Bitcoin (BTC) Approaches Major Inflection Point After Stunning Rally: CryptoQuant

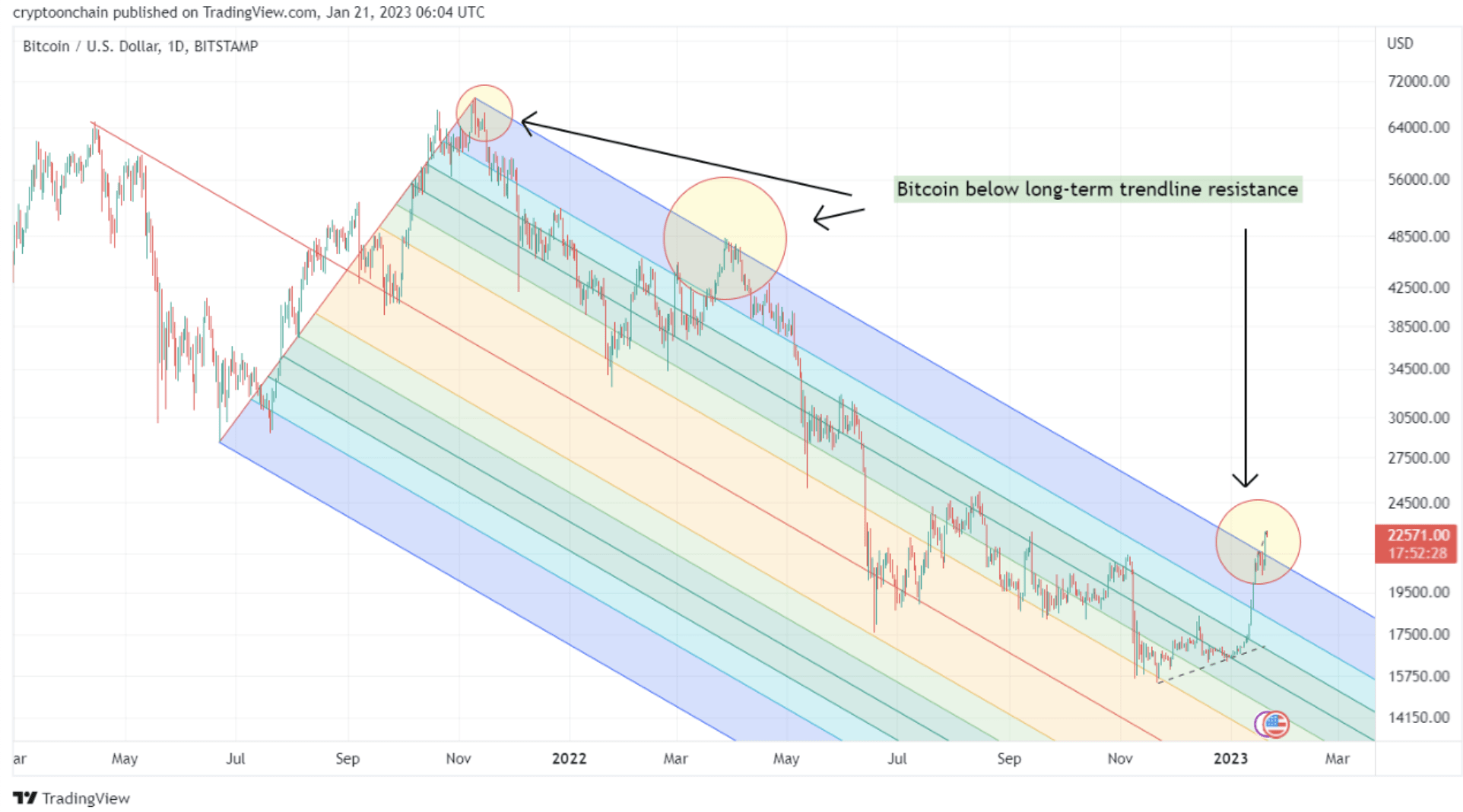

Bitcoin (BTC) appears to be approaching an important inflection point following its stunning rally over the past few weeks, according to an analysis by CryptoQuant.

With traders carefully eyeing this crucial decision point, both technical and on-chain data suggest that there is still much uncertainty in the near term about where the number one crypto asset will go next.

When assessing on-chain activity, evidence indicates that Bitcoin miners and short-term holders have increased their sales activity.

According to CryptoQuant’s Miner Position Index (MPI) and Bitcoin Miners Outflow charts, a notable outflow of Bitcoin from miners’ wallets has been observed lately as they look to cash out while prices remain relatively elevated.

Similarly, Bitcoin supply metrics such as profits and short-term holders have also jumped considerably. This suggests that short-term investors are looking to potentially make quick profits at these levels before any further pullback in BTC prices takes place.

However, bigger players, including cryptocurrency exchanges, seem to be exercising a great degree of caution, as evidenced by their reduced reserves of Bitcoin. This implies that they have not yet arrived at the conclusion that the downtrend has been broken.

With miners and short-term investors actively selling off their holdings at market resistance, it remains to be seen whether bulls or bears will ultimately prevail in deciding what comes next for BTC pricewise.

Should the wider market sentiment be favorable for prices to continue higher, then this neckline could likely represent a decisive break between bearish sentiment and bullish optimism in determining where the Bitcoin price goes next.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond