Bitcoin Price Makes a Strong Breakout, Above $ 19,000 After 2 Months

For the First Time Since the FTX Fiasco, the Bitcoin Price Clocks Above $19,000, Fueled by CPI Data

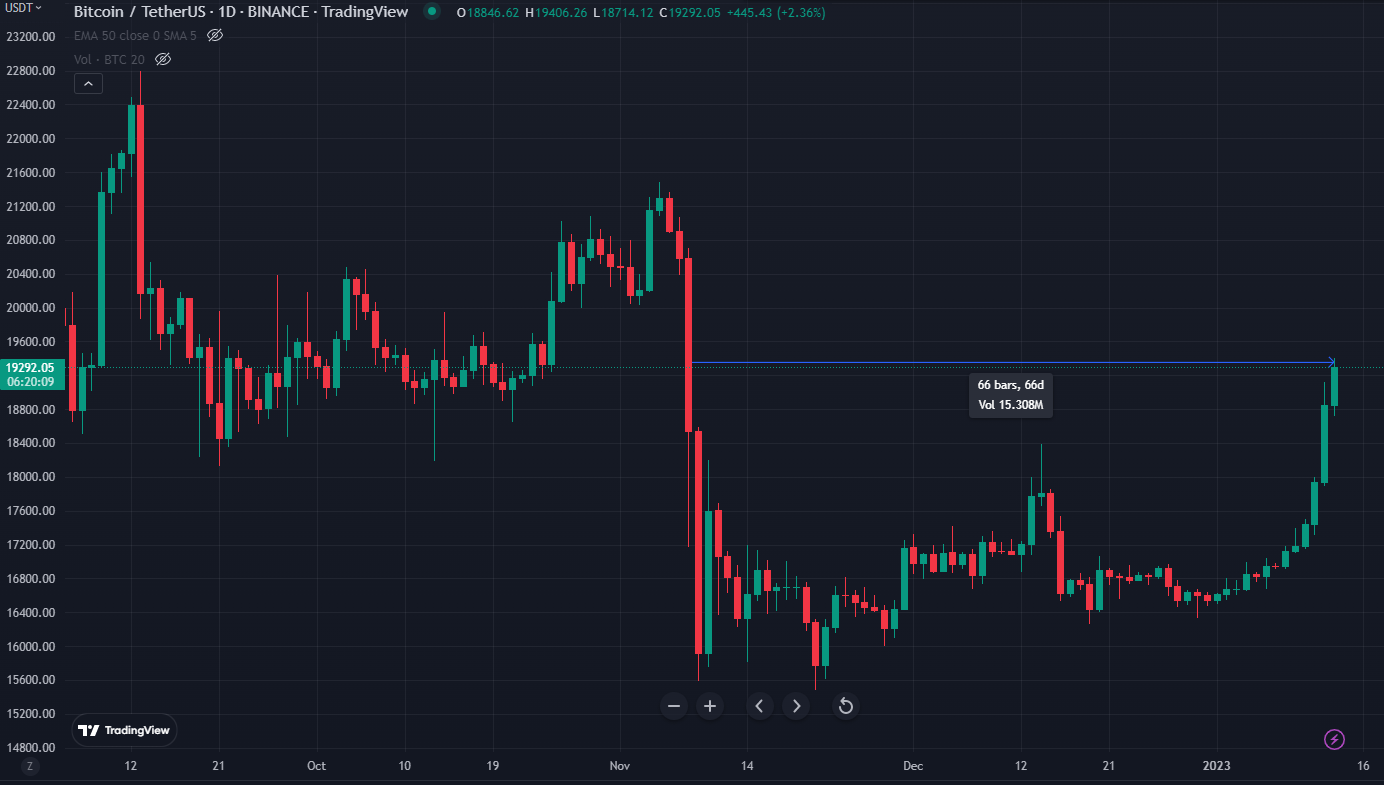

On Thursday, the price of bitcoin increased by more than three percent, and it briefly traded above $19,000 for the first time in eight weeks. After breaking above December highs of approximately $18,353, the mother coin traded for approximately $19,292 during the early trading session in Asia.

Bitcoin Price Chart. Source: tradingview.com

The release of new data for the Consumer Price Index (CPI) in the United States on January 12 coincided with an uptick in the market’s tendency toward upward volatility for Bitcoin and other crypto currencies. The Consumer Price Index for December did not change, as reported by the Bureau of Labor Statistics; this indicates that inflation in the United States stayed steady at 6.5 percent.

A favorable reaction from the Bitcoin and altcoin markets followed a fall in the value of the United States dollar. According to the aggregate data supplied by Coinglass, more than $80 million worth of short trades has been liquidated in the Bitcoin market over the past twenty-four hours.

Notably, about 38,245 traders lost their positions in the past twenty-four hours, and the total value of all liquidated crypto assets was $204.77 million.

On the crypto currency exchange OKX, a transaction involving an ETH-USDT swap with a value of about $2.31 million was the event that resulted in the single highest liquidation order.

The price increase in crypto currencies occurred when it was revealed that FTX authorities were prepared to liquidate around $5 billion to repay creditors. According to the data collected from on-chain transactions, Solana and SPL tokens were the most frequently implicated in fraudulent SBF transactions.

During a Wednesday hearing in Delaware on Wednesday, an attorney for FTX named Andy Dietderich revealed that his firm had discovered more than $5 billion in cash, liquid bitcoin, and liquid financial assets.

Bitcoin Price Action

Since the collapse of FTX and Alameda, the total value of bitcoin has now surpassed $939 billion for the first time. This was made possible by the price of bitcoin increasing by 13 percent year to date.

Our most recent crypto price oracles indicate that the overall market capitalization of Bitcoin is currently somewhere in the neighborhood of $362,146,594,951, and its 24-hour trading volume is in the vicinity of $43,964,939,526.

Santiment claims that Bitcoin whales were a key contributor to the latest rise above $19,000.

? #Bitcoin is on the verge of breaking the $19k resistance level for the first time since Nov. 8th. Whales are beginning to take interest and are likely perpetuating this climb, with $1M+ $BTC transactions rebounding to November, 2022 levels. https://t.co/UuH8aFUmh3 pic.twitter.com/2oeIyi3xSV

— Santiment (@santimentfeed) January 12, 2023

Aptos (APT) outperformed the top 100 crypto assets by market capitalization, with a growth of roughly 20 percent in the past 24 hours to trade at about $6.39.

This places APT in the top spot. Because the stock market is getting ready to close later today, it is anticipated that the volatility in the crypto currency business will increase throughout the course of the weekend as more traders strive to avoid missing out (FOMO).

In the meantime, the community surrounding the crypto currency exchange Gemini was taken aback when the SEC filed a lawsuit concerning its Earn program.

«It’s sad that the SEC chose to initiate an action today, as Gemini and other creditors are working diligently to try and recover funds. This move does nothing to advance our efforts or assist Earn users in retrieving their lost property.» The co-founder of Gemini observed that «their behavior is entirely unproductive.»

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur