Bitcoin price retargets $29K after Mt. Gox panic liquidates $320M

Bitcoin (BTC) returned to a familiar range on April 27 as panic over alleged Mt. Gox and United States government transactions faded.

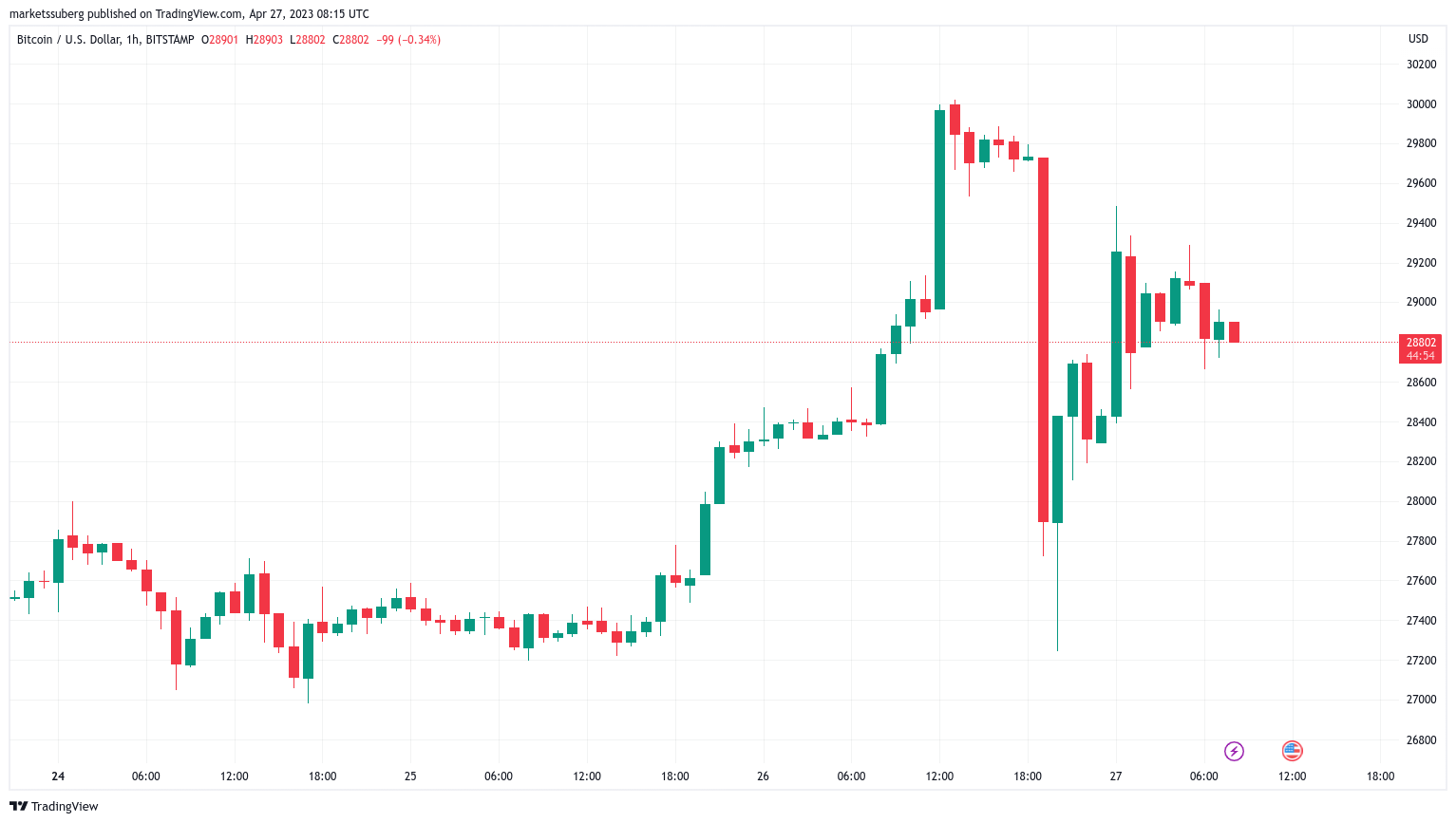

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Rough price action keeps Bitcoin traders cautious

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD traded near $29,000 on Bitstamp, up nearly $2,000 from the prior day’s low.

Snap volatility had kicked in following the Wall Street open as bulls’ trip to $30,000 was rudely interrupted by fears that BTC from wallets controlled by the U.S. government and entities related to defunct exchange Mt. Gox were on the move.

As Cointelegraph reported, the claims turned out to be false, but not before wiping a large slice of open interest from derivatives markets and sending BTC/USD down 7%.

A subsequent recovery returned the pair to $29,500 before consolidation kicked in.

Reacting, popular trader Jelle called on Twitter followers to filter out short-timeframe curveballs.

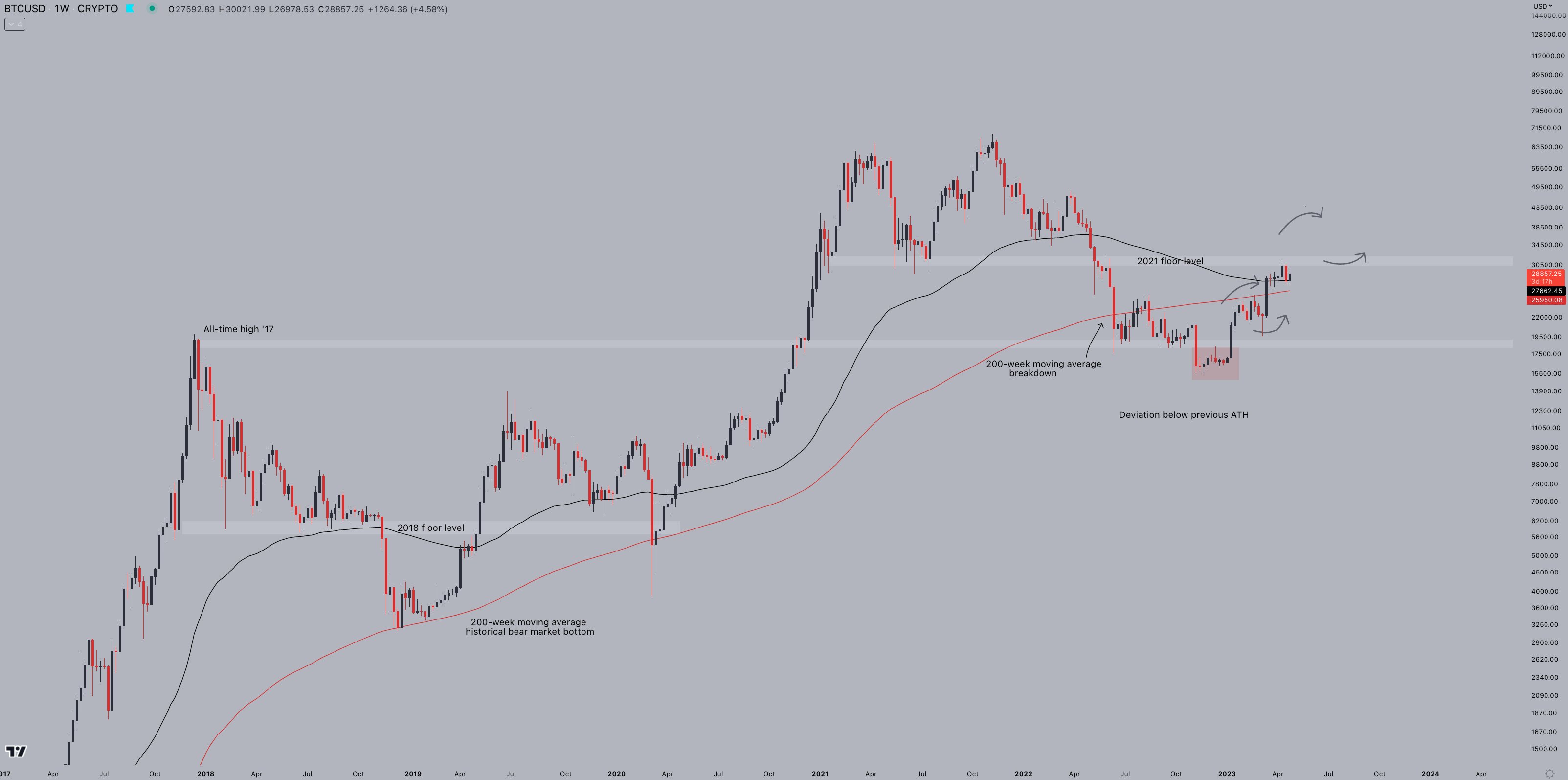

“Bitcoin higher timeframe direction is clear — everything else in the meantime is noise,” he wrote on the day.

“Trading the volatility is fine, but stay focussed on the bigger picture. Above $30,000, the targets increase quickly.”

BTC/USD annotated chart. Source: Jelle/Twitter

Jelle added that he was “not sure” on short-term price trajectory, but that the destruction of leveraged positions was a “usually a good sign” for market strength.

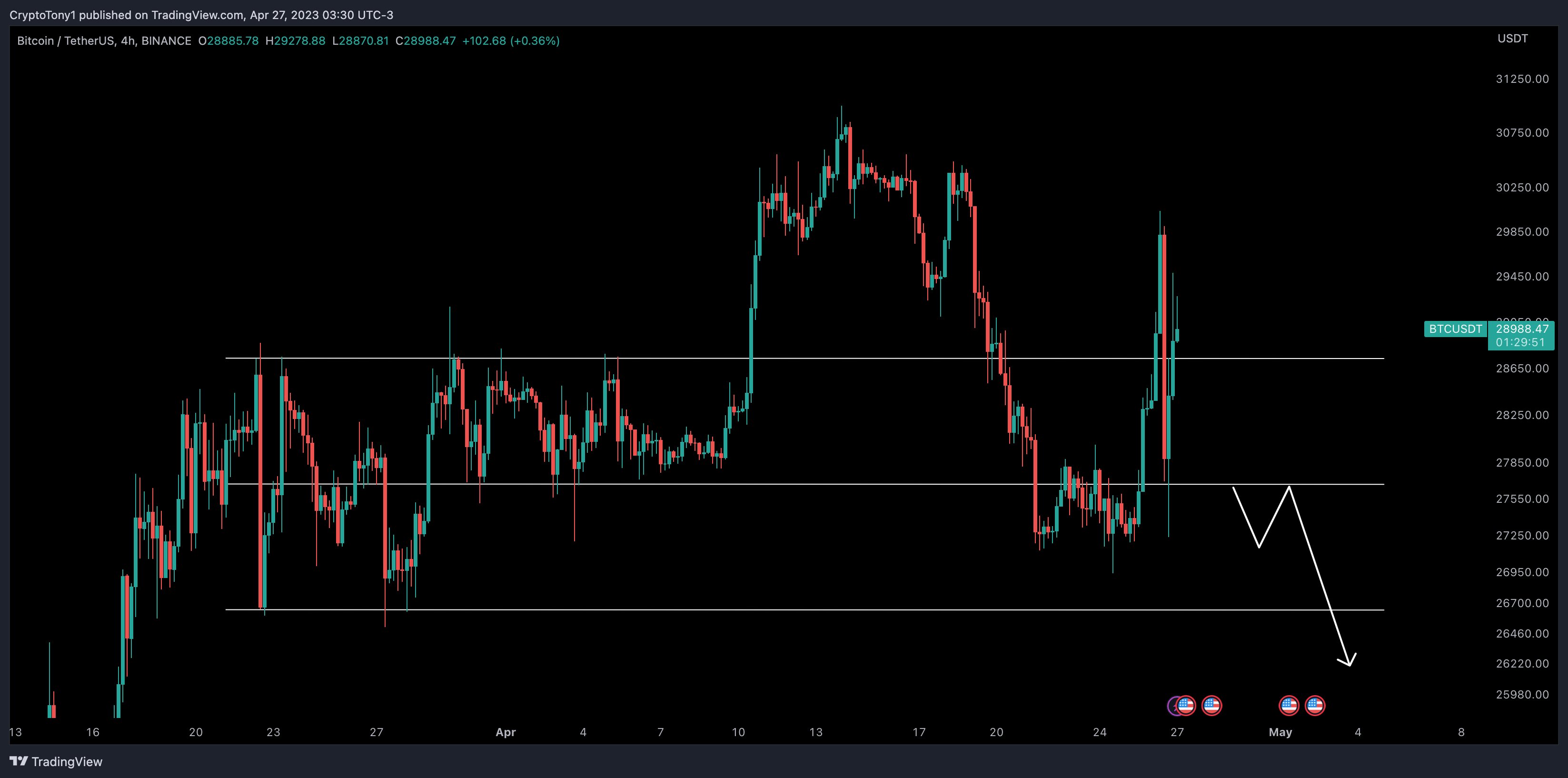

Fellow trader Crypto Tony was more cautious, choosing to wait for further cues before entering the market.

“$27,700 is the level i am watching close today for a short position. I need to see weakness first to get into this, but even a long here for me looks risky,” he stated.

“PA is rough, so sitting this out isn’t a bad play and to focus on a few stronger Alts.”

BTC/USD annotated chart. Source: Crypto Tony/Twitter

Trader Muro focused on $29,500 as the make-or-break zone for Bitcoin, with acceptance or rejection at that level key to determining trend direction.

$BTC thoughts

Watching 29500 for either rejection and a bigger correction (blue drawing)

or consolidation above 29500 would indicate a move higher to me (red) pic.twitter.com/ExWwp6kxZG

— Muro (@MuroCrypto) April 27, 2023

Traders wiped out in BTC price downmove

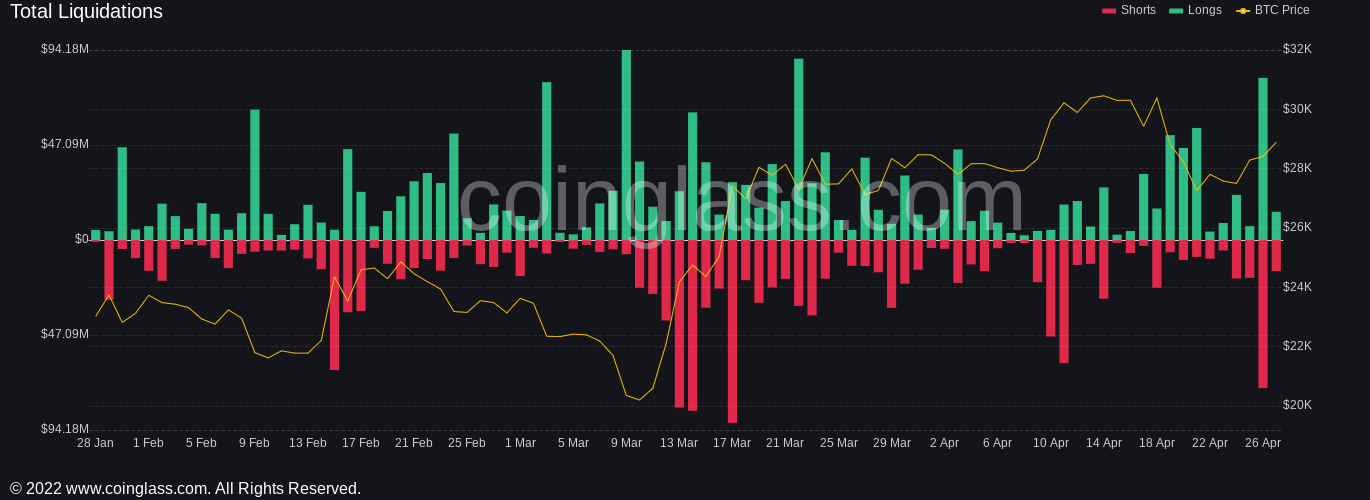

Data from monitoring resource Coinglass meanwhile showed the extent of the panic among market participants.

Related: Bitcoin price can ‘easily’ hit $20K in next 4 months — Philip Swift

Bitcoin liquidations chart. Source: Coinglass

On April 26, both shorts and longs suffered as liquidations on Bitcoin passed $150 million. Cross-crypto liquidations totaled over $320 million.

Observers noted the intense reaction to the news event on lower timeframes in particular, among them contributors to on-chain analytics platform CryptoQuant.

Second highest peak of liquidations at position Long in just one hour in 2023

About $36.5M in positions liquidated in the last hour

On today’s day alone (26th) that’s over $65M liquidated so far#BTC #Bitcoin pic.twitter.com/HweYWAF5GD

— G a a h (@gaah_im) April 26, 2023

Magazine: Shirtless shitposting and hunting SBF on the meme streets: Gabriel Haines, Hall of Flame

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond