Bitcoin price bearish macro outlook will not stop BTC bulls from scalping corrective rally

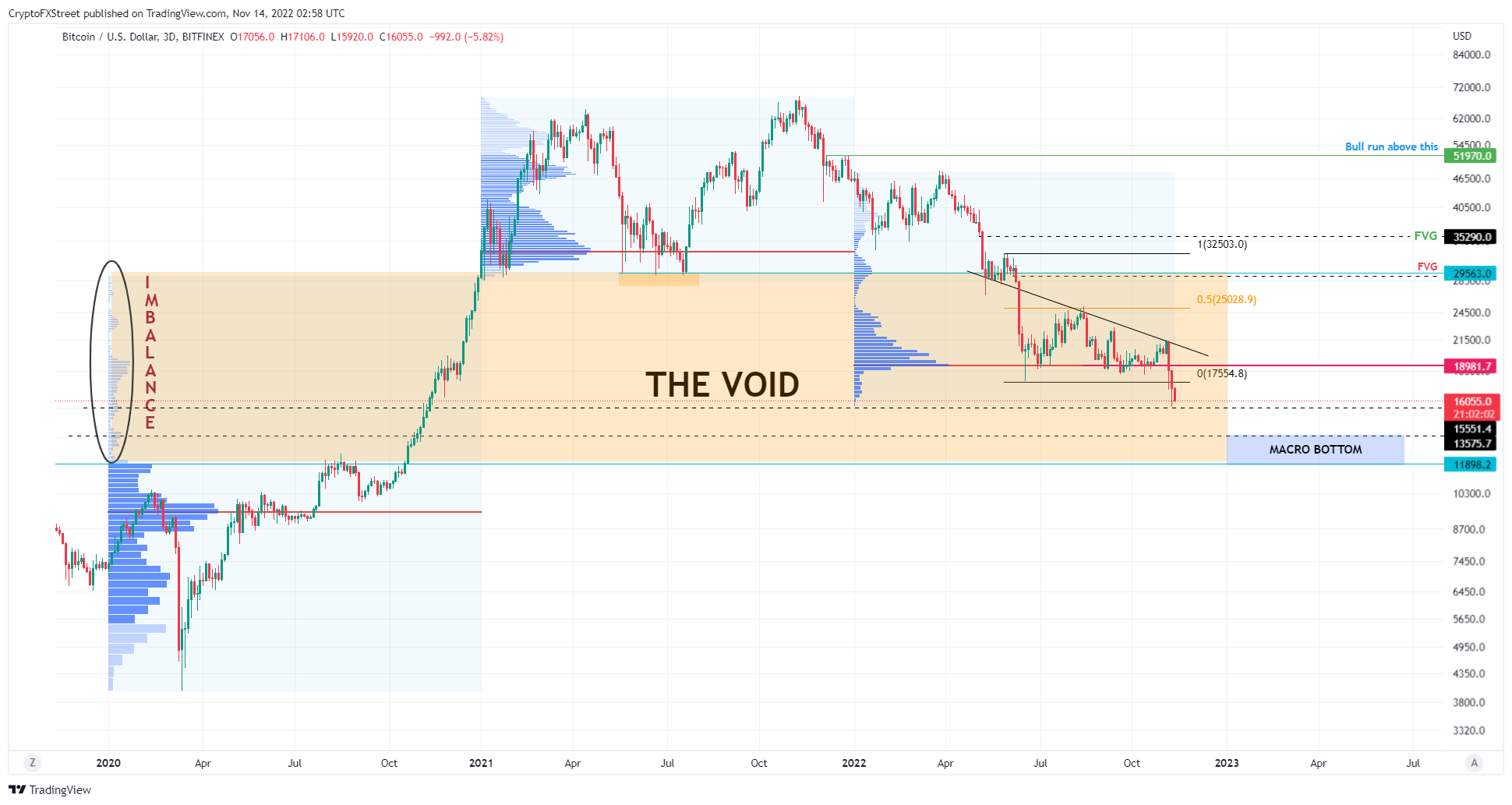

- Bitcoin price shows a bearish outlook on a three-day chart with targets ranging from $13,575 to $11,898.

- Lower time frame analysis shows BTC is ready to trigger a recovery rally attempt to retest $17,251.

- A flip of the $17,593 hurdle into a support level will question bears’ authority and could trigger a bullish move.

Bitcoin price has breached a stable support level that has prevented a collapse for the last four months. This development has knocked BTC down to retest some not-so-great footholds that could trigger a further crash in market value for the big crypto holders.

Bitcoin price remains indecisive

Bitcoin price slipped below the June 18 support level at $17,593 on November 8. This collapse was a result of the FTX exchange’s dilemma, which eventually led to bankruptcy. Although trouble for the Bahama-based platform began on November 2, the situation worsened in the coming days.

This caused the crypto market to tumble and Bitcoin price to flip the $17,593 support into a resistance level. As BTC auctions at $16,000, investors need to pay attention to $15,551, which is a decent support zone and was formed roughly two years ago.

A failure to hold above this level will further push Bitcoin price to the subsequent foothold at $13,575, which is also relatively weak, especially when compared to $11,898.

Therefore, from a macro perspective, a bear market bottom could occur anywhere between $11,898 and $13,575. So, investors need to be wary of Bitcoin price’s short-term bounces and not be lured by it.

BTCUSDT 3-day chart

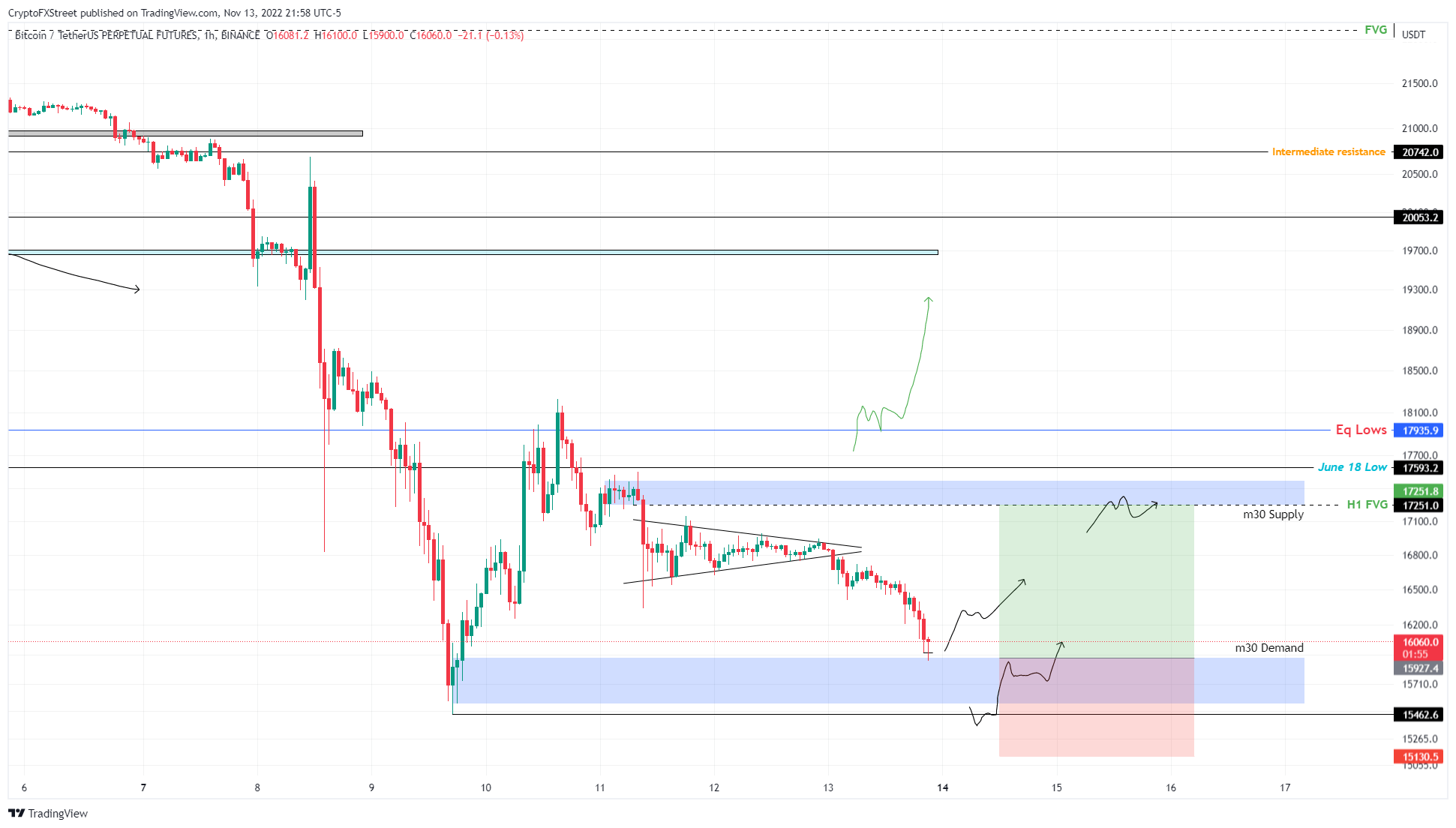

While the Asian session is not off to a bullish start, the London or the New York sessions could result in a spike in buying pressure. Therefore, investors need to be cautious of intra-day Bitcoin price moves for scalping opportunities.

On the one-hour chart, investors can see that Bitcoin price is hovering above a 30-minute demand zone, extending from $15,550 to $15,924. A bounce off this level could be key in triggering an 8% upswing that retests the inefficiency known as the Fair Value Gap (FVG) at $17,251.

Only a flip of the $17,593 hurdle will invalidate the bearish bias and extend this run-up’s target from $17,251 to $19,500.

BTCUSD 1-hour chart

While things are looking bearish in the long term, a flip of the $17,593 level would be a start of a recovery rally. This development would also invalidate the bullish theiss and potentially trigger a run-up to the $25,000 psychological level.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD