Bitcoin Price Analysis: After Spiking to 7-Week High, Can BTC Target $24K Next?

After recording its highest daily close since September, breaking above the 100-day moving average line, Bitcoin’s price eyes higher targets.

Technical Analysis

Technical Analysis By: Edris

The Daily Chart

On the daily timeframe, the price just broke above the 100-day moving average resistance line after multiple rejections during the last couple of weeks. this is the first time it succeeds since September, and if the price holds another day above it – it will become the longest period since April.

In the event of a bullish daily close above said moving average, the breakout would then be considered valid. The next targets for Bitcoin are the $24K resistance level and the 200-day moving average located nearby.

From a traditional technical analysis perspective, a bullish breakout above the 200-day moving average would theoretically mark the beginning of the new bear market.

The 4-Hour Chart

Looking at the 4-hour timeframe, the price has finally broken above the symmetrical triangle pattern to the upside, following significant momentum.

In this case, classical price action suggests that a bullish continuation toward the $22,500 level is the most probable outcome. However, consolidation and short-term correction are possible as the RSI indicator has entered the overbought area (above 70%).

If a pullback occurs, the higher boundary of the broken pattern and the $20K area could be retested, but if the price breaks down, a rapid drop back toward the $18K support level would become very likely.

On-chain Analysis

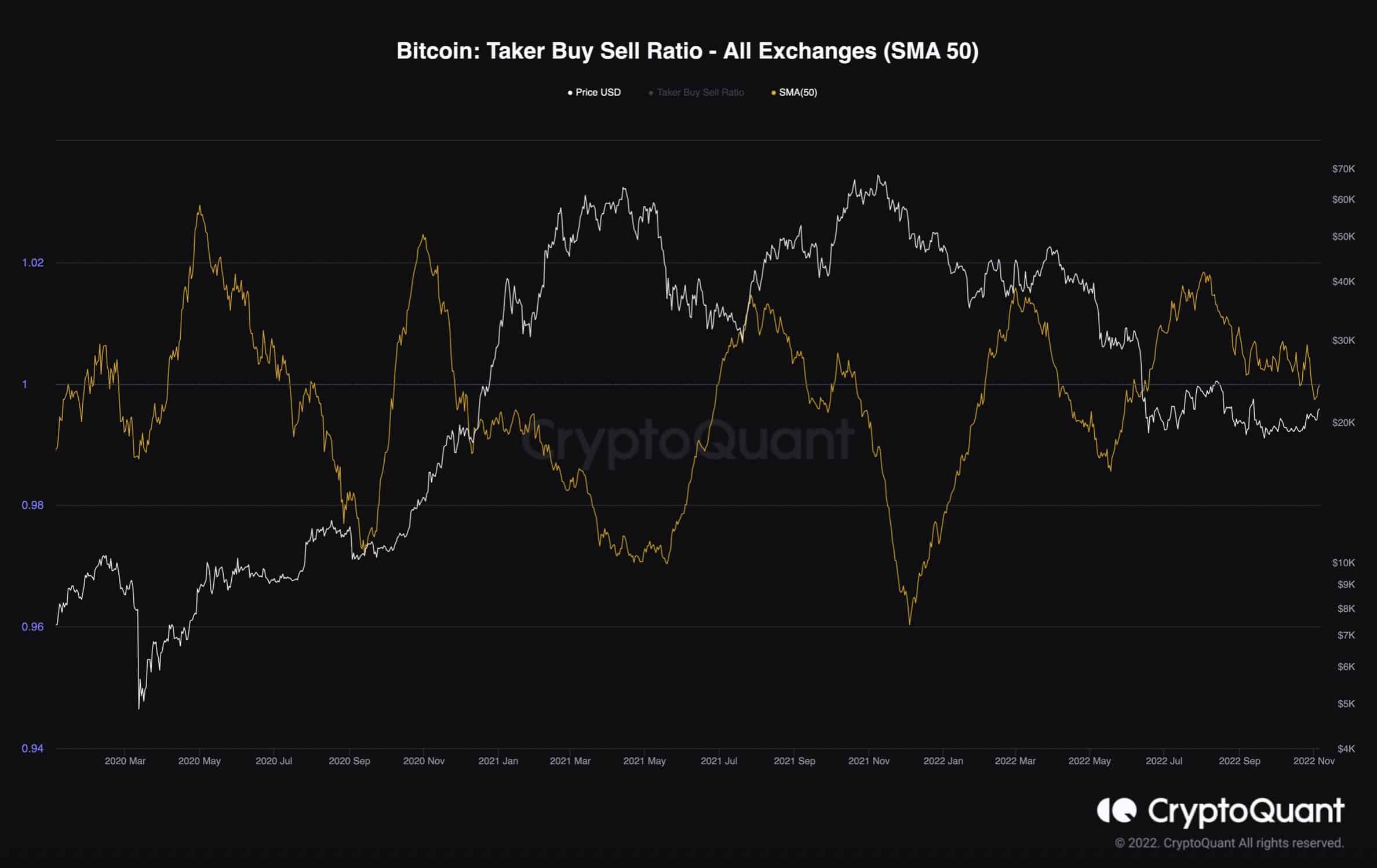

Bitcoin Taker Buy Sell Ratio

The futures market played a significant role during the recent cycle. So, evaluating the futures market sentiment should provide helpful evidence for determining future price action.

Taker Buy Sell Ratio is one of the most valuable metrics, as it quantifies the traders’ sentiment by demonstrating whether the bulls or the bears are more aggressive. Values above one are considered bullish, while values below one are bearish.

The Taker Buy Sell Ratio metric has recently crossed below 1, indicating that the bears are aggressively opening short positions in the market.

If this metric continues to trend below one, another significant decline could be in the next short-term future, similar to April’s correction.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur