Bitcoin Bollinger Band Breakout Starts To Squeeze Shorts | BTCUSD Analysis October 26, 2022

In this episode of NewsBTC’s daily technical analysis videos, we take a look at the ongoing Bitcoin price breakout above the upper Bollinger Band on daily BTCUSD charts and provide some insight into what the next targets might be.

Take a look at the video below:

VIDEO: Bitcoin Price Analysis (BTCUSD): October 26, 2022

The breakout across crypto has already resulted in a substantial amount of shorts liquidated. How far could this Bitcoin rally run?

Related Reading: Are Bitcoin Bulls Ready To Stampede? | BTCUSD Analysis October 25, 2022

Bitcoin Rally Approaches Middle Of Trading Range

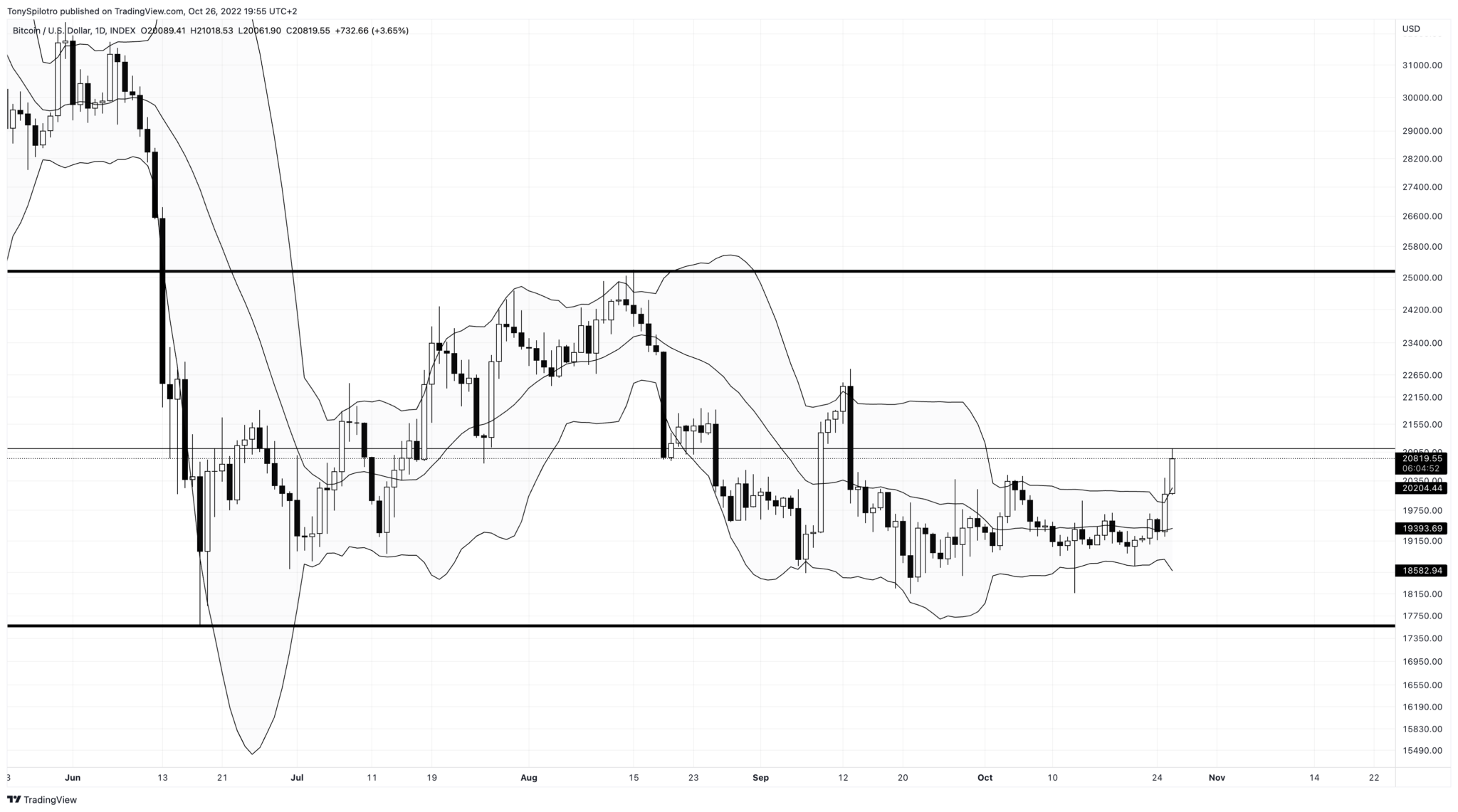

Bitcoin price is now at the middle-point of a horizontal trading range, making for a natural stopping point for profit-taking and to draw in a fresh set of short positions. Busting through the range median will result in another attempt at around $25K.

More importantly, the Bitcoin price is continuing to make a strong push outside of the Bollinger Bands on daily timeframes. After tightening for so long, and now starting to expand, the rally could have more legs than bears expect.

BTC is attempting to break through the median of a the trading range | Source: BTCUSD on TradingView.com

Related Reading: Can Bitcoin Bring An End To Crypto Winter? | BTCUSD Analysis October 24, 2022

BTCUSD Weekly Hits Resistance At Middle Bollinger Band

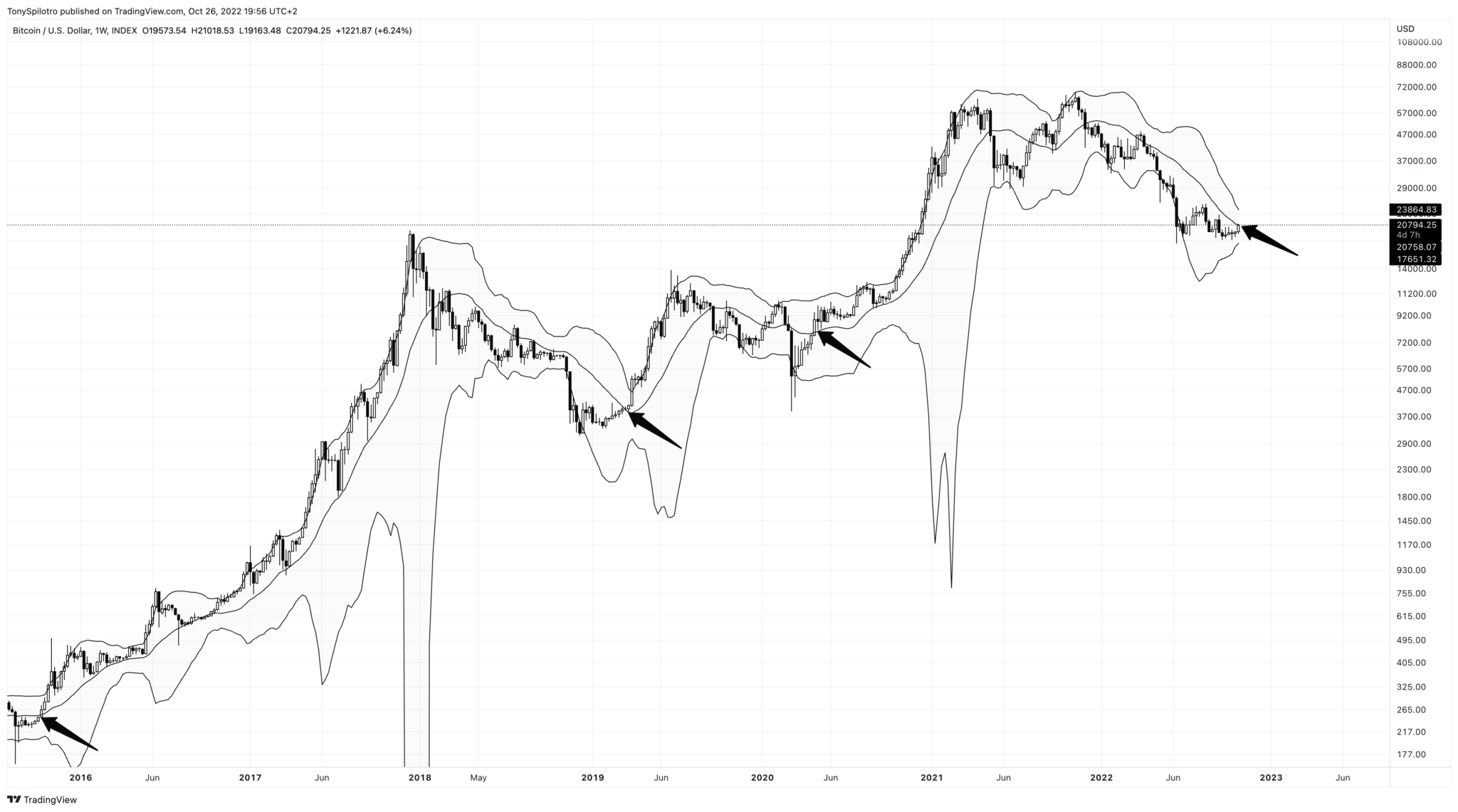

That is because Bitcoin price has already found and met resistance at the mid-Bollinger Band on weekly timeframes. The key resistance level at the 20-week SMA, was where I placed a hedge short entry today in case the rally is rejected instead.

If there is no rejection and Bitcoin keeps rising, we could be looking at a full-blown return to a crypto bull run. Zooming out shows just how significant a weekly close above the middle Bollinger Band would be.

Turning on Bollinger Band Width shows that the bands are some of the tightest ever. The last two instances were prior to the 50% breakdown to the 2018 bear market bottom. Before that was prior to the epic 2017 Bitcoin bull run that made the cryptocurrency a household name.

Importantly, in 2018, Bitcoin price was below the mid-Bollinger Band, while in 2016 it was above the mid-BB. The trend is more likely to continue on whatever side of the mid-BB price is on. If the weekly BTCUSD chart closes above the middle band and holds, it could be off to the races once again for Bitcoin bulls.

The crypto bull run could be back in with a weekly close above the mid-BB | Source: BTCUSD on TradingView.com

Related Reading: Bitcoin Dominance To Regain Control Over Crypto? | BTC.D Analysis October 20, 2022

Crypto Profit Targets To Watch For Using The Ichimoku

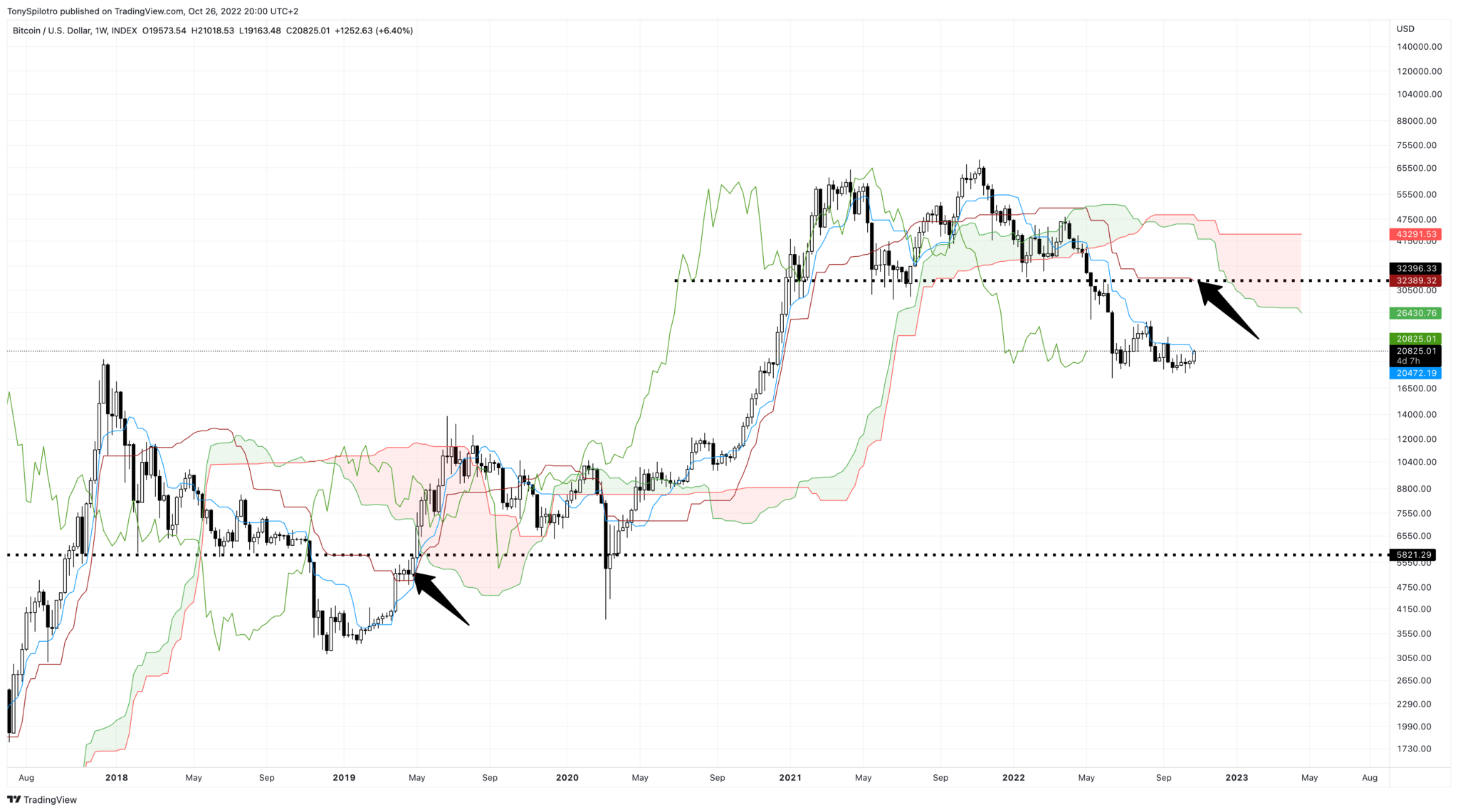

Back to those weekly Bollinger Bands, for a sense of what happens if BTCUSD were to get through the mid-BB. The upper band would become the next logical target, located at $23,800. Much like Bitcoin has done on daily timeframes, pushing outside of the upper band is possible given the abundance of short interest in the market.

Replacing the Bollinger Bands with the Ichimoku on the same weekly timeframe, also tells us a lot about what could happen next. Bitcoin price is pushing above the Tenkan-sen, making the next major resistance level the Kijun-sen located at $32,000. In 2018, we can see that the two lines were much closer together, but anything is possible with so much energy built up in the market.

During the first bounce from the 2018 bear market bottom, Bitcoin price pushed all the way outside of the top of the cloud, only to make it out of it, but ultimately lose it once again on Black Thursday 2020. If Bitcoin price were to reach the top of the cloud, the rally could be stopped at $43,000. Once above the cloud, all that’s left for Bitcoin is the moon.

Bitcoin price is stuck at former ATH resistance | Source: BTCUSD on TradingView.com

Learn crypto technical analysis yourself with the NewsBTC Trading Course. Click here to access the free educational program.

Featured image from iStockPhoto, Charts from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Siacoin

Siacoin  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur