How Much Energy Does Bitcoin Really Use? Less Than You Might Think

Crypto intelligence firm Coin Metrics released a report on Tuesday outlining how Bitcoin’s energy usage can be measured by scanning the blockchain for clues—linking activity on the network to specific, high-powered machines.

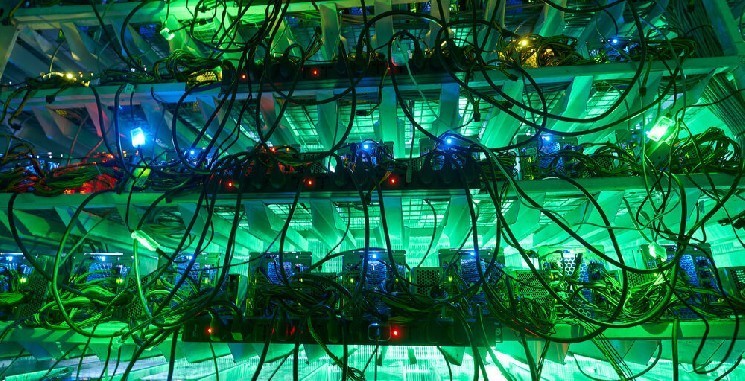

For years, Bitcoin’s electricity usage has been a contentious topic, as critics point to the energy-intensive nature of validating transactions on proof-of-work networks. By continuously crunching complex calculations in hopes of solving Bitcoin’s next block, thousands of machines make guesses on networks like Bitcoin in hopes of a reward.

As government organizations such as the White House put pressure on digital asset mining firms, mainly through its proposed 30% excise tax, the report aims to establish a more accurate approach to determining Bitcoin miners’ overall power consumption and builds on the methodologies of studies conducted by other institutions in the past.

The Hard Truth About Bitcoin’s Energy Consumption

“Obviously, there’s this massive debate about energy consumption,” the report’s lead author Karim Helmy told Decrypt in an interview. But one of the study’s other main motivations is capturing network-wide statistics that serve as a “really good reference value” for how competitive miners’ machines are, he said.

By taking a closer look at data included in miners’ constant stream of guesses, researchers at Coin Metrics say they can better deduce Bitcoin’s overall electricity consumption, matching up the “fingerprints” of each guess with the unique profile produced by certain machines.

Referred to as ASICs, these power-hungry machines are designed largely around making as many guesses to solve Bitcoin’s next block as quickly as possible. The study looked at 11 different ASICs across four manufacturers, including models released as early as 2016 to as recently as last year.

Cambridge Will Start Tracking Ethereum Energy Data Along With Bitcoin

Attaching network activity to specific machines leads to less room for overestimating Bitcoin’s energy usage because models can take into account the efficiency of each ASIC, the report states.

“Previous attempts at assessing Bitcoin’s power draw missed a critical element that can only be attained with this type of ASIC-level data: hardware efficiency,” the report states. “As the mining industry has evolved, ASICs have become substantially more efficient, generating more hashes per second and per unit of power drawn.”

The Coin Metrics report found that Bitcoin’s power draw has historically been less than other studies that didn’t include ASIC-level data, specifically those conducted by the University of Cambridge and the Digiconomist.

This breakdown is interesting on its own, but it’s also a useful stepping stone. By combining these figures with the manufacturer-provided specs for hashrate and power draw, we can get way more accurate estimates for energy consumption that are robust to fluctuations in BTC price pic.twitter.com/bRpq3hs8Df

— karim helmy ? (@karimhelpme) June 13, 2023

For example, Coin Metrics’ estimate for miners’ power consumption this past May is 16% lower than the University of Cambridge’s Bitcoin Energy Consumption Index, which the report acknowledges is the industry’s current “gold standard.”

While Coin Metrics argues its model is more accurate than Cambridge’s representation, which received pushback from within the digital assets industry after its release, Coin Metrics still commended the university’s researchers for their work.

“The figures produced by Cambridge were groundbreaking, and the methodology presented in this report is at its core a refinement of this existing work,” the report states.

Aside from producing accurate energy statistics, the report also seeks to capture data for miners to compare how their rigs stack up against the competition in terms of efficiency, Helmy explained.

“If you’re a miner, one of the key components on all of the models on your forecasted future profitability is a network-wide efficiency estimate,” he said. “You want to know where your fleet sits relative to other miners.”

Using the data, the firm’s report also paints a picture of which ASICs have grown in popularity over time, along with those that have fallen by the wayside. This is helpful from a security perspective, Helmy said, because tracking the dominance of hardware manufacturers can help identify potential points of centralization.

In addition to network-wide efficiency metrics, Coin Metrics was also able to produce estimates for e-waste, accounting for how often each ASIC needs to be replaced.

We can also use the difference between the peaks and valleys in each model’s hashrate to get an idea of how much hardware has been discarded (e-waste). It’s a rougher estimate than what we have for power draw, but it’s way better than what’s currently out there *cough cough* pic.twitter.com/JNYJ91m3SM

— karim helmy ? (@karimhelpme) June 13, 2023

Whether it’s miners’ energy use or the associated e-waste that firms produce, the environmental impact of crypto has come under heightened scrutiny within the past year. That’s been true at the White House and in art installations like Benjamin Von Wong’s “Skull of Satoshi.”

But breakthroughs, such as Coin Metrics’ new method, could lead to greater nuance in debates surrounding Bitcoin’s energy use and open the door to more robust, data-based discussions with info gleaned from the network’s blockchain.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur