Bitcoin, QQQ Correlation Dips to Lowest Level in More Than 2 Years

Bitcoin has decoupled from Investo’s QQQ Trust, suggesting the cryptocurrency’s days of trading virtually in tandem with Big Tech stocks may be in the past — at least for now.

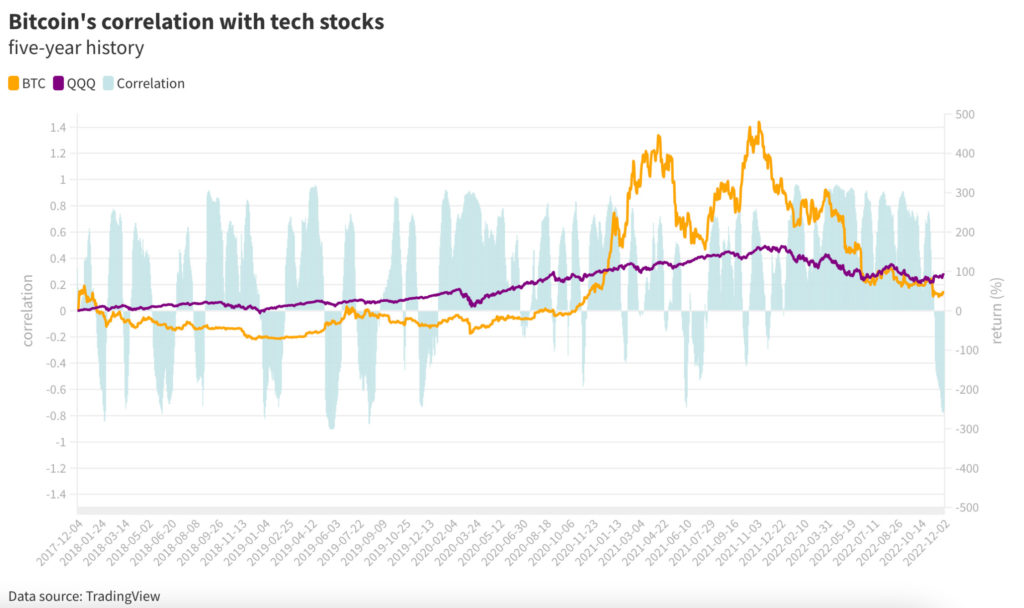

Bitcoin’s 30-day correlation coefficient to QQQ, the tech-heavy ETF known as the Qs, dipped below -0.77, hovering at more than three-year lows set earlier this week, per TradingView data. A correlation coefficient of -1 would mean the assets are moving in complete opposite directions.

BTC’s 60-day coefficient is also negative but not as extreme, sitting at -0.2, its lowest point since last July. Blue-chip, growth technology stocks are expected to continue underperforming, according to Tom Essaye, founder of Sevens Report Research.

“Tech and growth stocks have recovered some ground on value recently, but we continue to believe that progress in the economic recovery and subsequently higher interest rates will be a headwind for tech, and a rotation from growth to value can be utilized to reduce tech overweights, but not abandon super-cap tech holdings altogether,” Essaye said.

QQQ is up 90% over the past five years, double bitcoin’s returns | Chart by David Canellis

The divergence comes as equities have dipped, following a stronger-than-anticipated jobs report, which showed nonfarm payrolls increasing by 263,000 in November. Analysts expected a 200,000 raise. Average hourly earnings also increased 0.6% between November and October and are up more than 5% year over year, suggesting the Fed’s efforts to curb inflation may not yet be sufficient.

The S&P 500 and Nasdaq Composite indexes were each trading about 0.5% lower halfway through Friday’s session. Bitcoin was largely flat, while ether rallied 0.4%. QQQ lost close to 1%.

Still, risk-off sentiment is likely to persist in the long run, analysts say.

“Crypto traders need to remember that a key reason why crypto has fallen so much over the past year is that inflation was out of control and central banks were motivated to send rates higher which ultimately was bad news for all risky assets,” Edward Moya, senior market analyst at Oanda, said in a note Friday.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren