Bitwise Predicts Sideways Bitcoin Move Ahead of 2023 Recovery

A Bitwise analysis has predicted that Bitcoin will bounce back from the protracted bearish trend. This time, the recovery projects another dimension, different from the usual pattern we have seen in previous cycles.

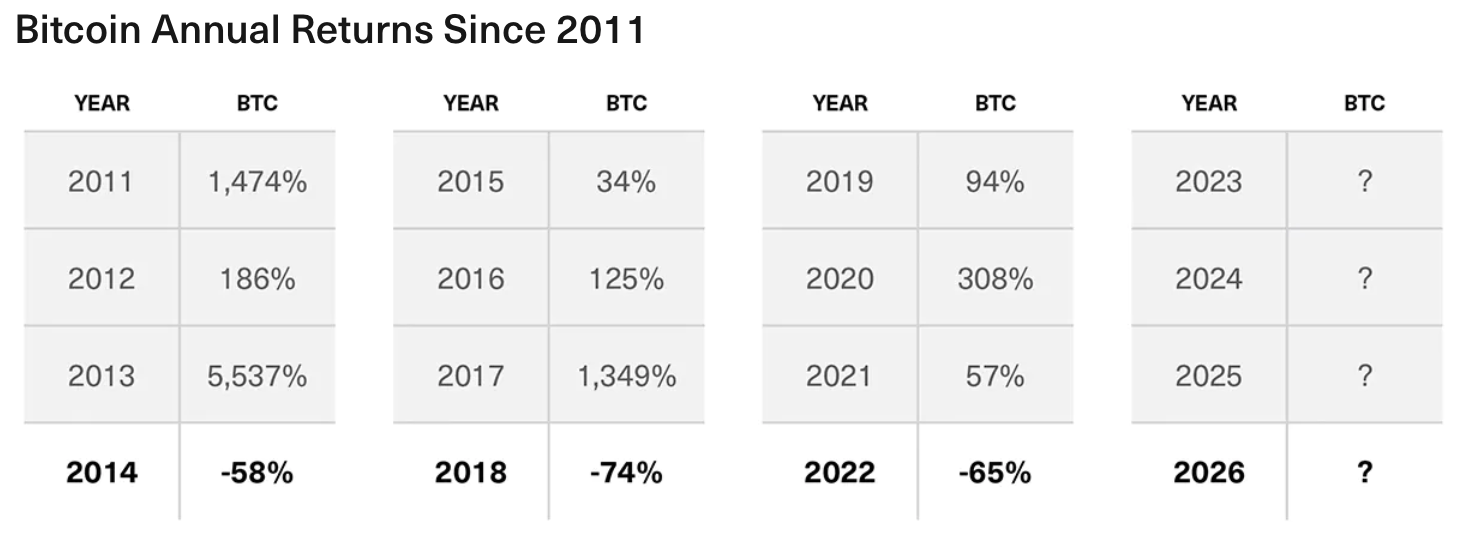

Bitwise’s prediction is based on Bitcoin’s historical behavior. There has been a pattern since 2011 when Bitcoin started gaining prominence. A diagram in the report shows that every Bitcoin cycle lasts for four years, with the fourth year hosting a pullback.

The pictorial expression suggests that 2022 fits perfectly into the pullback year for Bitcoin, implying that prices will spring back up in 2023, as shown below;

To support this recovery, Bitwise noted that the impact of industrial developments like Ethereum Merge will reflect this year. Other factors like the rise of Layer 2 solutions, and the litany of new applications developed will motivate a bullish trend for the crypto market.

Bitwise predicts a different approach to the expected recovery. Rather than the usual V-shaped price action, the firm predicts that prices will develop in a U-shaped pattern. That means there will be a sideways price movement before the rally kicks in.

Factors identified to alter the pattern include the various challenges faced by the industry in 2022. Setbacks like the FTX debacle and other crypto credit challenges shook investors’ confidence in the past year. Impending regulation and severed banking relationships were noted as factors that would make investors skeptical.

The planned release of 127,000 Bitcoins as part of the Mt. Gox settlement is another issue that Bitcoin has to face. It is an event that could unsettle the market dynamics. In addition, the existing distress in the Bitcoin mining industry, a fallout of China’s clampdown on crypto continues to loom.

These elements helped to form the opinion that Bitcoin price will likely move sideways, with a possibility of another leg down, before it eventually recovers. However, Bitwise believes that Bitcoin will bounce back. Based on history, it suggests the coming recovery could be the biggest yet that the industry has experienced. Perhaps, a new all-time high will be the icing on the cake when this happens.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur