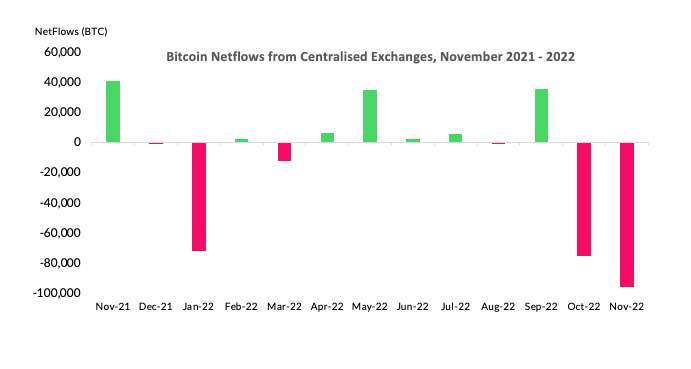

Bitcoin Exchange Netflows Hit Record Outflows of Over 91,000 $BTC

After the collapse of FTX on November 8, centralized exchanges experienced a series of outflows as investors become concerned about the safety of their deposits on these platforms. In November, BTC netflows recorded the largest negative flow in its history, with a netflow of -91,363 BTC, worth over $1.6 billion.

According to CryptoCompare’s latest Exchange Review report, a total of 91,363 BTC were withdrawn from cryptocurrency trading platforms last month over the collapse of FTX. Users are moving to custody their own funds in a bid to avoid losses associated with centralized third parties going down, as lenders Celsius and BlockFi also halted withdrawals before going bankrupt.

Source: CryptoCompare

The report notes that cryptocurrency exchanges have taken several measures to establish trust and credibility with their users, including releasing Proof of Reserves audits. Notably, as CryptoGlobe reported, after Binance’s report failed to quell concerns, the exchange saw outflows topping $3 billion in only 24 hours.

CryptoCompare’s report also details that after trust in centralized exchanges took a hit, users migrated their assets and trading activity to more reputable and established platforms deemed to be safer. As a result, Binance’s share of the market rose to 52.9%, its highest ever, after its spot trading activity rose 29.5% to $506 billion and its derivatives volume jumped 19% to $1.45 trillion.

The exchange also recorded its highest market share in the derivatives trading markets with a dominance of 67.2%. This consolidation of trading volume on Binance may raise new concerns for an industry that promotes decentralization, the report says.

Per the report trading activity across crypto markets hit recent highs last month, with spot and derivatives trading on centralized exchanges rising 13.7% and 10.1% to $1.06 trillion and $1.44 trillion, respectively. This was the largest volume recorded for spot and derivatives markets since September.

On November 8, the insolvency of FTX was confirmed, and Binance announced its intention to acquire the distressed exchange. The total spot trading volume on centralized exchanges reached $90.1bn on this day, the highest spot trading volume recorded since June. On that same day, total derivatives trading volume hit $297 billion, the second largest derivatives trading day in digital asset history, second only to May 19 2021, in which $384 billion were traded.

Image Credit

Featured Image via Pixabay

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM