Bitcoin’s Price Drop Causes Over $200 Million in Long Liquidations Across Crypto Derivative Exchanges

On Feb. 24, 2023, bitcoin’s price remained above the $23,000 threshold and then rose to a peak of $23,829 per unit on March 1. On March 2 at 8 p.m. Eastern Time, the price of bitcoin fell, dropping below the $23,000 mark. This decline resulted in a significant $237.97 million worth of long liquidations on a variety of crypto derivative exchanges. Of that total, $206 million in liquidations occurred on March 2 alone.

Bitcoin Derivatives Record $237 Million Liquidated in 24 Hours

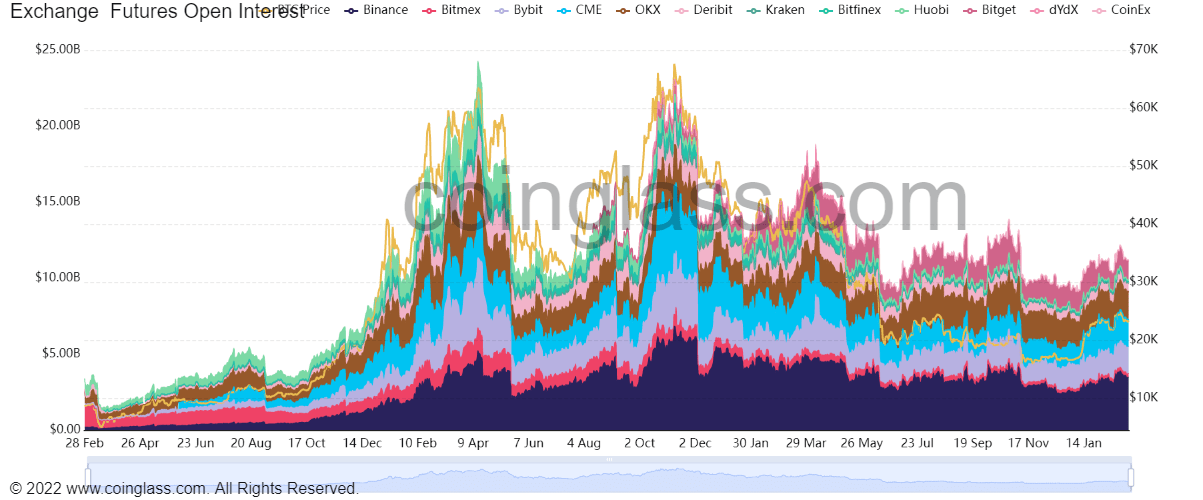

In the past 24 hours, 65 cryptocurrency derivative exchanges recorded a trading volume of $171 billion, which represents a 21.85% change from the previous day. Throughout February, the trading volume and open interest for bitcoin futures increased, reaching a total of $791 billion, with Binance accounting for $468 billion of that amount.

On Feb. 21, 2023, the total open interest in bitcoin futures peaked at $9.73 billion, but it has since decreased to $9.06 billion as of March 2. BTC’s price had stayed above the $23,000 threshold for approximately seven days leading up to March 2.

However, on Thursday, the price plummeted to a low of $22,259 per coin. Prior to the drop, there were many long positions, and according to statistics from Coinglass, 78,116 traders were liquidated when the price fell at 8 p.m. Eastern Time. The total liquidations since the price change amount to $237.97 million, with the largest liquidation occurring on Okx.

On March 2 alone, $206 million worth of liquidations occurred, with 90% of the positions being long. According to Coinglass, a BTC/USD swap on Okx had a value of approximately $4.16 million. Binance, Bybit, and Okx experienced the most liquidations in the past 24 hours, followed by Huobi, Coinex, and Deribit.

On March 2, there were $9.2 million in short positions betting against BTC’s value rising. The liquidations on March 2 were nearly as high as the number of long liquidations that occurred on Feb. 8 when $254 million in long positions were wiped out. The March 2 liquidations more closely matched those on Jan. 17, which saw $190 million in long positions liquidated.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Theta Network

Theta Network  Decred

Decred  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond