Blockchain.com Shopping Assets to Fill $270M Hole From Three Arrows Capital: Sources

Blockchain.com, the early Bitcoin wallet provider and exchange that boasted a $14 billion valuation as recently as last March, has been attempting to sell off assets in a scramble for capital.

Decrypt has learned from multiple sources of calls in December and January on which Blockchain.com senior executives have shopped parts of its business, including to Coinbase. Decrypt has also seen a private email setting up one of these calls.

A spokesperson for Blockchain.com denied that such calls have happened, and commented, “Blockchain.com is an asset buyer, not a seller.”

Even as the company denies attempting to sell off assets, the spokesperson shared that Blockchain.com recently sold off 80% of its stake in PolySign. Blockchain.com participated in the infrastructure startup’s 2021 $53 million Series B round.

Blockchain.com had lent $270 million in cash and crypto to Three Arrows Capital (3AC), the crypto hedge fund that filed for bankruptcy in July after the collapse of the Terra ecosystem.

More than $500 million in fundraising in just 18 months

The company had an enormous year in 2021 amid a booming crypto bull market. It raised $120 million in strategic funding in February 2021, then a $300 million Series C in March.

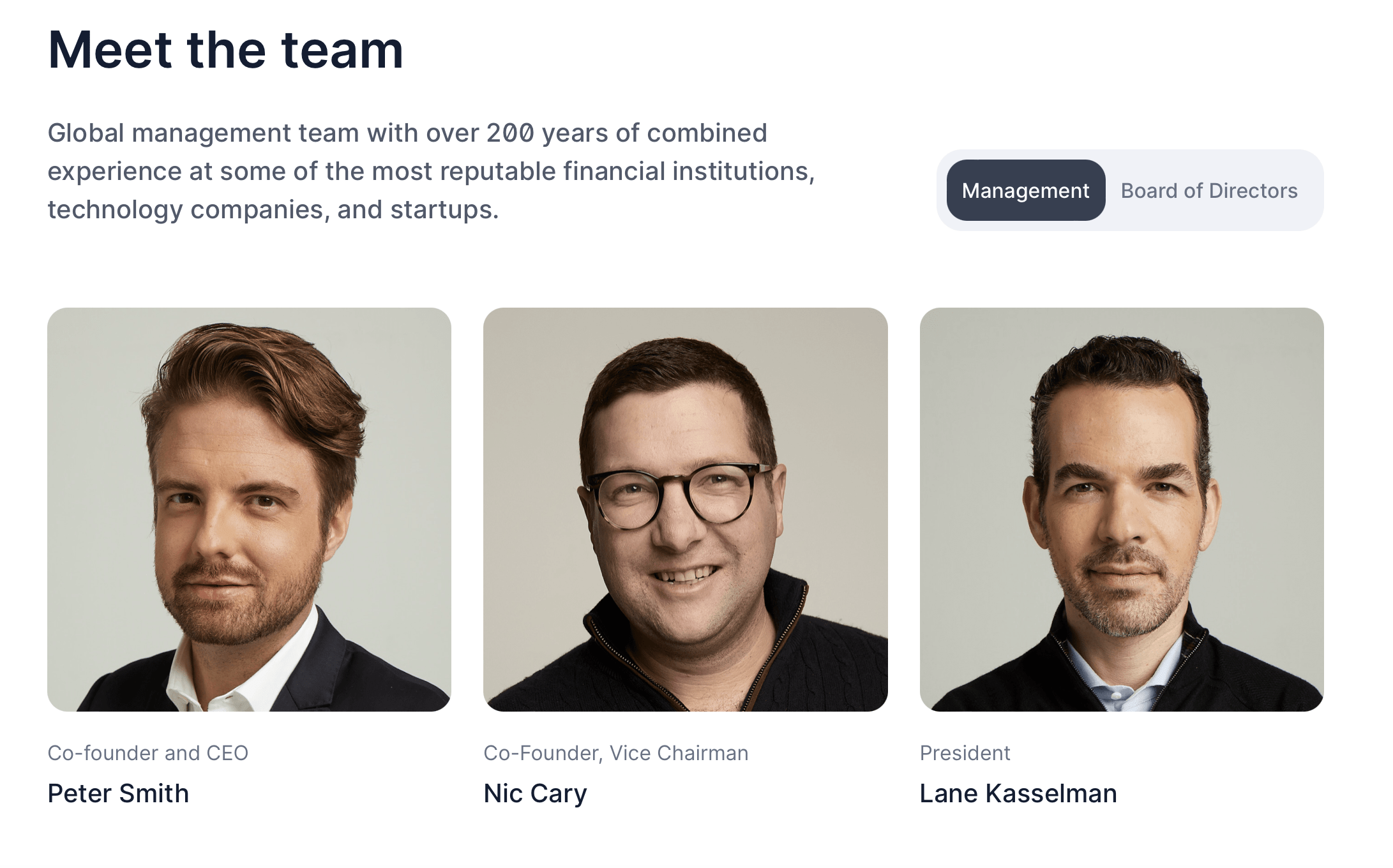

That month, it also brought on two Washington “fixers”: Lane Kasselman, a former head of communications at Uber who worked on Hillary Clinton’s 2008 presidential campaign, joined as chief business officer (he’s since been named president); and Jim Messina, who worked in the Obama White House, was named to the board.

In March 2022, the company raised a Series D that valued it at $14 billion. The amount was not disclosed.

Then in May 2022, Terra went down, and 3AC went down with it.

Following 3AC’s crash, Blockchain.com raised another $78 million in a strategic round led by Kingsway Capital, with participation from Lightspeed Venture Partners. CEO Peter Smith wrote in a blog post at the time that it would “strengthen our balance sheet.” The blog post also touted the company’s new partnership with the Dallas Cowboys.

That puts the total money raised in just an 18-month period at half a billion dollars—without even counting the undisclosed Series D.

Even so, Blockchain.com laid off 150 people in July 2022 and laid off another 110 people in January of this year.

The company is also actively seeking to raise more capital, even at a severely lowered valuation, according to sources. These efforts were previously reported in late October, and they are ongoing. Sources tell Decrypt the company is offering debt warrants.

On January 4, Blockchain.com’s Chief Strategy Officer and Global Head of Institutional Dan Bookstaber and CFO Adam Schlisman (whose name appears as “Schisman” on the filing) submitted a filing for a Regulation D offering with the SEC: Blockchain Capital Solutions DeFi, LLC.

Regulation D offerings cover capital raises for unregistered securities. They’re meant to allow companies to quickly raise money without going through the time-consuming process of registering a new security.

But that means there are tradeoffs. For example, the 506(c) exemption cited in Bookstaber and Schlisman’s filing means they can only raise capital from accredited investors—people with a gross annual income of at least $200,000 or a net worth of more than $1 million, as defined by the SEC.

In the filing, the two Blockchain.com executives indicated they were offering equity in exchange for investments of at least $1 million, but hadn’t made any sales as of January 4.

A Blockchain.com spokesperson declined to provide any more details about the filing.

The address on the SEC filing is the office of Miami FC, a team in the United Soccer League co-owned by Italian businessman Riccardo Silva, who in August also became a co-owner of the football club AC Milan.

The phone number on the SEC filing matches a Blockchain.com customer service line. When Decrypt called the number, an answering machine picked up: “Thank you for calling Blockchain.com. There are no support agents available to take your call right now, but please leave your number, phone number and email address and we will get back to you as soon as possible.”

The top row of Blockchain.com execs, from its website as of Feb 16, 2023.

One of the earliest names in crypto

Created by Ben Reeves in 2011, Blockchain.info was one of the earliest Bitcoin block explorers—a website that documents on-chain transactions in real time. It soon added a free crypto wallet, which now claims more than 85 million users, and changed its name to Blockchain.com. It also brought aboard Nic Cary (now vice-chairman) and CEO Peter Smith to help monetize the business. While the block explorer and wallets didn’t generate revenue, some investors believed that if the company could convert even a fraction of its wallet users into paying customers, it would blossom.

In that vein, in 2018, the company hired TD Ameritrade vet Nicole Sherrod to help spin up its retail exchange, which launched in 2019 as “The Pit.” Sherrod left after just 16 months, and the exchange never got hot, even with the addition of margin trading in 2021. Out of 576 crypto exchanges tracked by CoinGecko, Blockchain ranks 57th by daily volume as of publication, with about $6.1 million in daily trading volume—less than 1% of the volume by competitors in the top 5.

“The exchange was always lackluster, they were two years behind the curve and the UX/UI was terrible,” said a former Blockchain.com employee who spoke under condition of anonymity due to signing a non-disclosure agreement. “It was Peter’s pet project and he was personally the product manager on it, but then he had to let go of it to focus on bigger things.”

But the company doesn’t need to have a thriving exchange to succeed, and its recent strategy has leaned heavily on other services, including OTC and institutional lending, which it rolled out in 2019.

Speaking to Decrypt in May 2021 about where the bulk of Blockchain.com’s revenue came from, CMO Jason Karsh said, “If you asked me a few months ago, I think brokerage was definitely where we saw the most, meaning the buying and selling of Bitcoin in the wallet. But our institutional business has been growing like gangbusters.”

At the time, Karsh said the company was “in conversation with” many “recognizable names from mainstream finance.”

Kasselman’s hiring accelerated that focus. The former Uber communications head was brought on to deploy the company’s capital on mergers and acquisitions (M&A). Pointing to a “large balance sheet” and claiming the wallet, exchange and institutional lending were each in the top five in their markets, he told Decrypt in May 2021 that the M&A strategy would be focused on both complementing existing business units and expanding to new areas.

“We’re going to be opportunistic,” Kasselman said. “I can’t prognosticate on what’s going to happen if and when there’s another crypto winter, but if there is, sure seems like a good time to buy a lot of Bitcoin and buy up companies that may be struggling.”

Ultimately, Blockchain focused on improving lending and OTC trades for what Kasselman called the company’s “fast-growing institutional business.”

Since 2021, the company has purchased AiX and its “AI-powered negotiation and matching engine for institutional OTC traders” as well as the OTC desk of Singapore-based Altonomy. A third acquisition, Argentina-based crypto investing platform SeSocio, was shuttered seven months after being purchased as Latin American trading stagnated.

But crypto lending hasn’t been a safe business model over the past year. Celsius filed for bankruptcy in July after being dogged by regulators. Voyager did the same after exposure to 3AC. BlockFi, which had been “bailed out” by FTX, was forced to file for bankruptcy in November. And Genesis, which had exposure to both 3AC and FTX, filed for Chapter 11 protections this month.

Without a bustling trading business—and with 3AC representing a $270 million hole in its balance sheet—the company may be insufficiently diversified and too short on cash to survive the crypto winter. In conversations with Decrypt, several industry investors expressed strong doubts about the health of the company.

Meanwhile, last month, Peter Smith bought an $8 million seaside house in the Pacific Palisades.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  TRON

TRON  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  Enjin Coin

Enjin Coin  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  Zcash

Zcash  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  NEM

NEM  Ontology

Ontology  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  DigiByte

DigiByte  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  Ren

Ren  BUSD

BUSD  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Bitcoin Diamond

Bitcoin Diamond  Energi

Energi  Augur

Augur  HUSD

HUSD