Bitcoin Whale Activity Wakes Up As BTC Hovers Just Above $20,000 Level: On-Chain Data

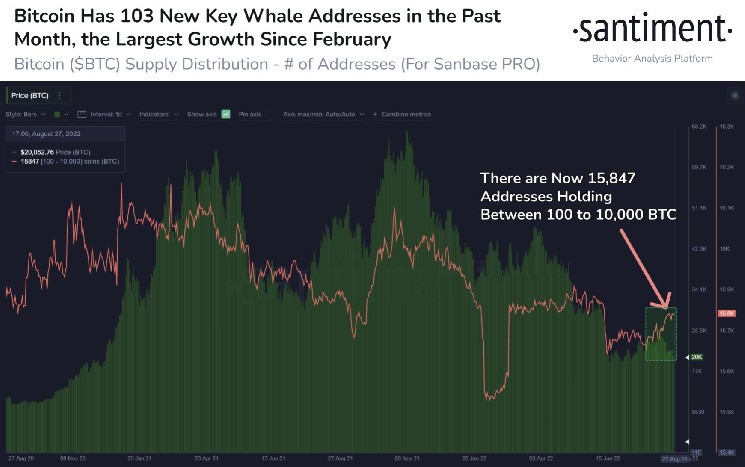

Crypto analytics firm Santiment is tracking an increase in the number of whale addresses holding Bitcoin (BTC).

According to a new post, the data aggregator highlights the uptick in wallets which hold between 100 and 10,000 Bitcoin as a reassuring indicator after the markets tanked last Friday in response to Federal Reserve Chair Jerome Powell’s statements about the economy.

“As Bitcoin has danced around $20,000 this weekend, a positive sign is the growth in the amount of key whale addresses.

There’s a correlation between BTC’s price and the amount of addresses holding 100 to 10,000 BTC, and they’re up 103 in the past 30 days.”

Source: Santiment/Twitter

When asked for data about how many of the 15,847 whales bought in since early last week, Santiment reports,

“There have been 16 new BTC whale addresses made in the last five days.”

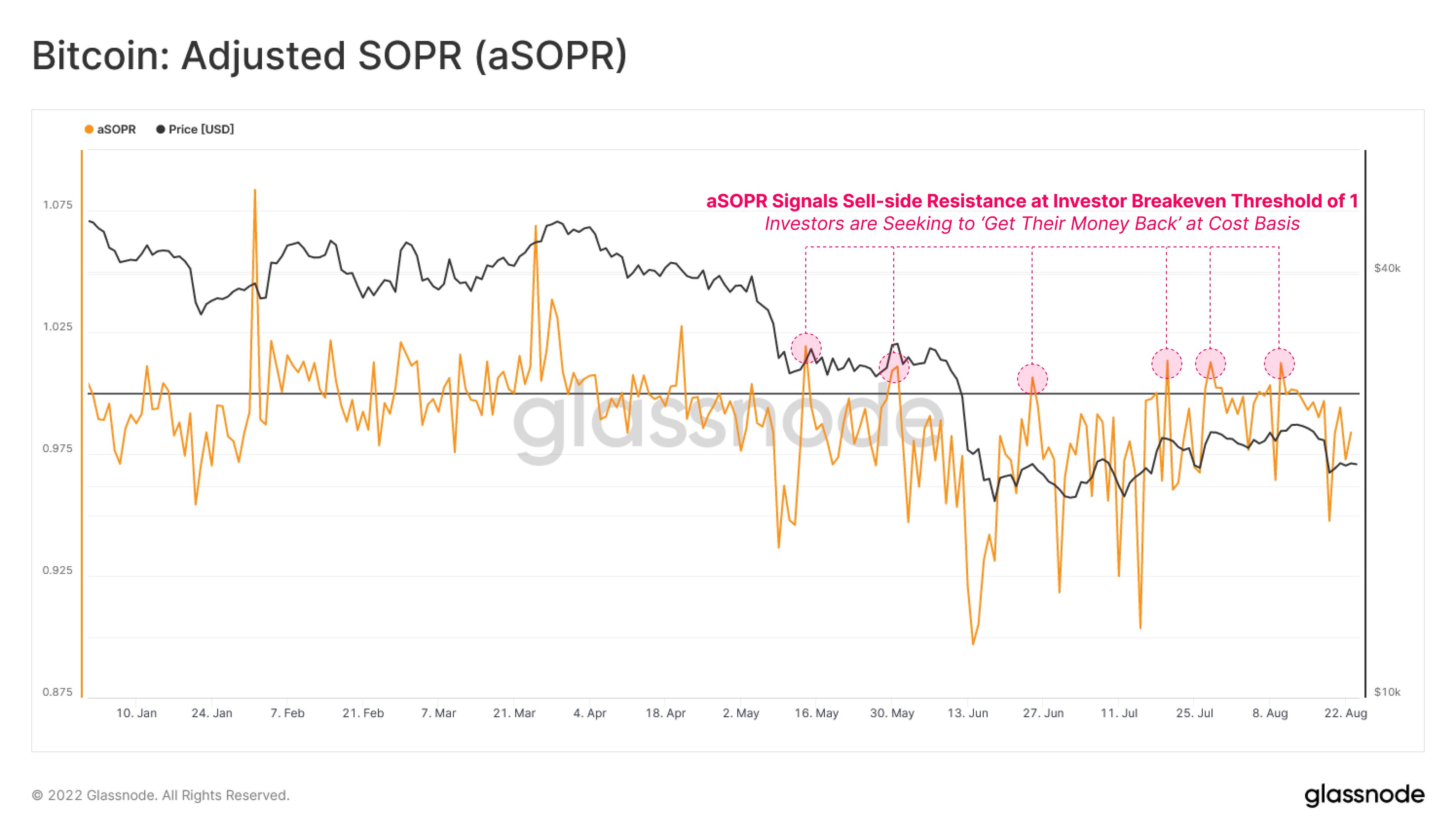

Fellow crypto analytics firm Glassnode also weighed in on the state of Bitcoin by utilizing on-chain data to analyze BTC’s adjusted SOPR (aSOPR), a metric that reflects the ratio between the selling and purchase prices of the flagship crypto asset.

According to Glassnode, BTC’s aSOPR suggests that investors are focused on recouping their investments.

“Bitcoin aSOPR continues to face heavy resistance at the break-even threshold of 1.0.

This suggests BTC investors are taking profits during bear market rallies, and are spending coins at their cost-basis to simply ‘get their money back’.”

Source: Glassnode/Twitter

At time of writing, Bitcoin is up nearly 3% and trading for $20,166.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Holo

Holo  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  BUSD

BUSD  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur