Bits Crypto Raises $1.2M to Facilitate Gradual Investments in Crypto

Fintech start-up Bits Crypto has raised $1.2 million in pre-seed funding to build out its mobile crypto investment application. The round was led by HOF Capital, the investor in crypto companies such as MoonPay, Stripe, and Kraken, the company said Tuesday.

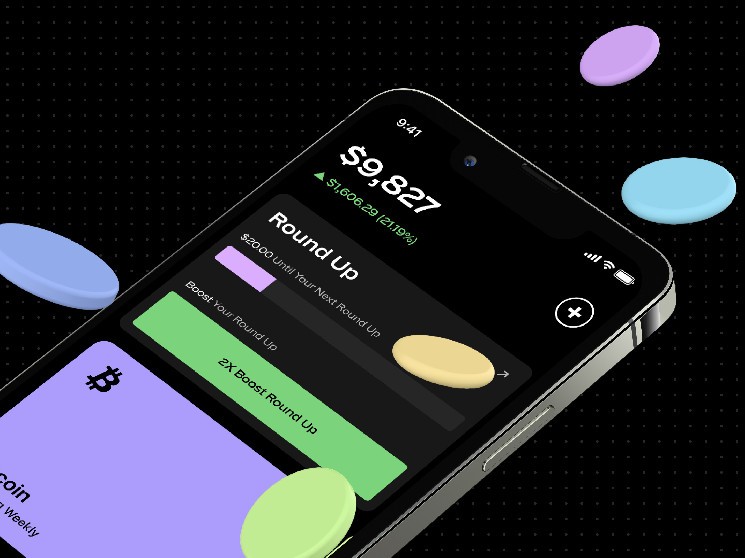

Bits allows users to invest their spare change in cryptocurrencies through automatic dollar round-ups. Each user’s credit card transaction is rounded up to the next dollar and that difference is invested in cryptocurrency. Similar to investment platform Acorns, which automatically invests in a portfolio of stocks, Bits’ caters to users who want to dollar-cost average small amounts to build their portfolio of crypto investments over time.

“Everybody knows that crypto is hard. There’s extreme market volatility, and that’s intimidating to first time investors or wannabe investors,” CEO Jameson Rader told CoinDesk. “Fortunately, there is dollar-cost averaging, which is a proven financial strategy to minimize exposure and risk to market volatility.”

Dollar-cost averaging is a strategy in which investors put money into assets incrementally over time. It can be beneficial to those who want to spread their investment out, with a likelihood of seeing higher returns as opposed to a one-time, all-in investment.

Chief Design Officer Nick Bembenek told CoinDesk that to start investing, users download the app and connect their credit card. They then choose a basket of up to three currencies to allocate their investments across. Users spend money as usual, and with each transaction, the spare change rounded up to a dollar is deposited into the app. From there it’s invested across the basket, in $25 increments to avoid heavy gas fees.

Bits also lets users select amounts for daily, weekly and monthly automatic investments.

Differentiators

Financial services companies such as Robinhood and Cashapp currently offer crypto roundup features. However, these require the use of these platforms’ native credit cards.

Rader calls this a “major product differentiator,” as Bits utilized banking software Plaid to allow users to plug in any debit card, credit card, or bank account to begin round ups and scheduled investments.

Bits has integrated Coinbase for users to invest in tokens listed on the exchange, as well as withdraw their profits via Coinbase wallet.

According to COO Alex Poscente, the integration of Coinbase and Plaid allows the product to operate across all 50 states in the U.S.

It’s also building out educational content, called Tidbits, to educate and onboard users new to the crypto space on what tokens are available to purchase. After trending twice on Reddit as the top thread in the 5.1 million-member large Cryptocurrency community for its beginner descriptions of every coin available on Coinbase, it’s making an effort to not only make its application user-friendly for beginners, but educational.

An early user of Bits told CoinDesk that she likes the app’s orientation towards onboarding users new to the crypto space.

“It definitely has changed my view [of investing in crypto] in the sense that one I’m not scared and two, I’m actually able to act and be active in this space as well, as an investor,” the user told CoinDesk.

The funding round also saw participation from VC funds Founders Inc. and Founders Committee.

Bits plans to launch its app to the public in September. Eventually, the team hopes to make a fully decentralized, on-chain custodial Bits wallet by early 2023.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD