BTC’s Realized Cap HODL Waves Has Surged By 80+%: On-Chain Data

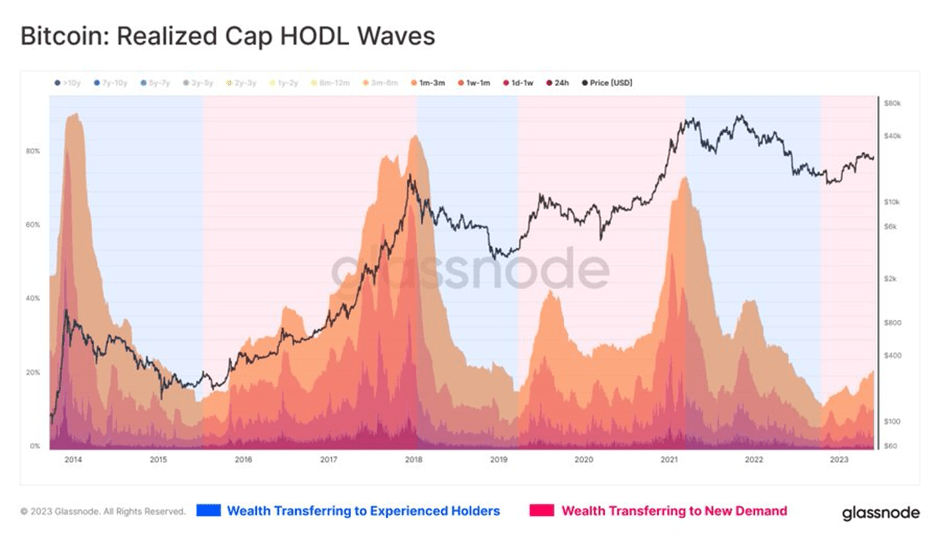

In a tweet posted yesterday, the on-chain analysis firm Glassnode noted that the 1d-3m Bitcoin (BTC) Realized Cap HODL Waves experienced a significant increase, rising from a cycle low of 11.5% to a current value of 21.4%. This meant that BTC’s Realized Cap HODL Waves experienced a more than 80% surge.

BTC: Realized Capo HODL Waves (Source: Twitter)

This observation indicated a noteworthy transfer of wealth from long-standing Bitcoin holders to newer participants in the market. Such a phenomenon is frequently observed during critical turning points in the market cycle.

In simpler terms, it suggests that experienced Bitcoin investors are selling their holdings, and a new wave of demand is emerging from newer investors who are acquiring BTC. This shift in ownership is a perfect example of the dynamic nature of the Bitcoin market and the continuous interplay between different groups of investors.

BTC price (Source: CoinMarketCap)

At press time, CoinMarketCap indicated that BTC was once again trading above the important $27K level at $27,114.40. This came after the market leader experienced a 0.98% price increase over the past 24 hours.

As a result, BTC was trading much closer to its 24-hour high of $27,203.32 than its daily low of $26,574.64. The crypto’s price increase also succeeded in pushing its weekly performance even further into the green at +2.46%.

On the other hand, BTC’s performance throughout the past day was not enough for it to strengthen against its biggest competitor, Ethereum (ETH). At press time, BTC was down against the altcoin leader by about 0.63%.

Meanwhile, BTC’s 24-hour trading volume experienced a more than 3% decrease and stood at $14,598,151,548. In terms of market cap, the market leader’s capitalization stood at $525,685,461,408.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur