Bitcoin ($BTC) Trading Into $BUSD Surges Nearly 80% Over Binance’s Stablecoin Conversion

The cryptocurrency ecosystem endured a market-wide sell-off last month over macroeconomic factors that continued to weigh down risk assets, including equities. The fall was reflected in spot trading volumes, which rose significantly last month.

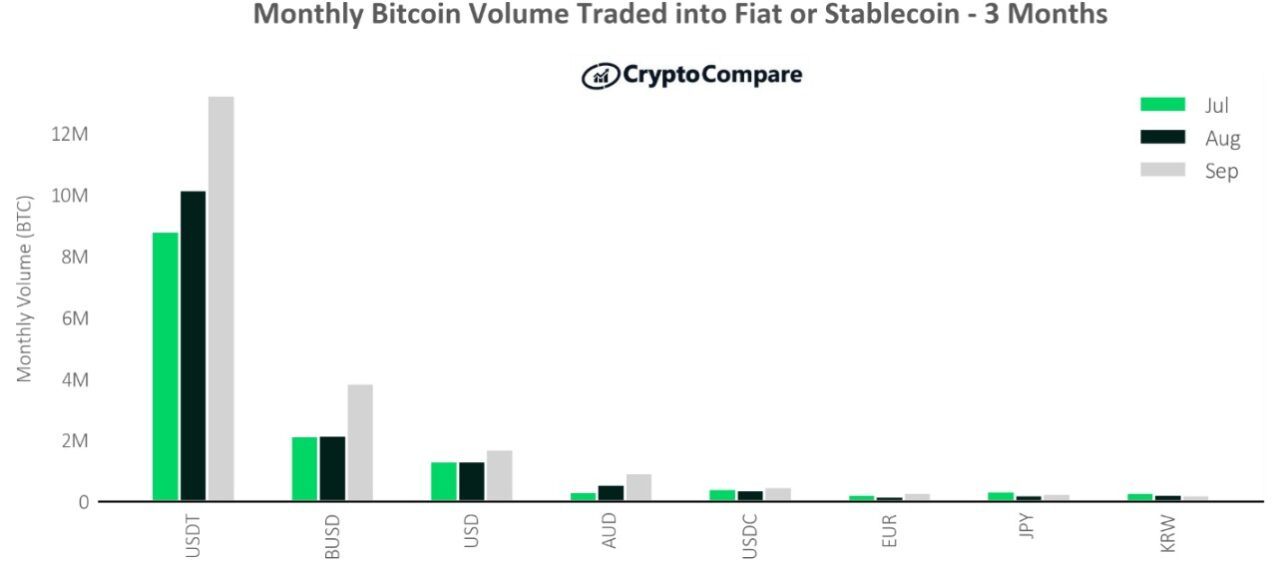

According to CryptoCompare’s latest Exchange Review report, BTC spot trading into BinanceUSD ($BUSD), the stablecoin issued by leading cryptocurrency exchange Binance, jumped 79.2% to 3.84 million BTC last month, benefitting from the exchange’s move to auto-convert users’ USDC, USDP, and TUSD into BUSD.

Source: CryptoCompare

The move, according to Binance, is intended to “enhance liquidity and capital efficiency for users.” The exchange will also remove and stop trading on spot pairs involving USDC, USDP, and TUSD.

Analysts at JPMorgan have said that Binance’s move will benefit Tether, as it will increase the cryptocurrency’s importance in crypto trading. The investment bank noted that Tether’s market share in the stablecoin ecosystem has been declining over the past 18 months, which shows its importance has been dwindling.

CryptoCompare’s report adds that fiat trading pairs also saw an increase in BTC spot trading volume “amid the weakening of several currencies worldwide,” adding that BTC spot trading into USD rose 29.5& to 1.7 million BTC, while trading to Australian Dollars, Euros, and Great British Pounds rose 65.1%, 68.3%, and 233% respectively.

According to CryptoCompare, last month total spot trading volumes in the cryptocurrency space rose 3.58% to $1.56 trillion, with Top-Tier exchanges seeing their volumes rise 4.48% to $1.46 trillion, and Lower-Tier exchanges seeing their volumes drop 8.1% to $99.5 billion.

Per the report, in September the spot trading volume of the Nasdaq-listed cryptocurrency exchange Coinbase fell 17.6% to $48.1 billion, its lowest since January 2021.

Coinbase’s competitors Binance, OKX, and FTX all saw their spot trading volumes rise, with gains of 23.5%, 8.26%, and 5.49% respectively. The drop came even after Coinbase introduced changes in its fee schedule in a bid to attract more retail and institutional trading.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond