Bitcoin Mining Margin Squeeze Sees Revenues Evaporate

Bitcoin mining operators are having a tough time during the bear market as reduced margins have resulted in much lower revenues.

BTC prices may have rallied back over $20K this week, but Bitcoin mining operations are still in the doldrums.

On Oct. 26, Jaran Mellerud from Hashrate Index reported that mining margins have evaporated over the past year. As an example, he used the gross margin of a Bitmain Antminer S19j Pro which was 88% in October 2021. Today, that gross margin has fallen to 38%.

However, this does mean that Bitcoin mining remains profitable … for now.

Bitcoin mining woes

According to the report, this time last year, Bitcoin miners could produce 50% more BTC per terahash per second than they can today.

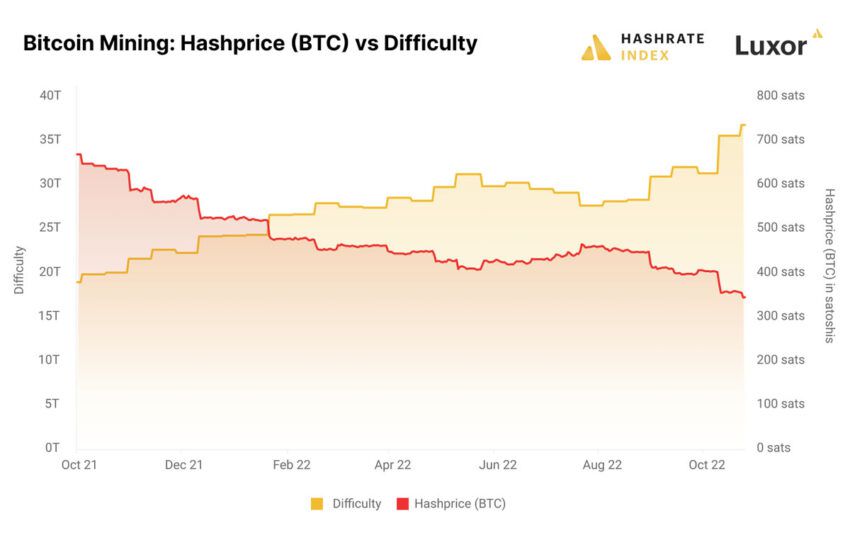

This is largely due to the increase in difficulty, a measure of competition among miners seeking to solve the network’s next block, and a decrease in hashprice.

Hashprice is a measure of market value assigned per unit of hashing power in dollars per terahash per second per day ($/TH/s/d).

Source: hashrateindex.com

The large Bitcoin mining companies and pools have greater capacity in exahashes per second. One EH/s now produces 3.5 Bitcoin per day, compared to 6.7 BTC per day this time last year, the report noted.

This means that only the miners who have doubled their hash power over the past year can earn the same amount of BTC as they did in October 2021. Essentially, the smaller players have been squeezed out of the market.

The report added that hashprice will likely continue trending downward as the difficulty increases. “It looks particularly bad in the long-term,” it said in reference to the May 2024 Bitcoin halving event which will drop block rewards from 6.25 to 3.125 BTC.

Miners that want to remain competitive and profitable will need to continue expanding their hash power to keep up. This additional expense, in addition to escalating energy costs, will become a challenge for many companies.

Bitcoin holds gains

BTC prices have held onto gains made over the past couple of days. The asset has made 2.6% over the past 24 hours to reach $20,778 according to CoinGecko.

As a result, its weekly gain has increased to 8.7% as BTC taps its highest price since mid-September.

The asset is still down 70% from its all-time high and markets are still bearish. The four-month consolidation is still in play and will remain so until BTC can break above $25K.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur