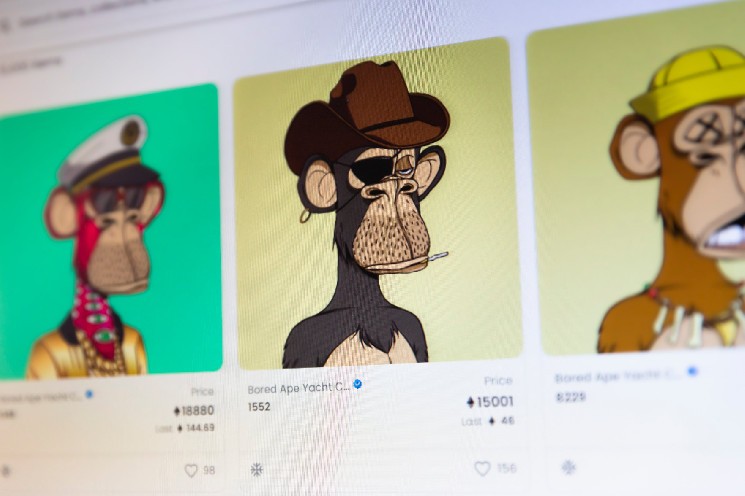

Bored Ape Yacht Club Trade Volume up 80%+ After SEC’s Yuga Probe Revealed

Various assets related to Yuga Labs, the creators of Bored Ape Yacht Club, reacted to the news of an SEC probe in a dramatic way. The company’s major NFT collection experienced a massive increase in their trading volume, while the ApeCoin suffered a massive price drop—and achieved a quick recovery.

Trade Volume of Yuga Labs’ Ape NFTs Surges as the SEC’s Probe is Revealed

Data from Cryptoslam demonstrates that Yuga Labs’ two major NFT collections—Bored Apes Yacht Club and Mutant Apes Yacht Club—reacted to the news of the SEC probe in a spectacular fashion. BAYC achieved a volume of $1.8 million in a day—an 86% increase. The data is particularly striking considering the daily volumes on major NFT marketplaces have been constantly declining throughout 2022.

The Mutant Ape Yacht Club showed an even more dramatic spike to over $1 million—300% compared to the previous day. While the slight slump of around 2% in the BAYC floor price might indicate panic selling, the picture isn’t entirely clear.

Individual Bored Ape NFTs have been selling for more than $100,000 even after the probe was revealed. Furthermore, while it is clear from the price movements of the associated ApeCoin that some panic selling occurred, it appears to be over for now.

ApeCoin quickly reacted to the news by going through a cliff-like drop in the first few hours after the probe was revealed. Over the following 24 hours, the price of the token recovered and is now matching the previous day’s high of around $4.72. It is however noteworthy that the ApeCoin, unlike Yuga’s NFTs, suffered a drop in trading volume of around 50% within the same timeframe.

SEC’s Yuga Probe Explained

While the SEC has been actively targeting crypto companies for their ICOs ever since the Commission published its DAO report in 2017, it has been keeping an eye on NFTs for the better part of 2022. The scrutiny of this side of the market started in March and started zeroing in on October 11th.

The first major target of the Commission came in the form of Yuga Labs, the creators of some of the most successful NFT collections. It is important to note that the launching of the probe doesn’t guarantee the company will be accused of any wrongdoing.

It is possible that the recovery of ApeCoin’s value, and the relative stability of BAYC’s floor price, is the result of the lack of aggressive action on the SEC’s part. While the Commission has filed numerous complaints designating cryptocurrencies as securities, it has yet to take a decisive stance on non-fungible tokens.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Zcash

Zcash  Decred

Decred  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur