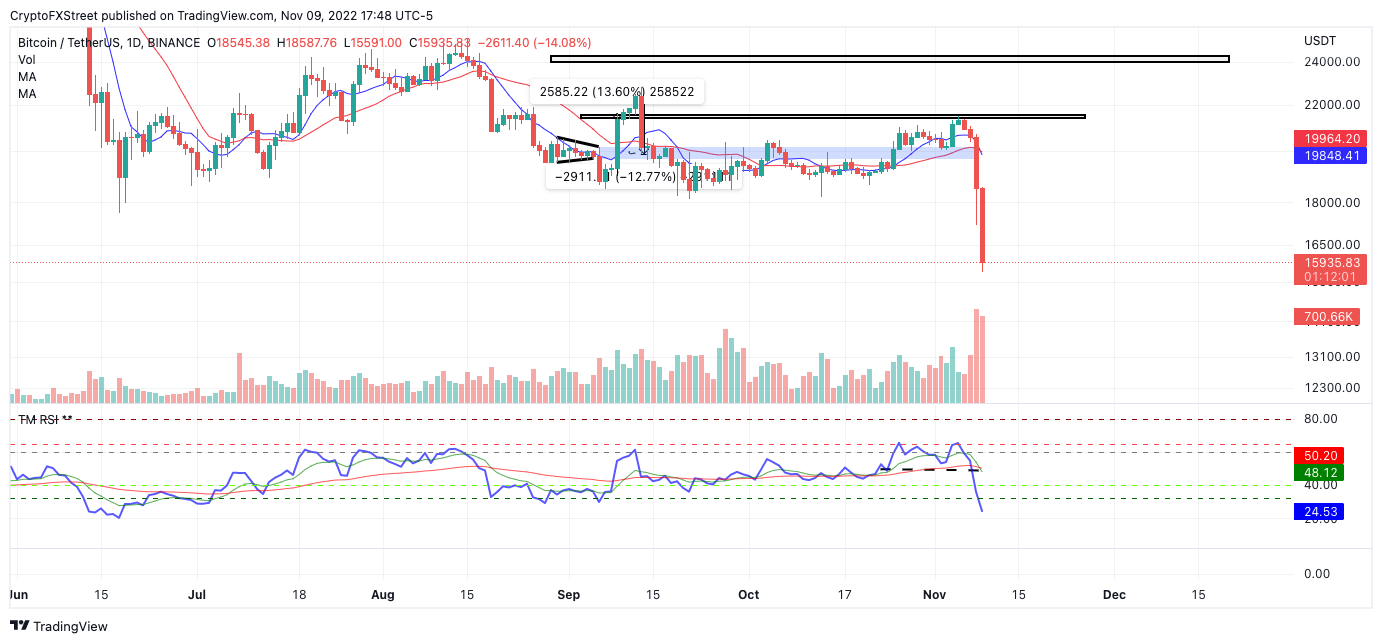

Bitcoin falls to 2020 levels at $15,600

- Bitcoin price free falls, bringing the market value down by 25% on the month at $21,000 as the bears have forged a weekend sell-off.

- $679 million worth of longs have been liquidated in the last 24 hours.

- Invalidation of the bearish thesis is a breach above.

Bitcoin price is witnessing a devastating crash, wiping out liquidity levels as far back as 2020. Key levels have been defined to gain perspective on BTC’s potential landing grounds.

Bitcoin price in a free fall

Bitcoin price has experienced a jaw-dropping decline as the peer-to-peer digital currency breached new yearly lows at $15,600. As investors jump ship, traders are forced to ask the question, how far can Bitcoin truly fall?

Bitcoin price currently auctions at $15,894. The massive decline saw 679,000,000 dollars worth of long liquidations in the last 24 hours. BTC now auctions in levels last touched in 2020 before its infamous bullrun. The Relative Strength Index continues to descend into oversold levels as retail bears have now joined the trend.

Crypto Total Liquidations

It is worth noting that the Volume Profile Index shows fewer transactions in the current sell-off than in the US midterm elections liquidation. This could be a subtle cue that the downtrend is losing steam. Still, if the downtrend is not over, the next targets would be 2020 liquidity levels between $15,000 and potentially $14,500.

BTCUSDT 1-Hour Chart

Invalidation of the bearish thesis may rise if the bulls can breach the $17,900 swing high. In doing so, a rally toward $21,500 could occur. Such a move would result in a 35% increase from the current Bitcoin price.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Algorand

Algorand  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Holo

Holo  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur