Bitcoin (BTC) Flashing Weak Hand Capitulation, Holding Steady Amid Stock Market Drop: Analytics Firm Santiment

A leading digital asset analytics firm says one reliable technical indicator is suggesting that weak hands have already left the crypto markets.

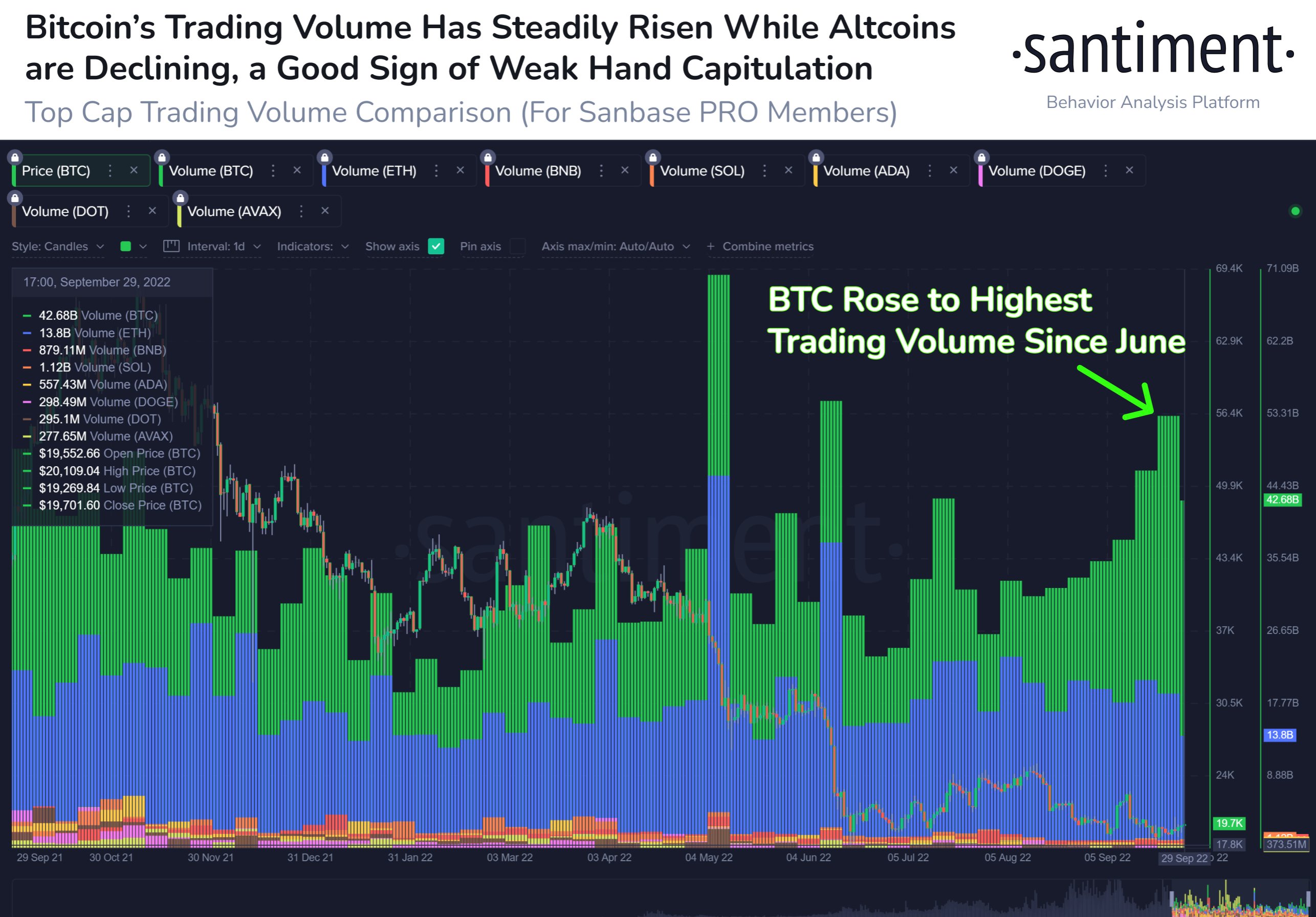

Santiment says it’s keeping a close watch on Bitcoin’s (BTC) volume, which the firm says has been in an uptrend since June when the king crypto printed its current bear market low.

According to the analytics firm, the surge in Bitcoin’s volume at the expense of trading activity in altcoins indicates that crypto tourists have been rinsed out of the markets.

“Bitcoin’s trading volume has steadily risen since mid-June, while other top cap assets are declining. Trader interests are beginning to return to relative safe-haven assets like BTC, while the rest of the markets have less trading interest.”

Source: Santiment/Twitter

Santiment also highlights that BTC’s rising volume comes as Bitcoin continues to show strength in the face of heavy selling in the stock market.

“Bitcoin has stuck around $19,000 and Ethereum at $1,340 today. But the story is the fact that they are doing so without the support of the S&P 500, which is down 2.4%. If the correlation is easing between crypto and equities, this is very encouraging.”

Source: Santiment/Twitter

Popular crypto strategist Rager is also noticing the difference in the short-term price action of Bitcoin and the S&P 500 (SPX). Rager predicts Bitcoin will rally once the stock market shows signs of life.

“If you want to be encouraged just compare the SPX and BTC charts.

Since the 22nd of Sept, equities index downtrend while Bitcoin, while choppy, has maintained a relatively sideways.

You better believe Bitcoin will have a strong reaction when the stock market reverses up.”

At time of writing, BTC is changing hands for $19,333, up over 4% in the last seven days, while the S&P 500 is down more than 2% over the same timeframe.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond