DeFi Kingdoms to leave Harmony for metaverse-focused blockchain

Blockchain-based game DeFi Kingdoms (DFK) has found a new home for the Serendale-based part of its game on the metaverse-focused blockchain Klaytn, the company has announced.

A spokesperson for DeFi Kingdoms confirmed to The Block on Monday that this means it will be leaving Harmony completely. The move comes two months after the Harmony blockchain network announced an attack on Horizon, its cross-chain bridge to Ethereum. Hackers made off with nearly $100 million in ETH.

Only the first of DFK’s game maps, Serendale, will be affected, with Crystalvale remaining on the DFK Chain, an Avalanche subnet.

New partner Klaytn is the product of South Korean internet giant Kakao Corp and has been around since 2019. Earlier this year it pivoted to become a metaverse, gaming and creator-focused chain.

Few details have been released about the terms of the new relationship with Klaytn, although Kingdom Studios president Dreamer admitted in an AMA on Thursday that «this is another major chain paying for a collaboration with DFK.»

«We have come to an agreement on good incentives for us to consider the move as being worth it not just for the initial work but also to extend our runway and to align our mutual interests in DFK and their success in Klaytn,» he said.

The decision is hardly unexpected. DFK has been looking for a new blockchain for Serendale for some time due to difficulties working with Harmony.

Harmony didn’t respond to a request from The Block for comment, but the departure of its most popular project is likely a blow for the ecosystem.

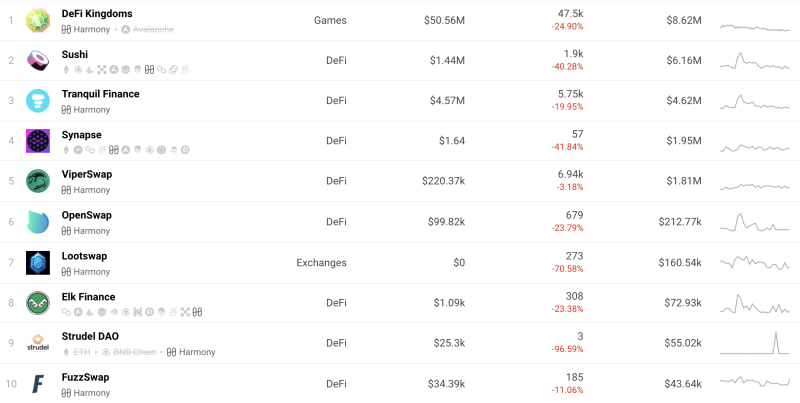

Top Harmony dapps by volume over 30 days leading to Aug 23, 2022. Source: DappRadar

According to DappRadar, over the last 30 days, $8.62m entered DFK’s smart contracts. Second ranked, the Harmony arm of Sushi Swap, saw $6.16 million over the same period and the second biggest game dapp, Knights and Peasants, just $14.68k.

The DFK community will get the chance to ask further questions in a Discord AMA on Thursday.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Maker

Maker  Zcash

Zcash  Theta Network

Theta Network  Tether Gold

Tether Gold  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Synthetix Network

Synthetix Network  Decred

Decred  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Status

Status  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Hive

Hive  Waves

Waves  Lisk

Lisk  NEM

NEM  Steem

Steem  Pax Dollar

Pax Dollar  Numeraire

Numeraire  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD