Bitcoin Traders Are Aiming at $17,000, Here’s Why

According to the orderbook on the Coinbase exchange, Bitcoin traders and investors are aiming at the $17,000 price range as the first cryptocurrency has previously tested the lowest price in almost two years.

The last time we saw such a bid-side tilt in the orderbook was back in March 2020, when Bitcoin reached its absolute lows after the bullrun of 2017, which caused a panic on the market and created a huge imbalance between bid and ask.

Such a large imbalance is not necessarily bearish for the market as the large buying volume around a price does nothing but form an orderbook support level and does not push the price to a level.

What does this tell us?

The distribution of orders on the market is a great tool for determining the current sentiment of retail investors as it reflects their desired purchase price. In this case, we can clearly see that the majority of market participants are aiming at another plunge in BTC in the foreseeable future.

The lack of positivity on the market is mostly speculative as Bitcoin and events around it have not shown any reasoning that would make us believe that the first cryptocurrency is going to plunge back below $20,000, especially after the successful run we saw for the last few weeks.

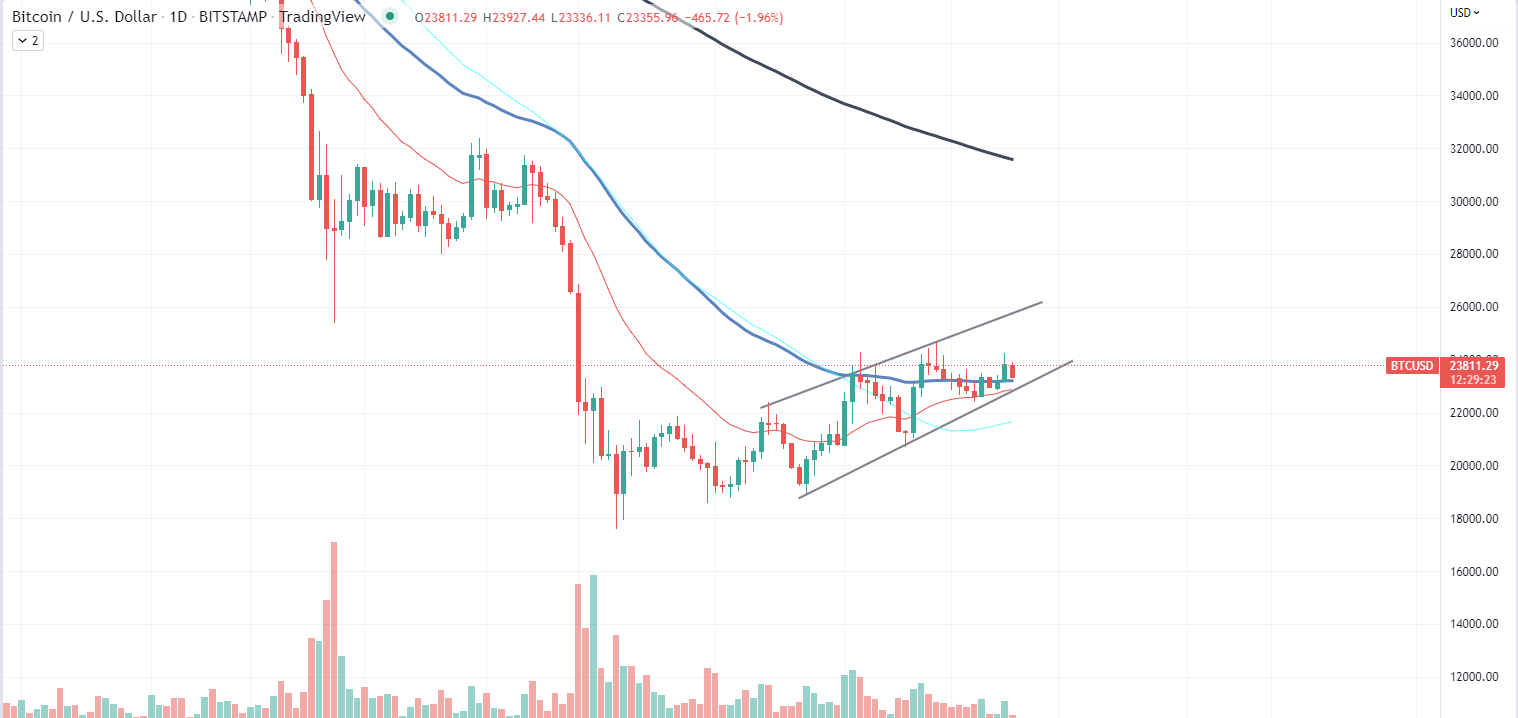

For now, the first cryptocurrency is moving in the ascending channel that it has not been able to break for the last weeks. Unfortunately, Bitcoin could not break above the $24,000 price range either, returning to the lower border of the channel.

At press time, Bitcoin is trading at $23,811 and is losing around 2% of its value in the last 24 hours.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Algorand

Algorand  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur