BTC losses get real as Bitcoin SOPR metric hits lowest since March 2020

Bitcoin (BTC) sellers are nursing their largest overall losses since March 2020, one on-chain metric suggests.

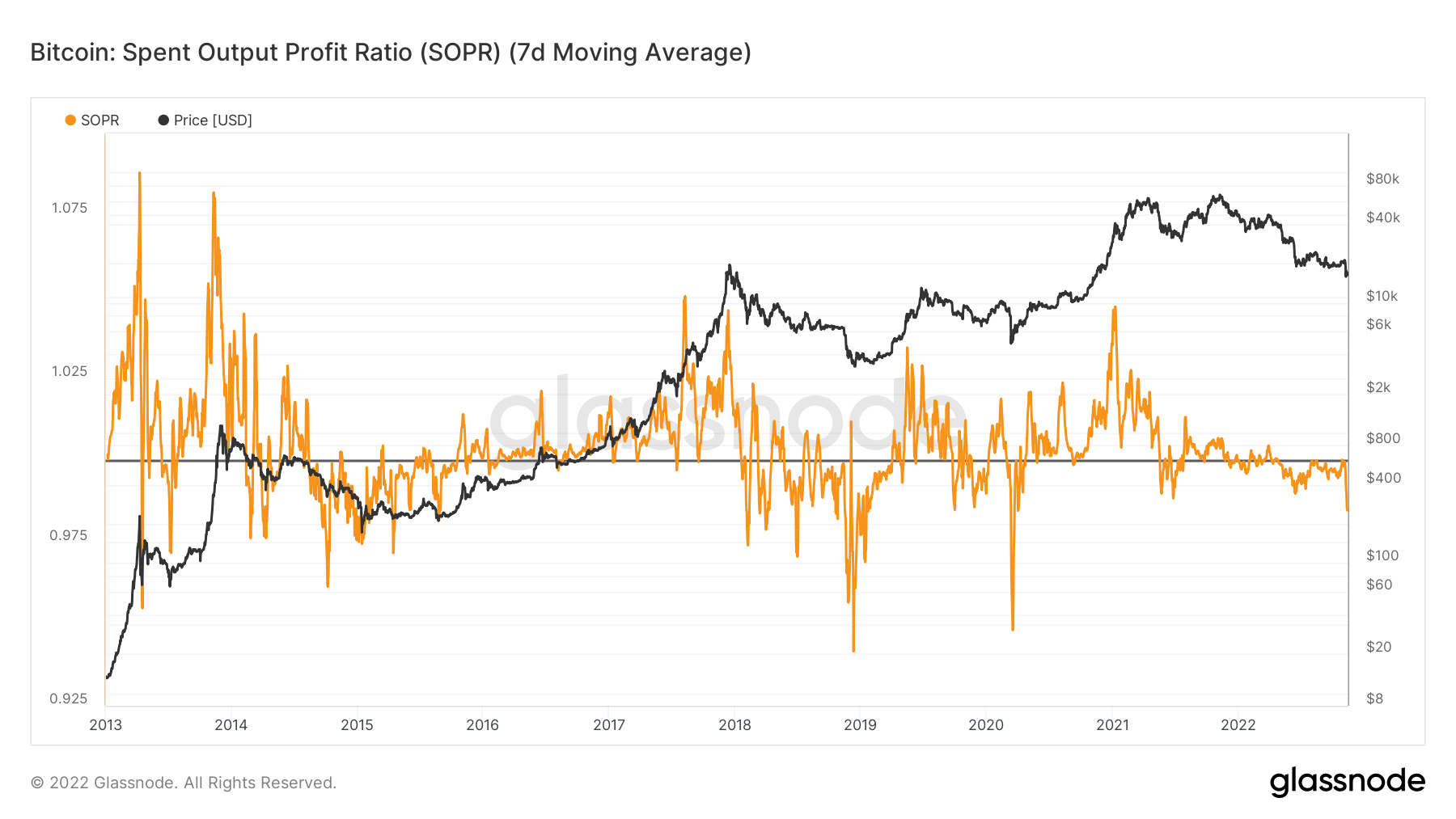

Data from on-chain analytics firm Glassnode confirms that Bitcoin’s spent output profit ratio (SOPR) has now fallen to two-year lows.

BTC on-chain losses mount

As Bitcoin holders attempt to pull funds from exchanges into non-custodial wallets, those moving coins around are doing so at multi-year high losses.

SOPR divides the realized value of coins in a spent output by their value at creation. In other words, as Glassnode summarizes, “price sold / price paid.”

As Cointelegraph reported, SOPR fluctuates around 1, and tends to be below that level during Bitcoin bear markets and above it in bull markets.

This is logical, as unrealized losses increase through the bear market phase, leading to relatively larger overall realized losses once coins are sold.

As such, the end of bear markets tends to see lower SOPR. As of Nov. 14, the metric’s 7-day moving averag was at 0.9847 — its lowest since the March 2020 COVID-19 cross-market crash.

Bitcoin spent output profit ratio (SOPR) chart. Source: Glassnode

SOPR has further implications for BTC price action.

Should BTC/USD start gaining, hodlers will have an incentive to sell at cost price or slightly above to avoid losses. This leads to a supply glut, which without buyers logically forces the price lower again.

SOPR thus acts as a useful forecasting tool for potential price trends, with 1 once again being the important line in the sand when it comes to hodlers turning to sellers.

“Due to the fundamental nature of underlying metrics on which the SOPR relies on, it would be fair to speculate that the Spent Output Profit Ratio is influencing price changes,” Renatio Shirakashi, the metric’s creator, stated in an introduction to it in 2019.

“This can be of considerable significance, since most current indicators are lagging indicators.”

March 2020 briefly saw SOPR dip to just 0.9486, still not as low as the end of the 2018 bear market, which produced a score of 0.9416.

Bitcoin spent output profit ratio (SOPR) chart. Source: Glassnode

4 million wallets now hodl at least 0.1 BTC

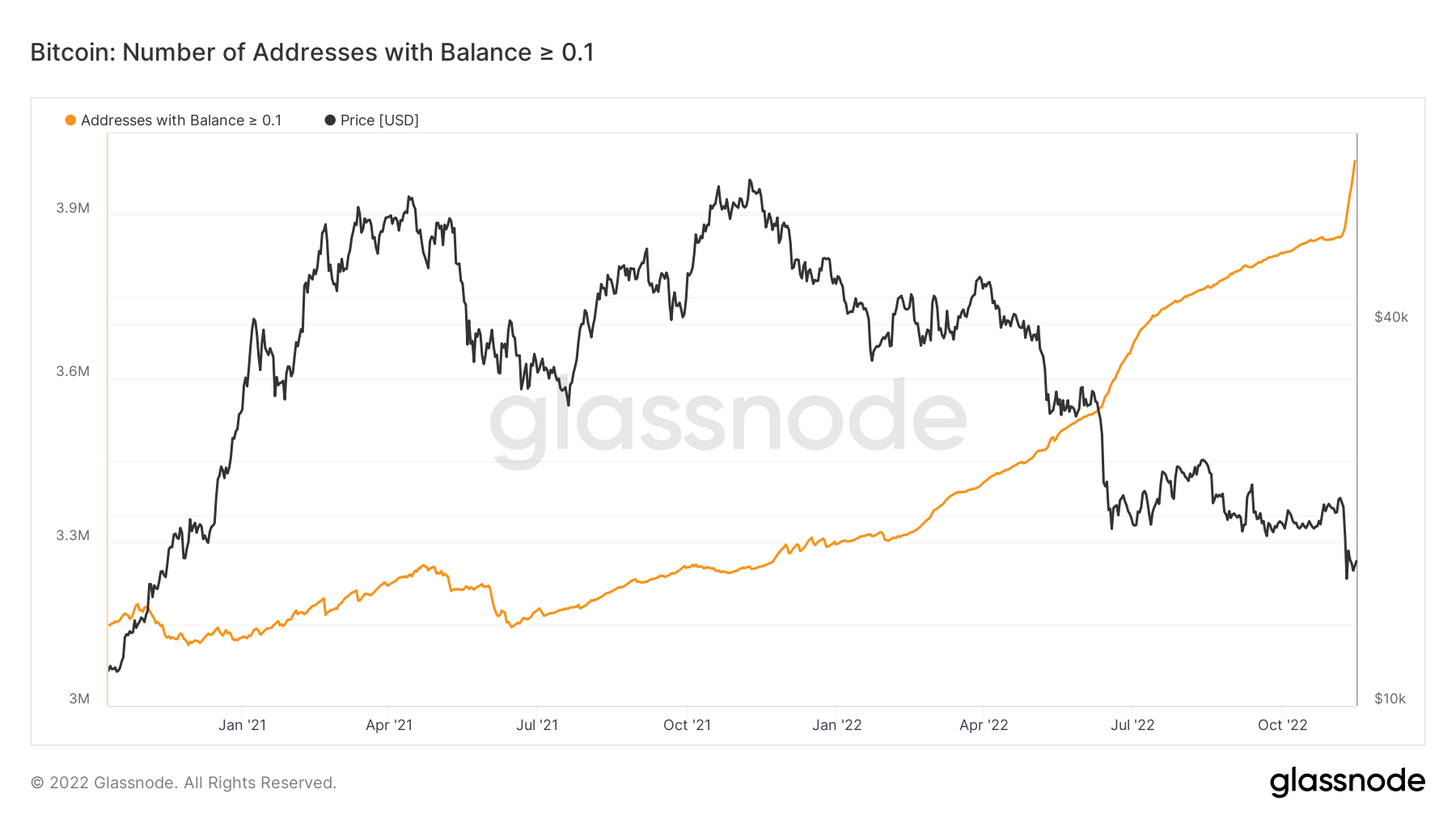

Meanwhile, those engaged in buying the dip are doing so even at the smallest level.

Related: Elon Musk says BTC ‘will make it’ — 5 things to know in Bitcoin this week

Further Glassnode data shows that the number of wallets containing at least 0.1 BTC ($1,700) has now passed 4 million.

While almost constantly rising this year, the trend saw a marked acceleration as BTC/USD fell due to the FTX scandal.

Bitcoin addresses with 0.1 BTC or more chart. Source: Glassnode

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond