Bitcoin sees golden cross which last hit 2 months before all-time high

Bitcoin (BTC) lingered near $23,000 on Feb. 7 as a key chart phenomenon hit for the first time in 18 months.

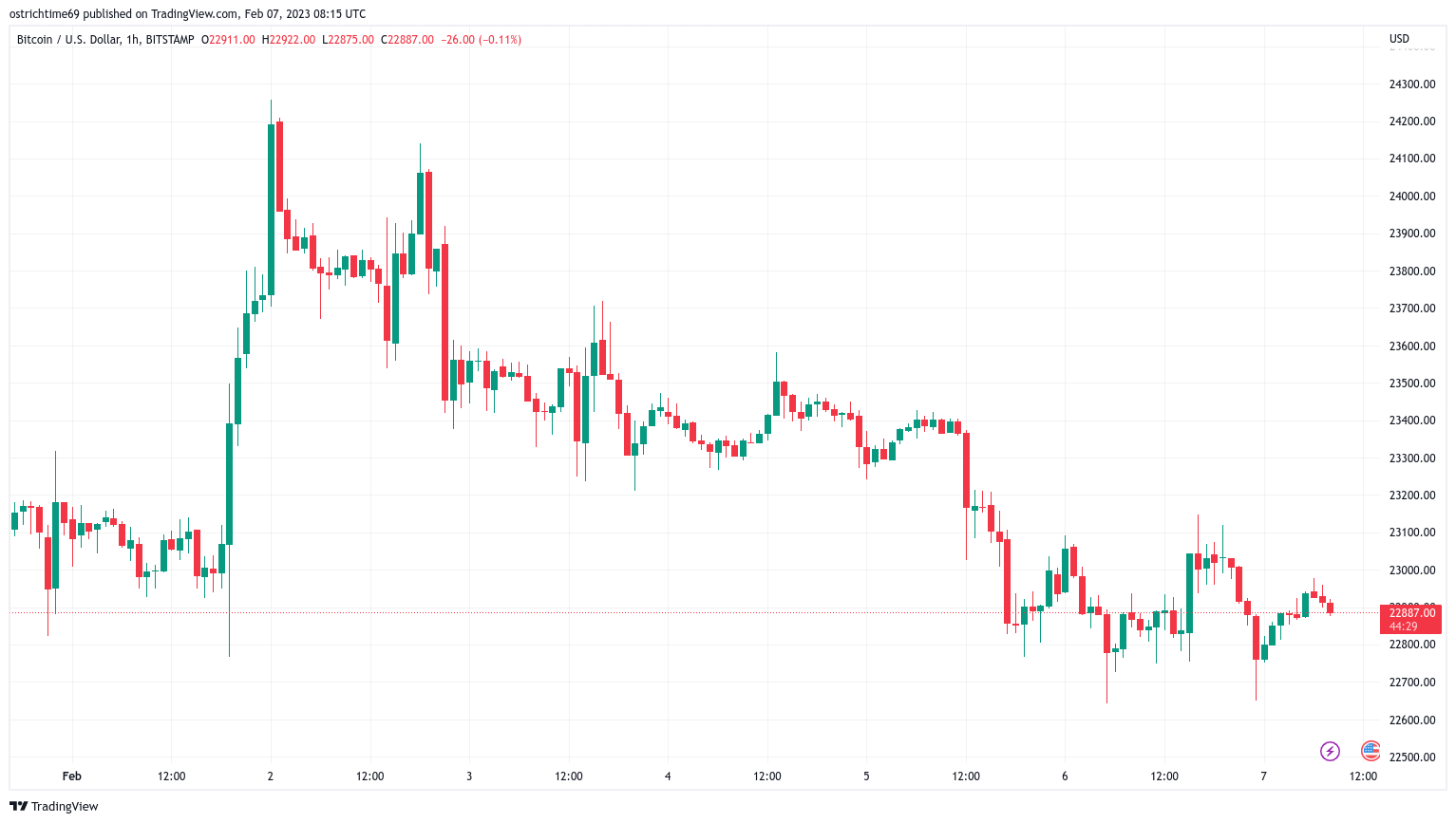

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Battle of the Bitcoin crosses begins

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD tracking sideways overnight, having shunned volatility at the week’s first Wall Street open.

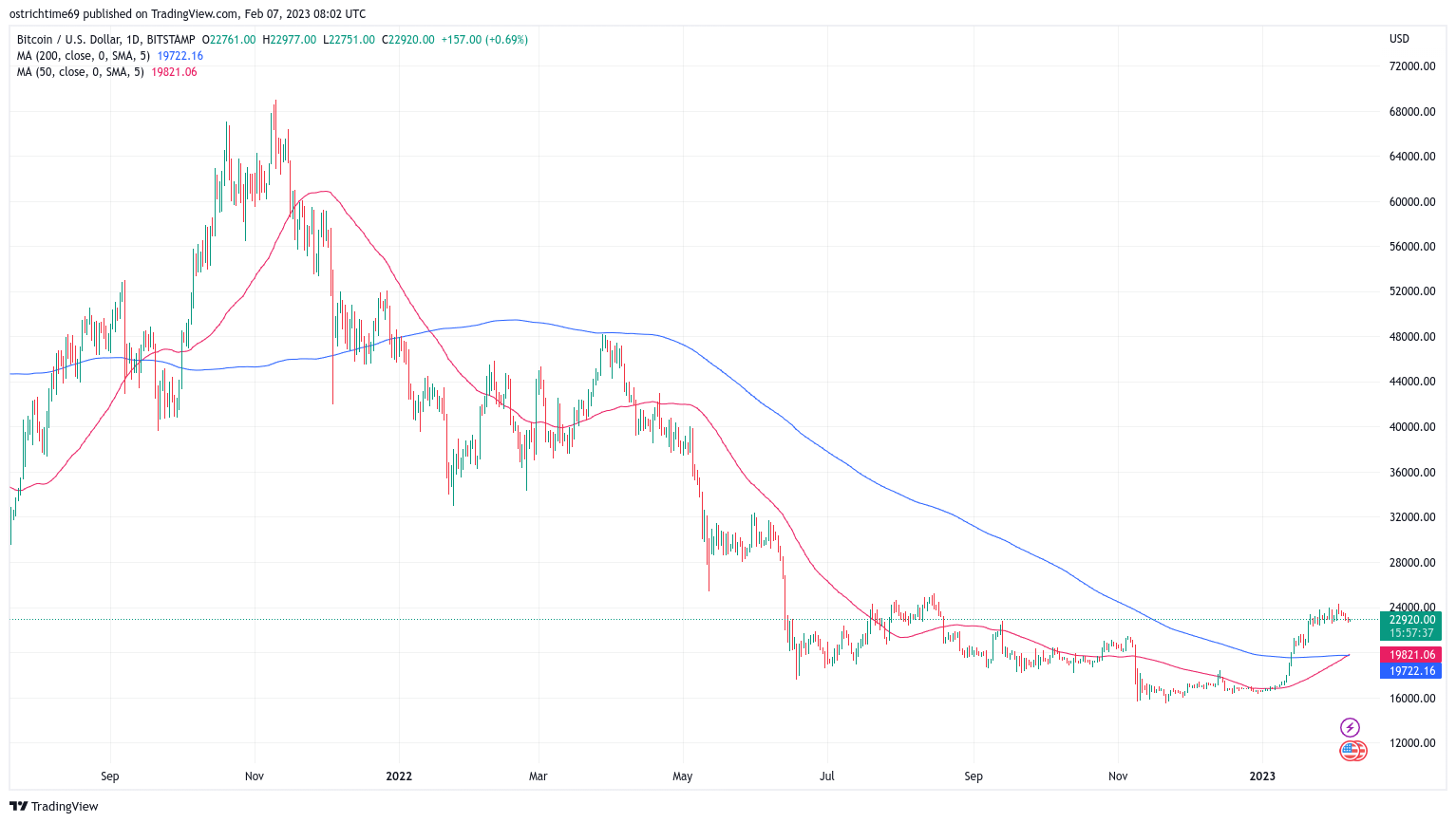

While failing to flip $23,000 to support, the pair nonetheless saw a potentially significant event on Feb. 6 in the form of a “golden cross” on the daily chart.

This refers to the rising 50-period moving average crossing over the 200-period moving average. The last time that this occurred on daily timeframes was in September 2021 — two months before Bitcoin’s latest all-time high.

BTC/USD 1-day candle chart (Bitstamp) with 50, 200MA. Source: TradingView

The cross has been keenly watched by some crypto analysts, with Venturefounder, a contributor to on-chain data platform CryptoQuant, arguing that $25,000 could reappear as a result.

“Bitcoin goldencross just happened!” he summarized in a Twitter reaction.

“This potential correction could see BTC retest $20k (200DMA and key support), then in the bullish case, test $25k next. Make $25k support and it’s nail in the coffin for the bears.”

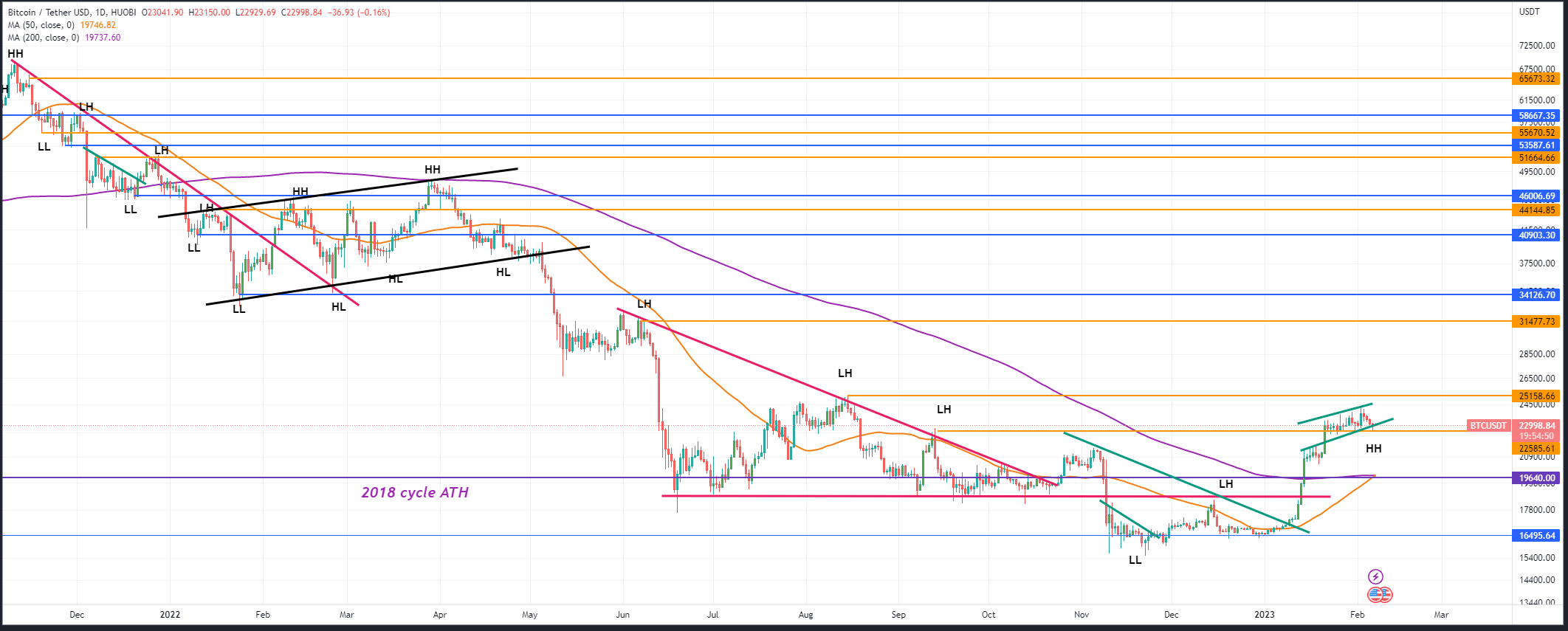

BTC/USD annotated chart. Source: Venturefounder/ Twitter

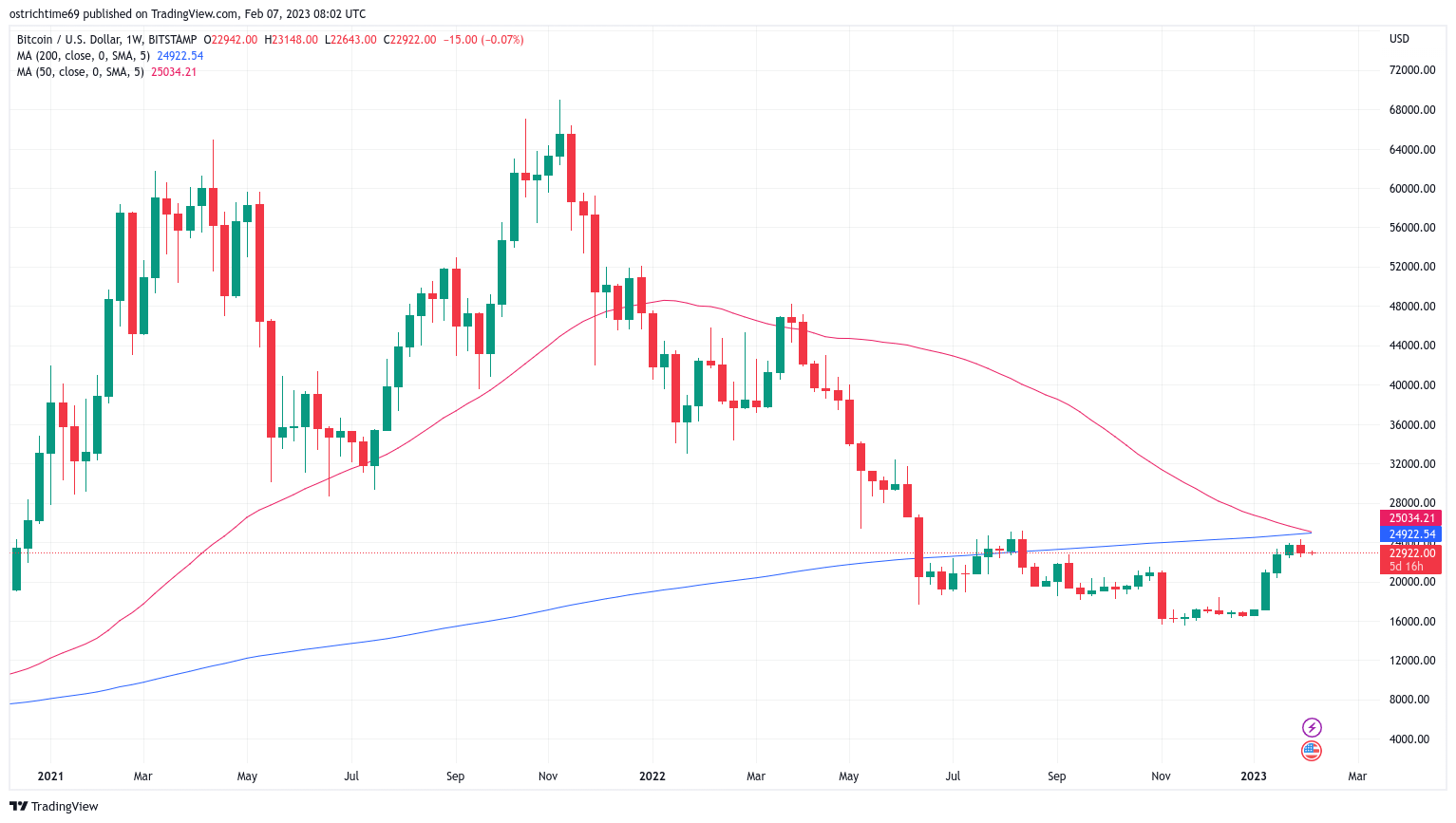

The picture remained complicated on the day thanks to an upcoming “countercross” on weekly timeframes, where the 50-period moving average remained on course to drop below the 200-period one — a phenomenon known as a “death cross” for its conversely detrimental impact on BTC price action.

BTC/USD 1-week candle chart (Bitstamp) with 50, 200MA. Source: TradingView

For on-chain monitoring resource Material Indicators, it remained uncertain as to whether the golden cross alone could propel BTC/USD higher.

“Whether it’s enough to get a legit test of the $25k range remains to be seen,” it wrote in part of commentary on the Binance order book.

An accompanying chart showed major resistance in the form of ask liquidity stacked at $23,500 — the first major hurdle for bulls to overcome in the event of a move higher.

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

Powell speech only key factor of macro week

Another factor on the radar for Feb. 7 meanwhile came in the form of comments from the United States Federal Reserve.

Related: Is BTC price about to retest $20K? 5 things to know in Bitcoin this week

Ahead of next week’s macroeconomic data prints, multiple Fed officials were set to speak, with Chair Jerome Powell’s words expected to be the most significant in terms of market-moving potential.

Nothing special this week, the only key factor to watch is Powell tomorrow afternoon. Perhaps one more sweep for correction and then the party should continue rallying upwards, part of Twitter analysis by Cointelegraph contributor Michaël van de Poppe stated on Feb. 6.

Van de Poppe added that buy the dip might be an appropriate option on altcoins in the meantime, as Material Indicators noted was already the case with Bitcoin whales.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur