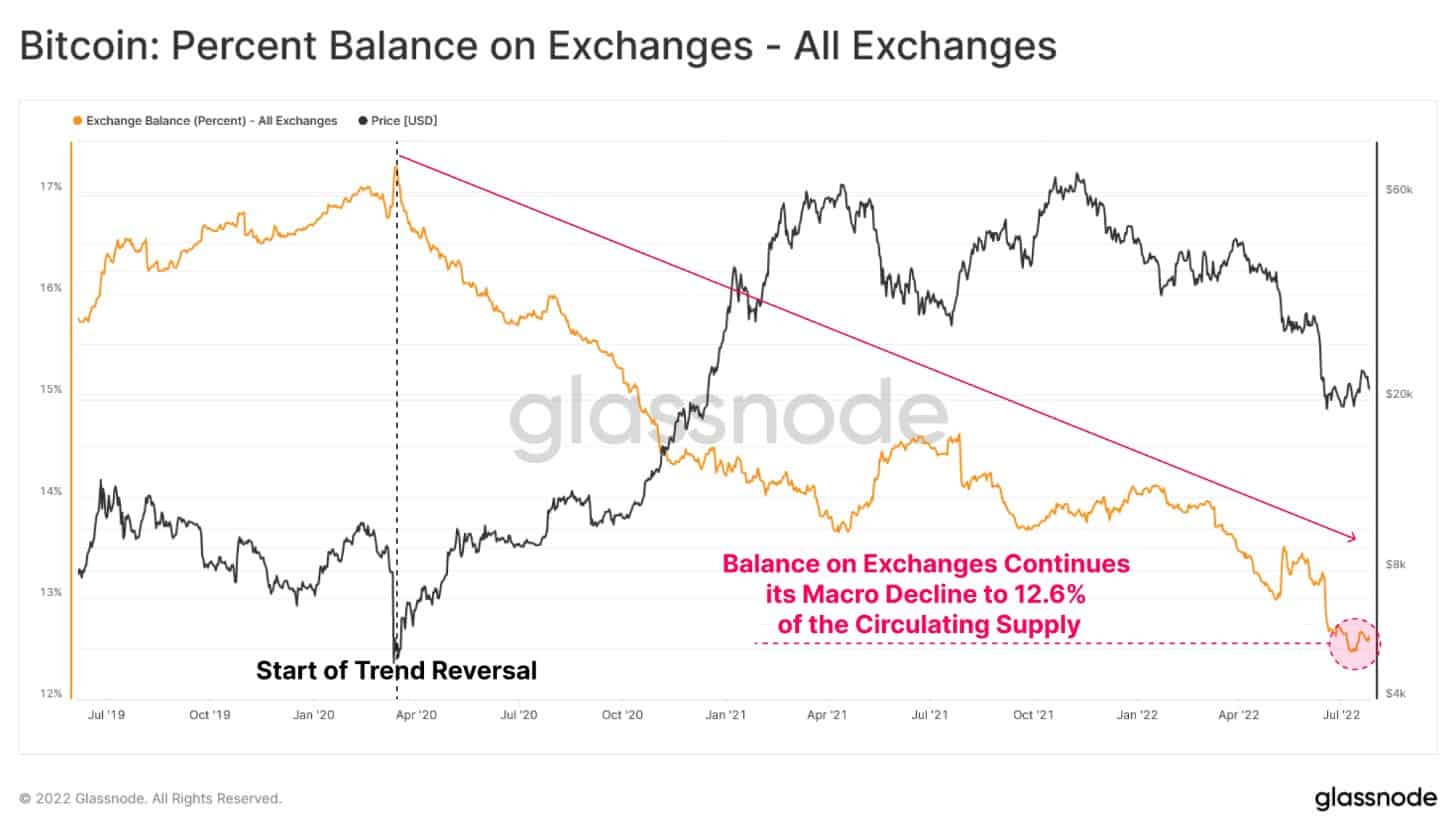

On-chain metrics reveal that Bitcoin balance on cryptocurrency exchanges continued its macro decline. The figures have reached 2.4 million BTC, which is around 12.6% of the circulating supply.

- According to Glassnode, Bitcoin exchange balances witnessed a macro outflow of more than 4.6% of the circulating supply after reaching an all-time high on March 2020.

- The balance on exchanges shrunk considerably in the last few months.

- This is a healthy sign of Bitcoin’s long-term performance and underscores a strong demand at lower price levels.

- The reversal in the trend first started in April.

- As the crypto winter deepens, some investors offloaded their wallets.

- However, on a macro level, players are still holding onto their tokens, but not on the exchanges.

- Instead, they are storing their coins offline in crypto wallets.

- The crypto analytic firm had earlier stated:

“Bitcoin has seen a near complete expulsion of market tourists, leaving the resolve of HODLers as the last line standing”

- The further decline comes in the wake of Bitcoin performing an impressive rally, increasing by over 15% over the past few days. At the time of this writing, the cryptocurrency trades at around $23,600.

- Previous reports suggested that the holders of the world’s largest cryptocurrency were in an accumulation mode that subsequently did result in a short-term relief rally.

- It will be interesting to see if Bitcoin manages to retain the present momentum.

- Craig Johnson, chief market technician at Piper Sandler Companies had recently weighed in on the price action and said that only a close above $26,000 or $28,000 could finally put a stop to the downward slide that the crypto-asset has been on since April.

Click to rate this post!

[Total: 0 Average: 0]

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur