Bitcoin Price Drops Below $28,000 Post Labor Day – Rough Road Ahead?

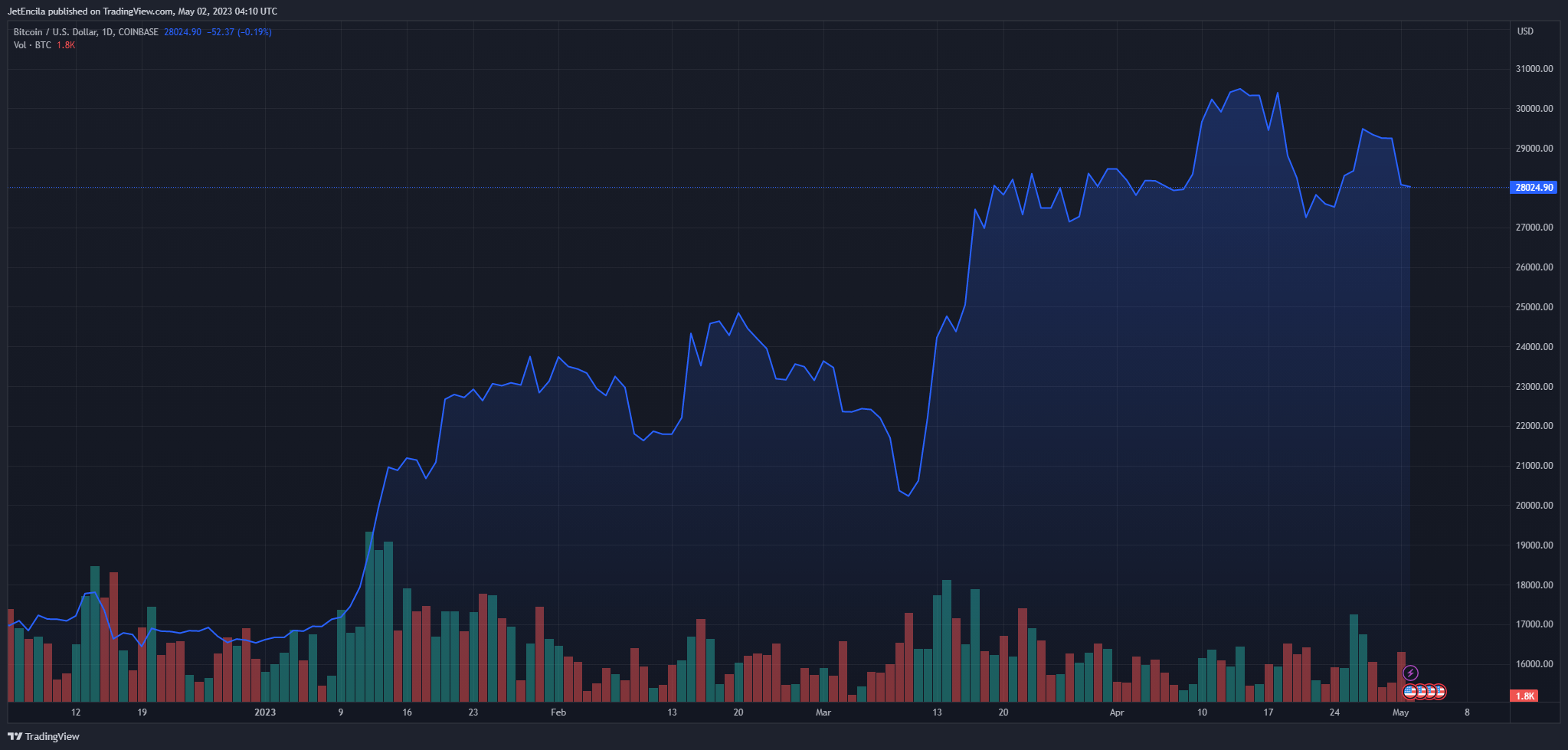

Bitcoin price suffered a setback today, May 2, as its price slipped below the crucial $28,000 level following a four-month-long solid streak.

Throughout April, the alpha coin had been on an upward trajectory, experiencing its longest stretch of consecutive monthly gains since 2021.

However, the latest dip in Bitcoin’s value raises questions about the sustainability of its recent surge, leaving investors wondering whether this is merely a minor hiccup or the start of a more significant market correction.

Bitcoin Price Loses $28K Handle

Bitcoin experienced a 2% drop in the last 24 hours, and its value, as reported by CoinMarketCap, dropped below the $28K level, and currently at $27,974. Additionally, its 2.17% increase over the past seven days indicates Bitcoin’s ability to withstand market fluctuations and remain stable.

Source: CoinMarketCap

Nonetheless, Bitcoin’s recent 73% recovery from the 2020 crypto market crash has come to a halt near the $30,000 level, leaving traders eagerly waiting for new catalysts to boost the cryptocurrency’s value.

This rally has been driven by the belief that the US Federal Reserve will eventually adopt a more relaxed monetary policy and the argument that the US banking crisis has eroded trust in fiat currency.

“The market is very jittery as it waits to see what happens to First Republic Bank,” Adrian Przelozny, head of crypto exchange Independent Reserve, told Bloomberg.

First Republic Bank Crisis Sparks Fears

The collapse of Silicon Valley Bank (SVB) and Signature Bank due to massive withdrawals has caused alarm among investors and depositors, who now fear that First Republic Bank could be the next institution to fail.

In recent weeks, the bank’s wealthy depositors have been transferring their funds to larger, more established institutions perceived as less likely to collapse.

According to the Wall Street Journal, First Republic Bank’s depositors have withdrawn approximately $70 billion since SVB’s collapse earlier this month, triggering concerns of a potential run on deposits.

The bank’s high rate of uninsured deposits, at 68%, has added to investors’ anxiety, as this exceeds the FDIC’s $250,000 limit, leaving a significant portion of the bank’s funds at risk.

While federal regulators intervened to protect SVB’s uninsured deposits due to the systemic risk it posed to the financial system, depositors at First Republic are not willing to take that same risk, fearing their funds may not receive the same level of protection.

As a result, the bank is at risk of a mass withdrawal of deposits, which could potentially lead to its collapse and send shockwaves through the financial industry.

Historical Data: Potential For Bitcoin Price Continued Growth

Meanwhile, according to data compiled by Bloomberg, the Bitcoin price recent four-month winning streak through April marks the longest stretch of gains since the six-month advance leading up to March 2021.

Over the past decade, four-month winning runs in Bitcoin have historically been associated with an average surge of 260% in the subsequent year, indicating the cryptocurrency’s potential for sustained growth.

This historical data provides a glimmer of hope for investors who have been anxiously waiting for Bitcoin’s value to recover after its recent decline.

-Featured image from Freepik

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren