Bitcoin Price Analysis: 20805 Headwinds — 4 November 2022

BTC/USD Gives Back Recent Gains: Sally Ho’s Technical Analysis – 4 November 2022

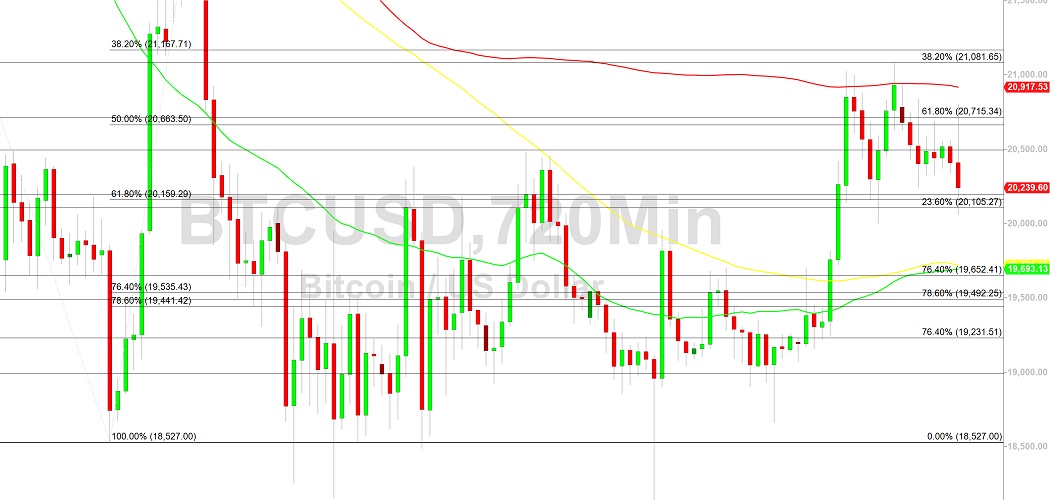

Bitcoin (BTC/USD) gave back some recent gains early in the Asian session as the pair drifted lower and closer to the psychologically-important 20000 figure after strong selling pressure emerged around the 20805 area. Traders elected Stops as they lifted BTC/USD to this level, representing a test of the 61.8% retracement of the depreciating range from 21080 to 20237. Buying pressure emerged around the 20055 area during the pullback, right around the 50% retracement of the appreciating range from 18131 to 21080. Additional retracement levels in the same appreciating range include the 19600, 19039, and 18954 levels, with Stops in place below these areas.

BTC/USD bears observe larger Stops accumulating below the 17803, 17701, 16966, and 16503 areas, significant technical levels related to historical upside pressure around the 3858 and 9819 levels. Additional significant technical areas on the downside include the 16990.14, 14500.15, and 10432.73 areas. Stops are also accumulating below the 19711 and 19355 areas. Traders are observing that the 50-bar MA (4-hourly) is bullishly indicating above the 100-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bearishly indicating below the 100-bar MA (hourly) and below the 200-bar MA (hourly).

Price activity is nearest the 100-bar MA (4-hourly) at 19879.23 and the 50-bar MA (Hourly) at 20441.24.

Technical Support is expected around 16990.14/ 14500.15/ 10432.73 with Stops expected below.

Technical Resistance is expected around 25256.96/ 27455.20/ 32383.96 with Stops expected above.

On 4-Hourly chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

Disclaimer: Sally Ho’s Technical Analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond