Bitcoin scarcity rises as bad exchanges take 1.2M BTC out of circulation

One of the biggest factors differentiating Bitcoin (BTC) from fiat currency and most cryptocurrencies is the hard limit of 21 million on its total circulating supply. However, the demise of numerous crypto exchanges over the last decade has permanently taken out at least 5.7% (1.2 million BTC) of the total issuable Bitcoin from circulation.

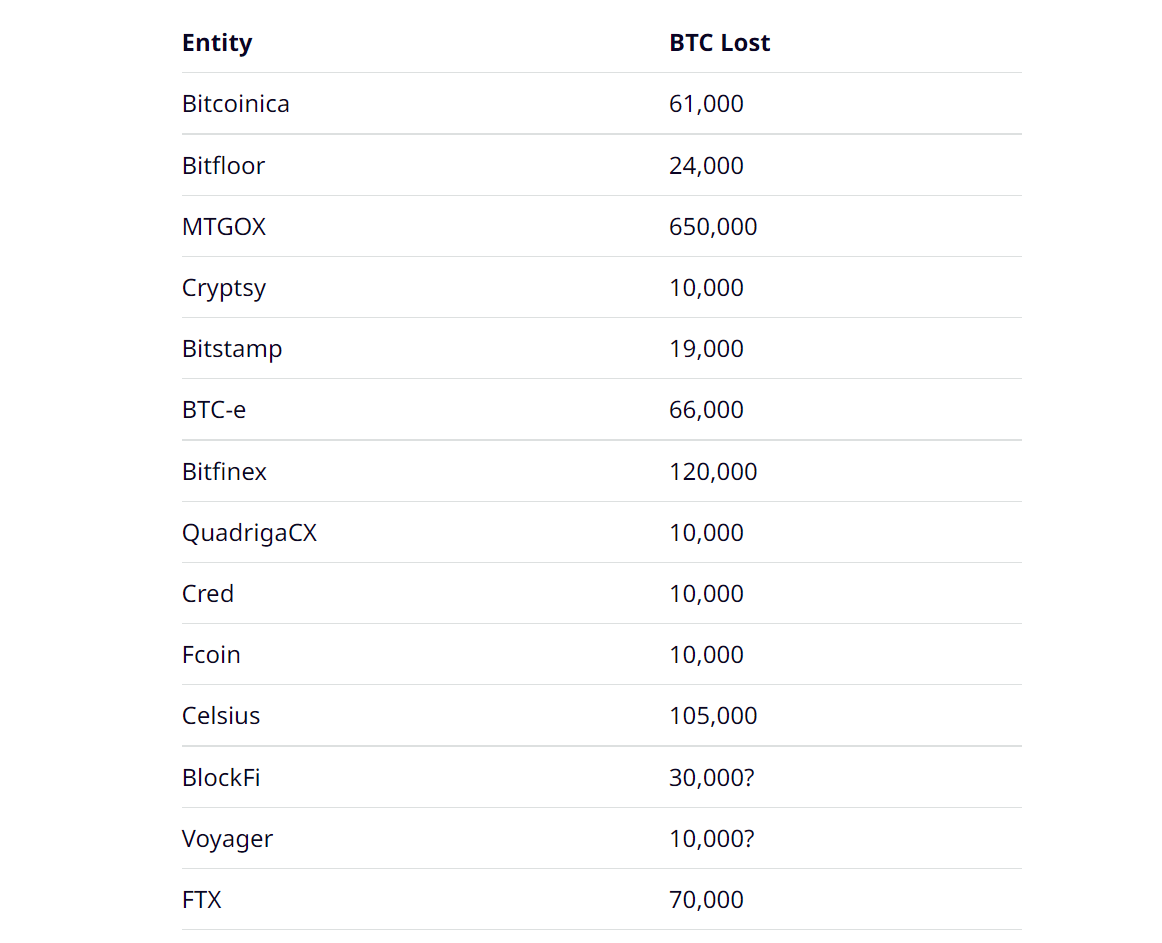

The lack of clarity around a crypto exchange’s proof-of-reserves came out as the primary reason for their sudden collapses, as seen recently with FTX. Historical data around crypto crashes revealed that 14 crypto exchanges, together, were responsible for the loss of 1,195,000 BTC, which represents 6.3% of the 19.2 Bitcoin currently in circulation.

Bitcoin lost due to defunct crypto exchanges. Source: Casa Blog

An investigation conducted by Jameson Lopp, co-founder and CTO of Bitcoin storage platform CasaHODL, revealed that Mt. Gox maintains the top position when it comes to exchanges losing BTC holdings.

While the scarcity of Bitcoin is directly related to its value as an asset, Lopp pointed out that fake Bitcoin offerings currently threaten the ecosystem, adding that “Bitcoin will not be a great store of value if most people are buying fake bitcoin.” Investigations confirm that at least 80 crypto assets have “Bitcoin” in their names, aimed purely to mislead BTC investors.

As a result, investors purchasing fake Bitcoin assets negatively impact the price appreciation of the original Bitcoin.

80 crypto assets have the word «bitcoin» in their name.

14 have a market cap over $1,000,000.

3 claim to be Bitcoin.

1 is Bitcoin.— Jameson Lopp (@lopp) September 22, 2022

To ensure Bitcoin’s position as sound money, self-custody comes out as the most effective way to reduce reliance on crypto exchanges and corporate “paper Bitcoin” contracts.

Related: Blockstream CEO Adam Back talks Bitcoin over a game of Jenga

Salvadorean President Nayib Bukele announced plans to acquire 1 BTC every day starting from Nov. 17, 2022.

We are buying one #Bitcoin every day starting tomorrow.

— Nayib Bukele (@nayibbukele) November 17, 2022

Public records show that El Salvador currently holds 2,381 BTC at an average buying price of $43,357. However, stagnant Bitcoin performance opened up a window of opportunity for the country to substantially bring down its average price of Bitcoin acquisition.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Qtum

Qtum  Synthetix

Synthetix  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond