Bulls Need to Dive in and Invalidate the Choppy Waters on BTC Prices

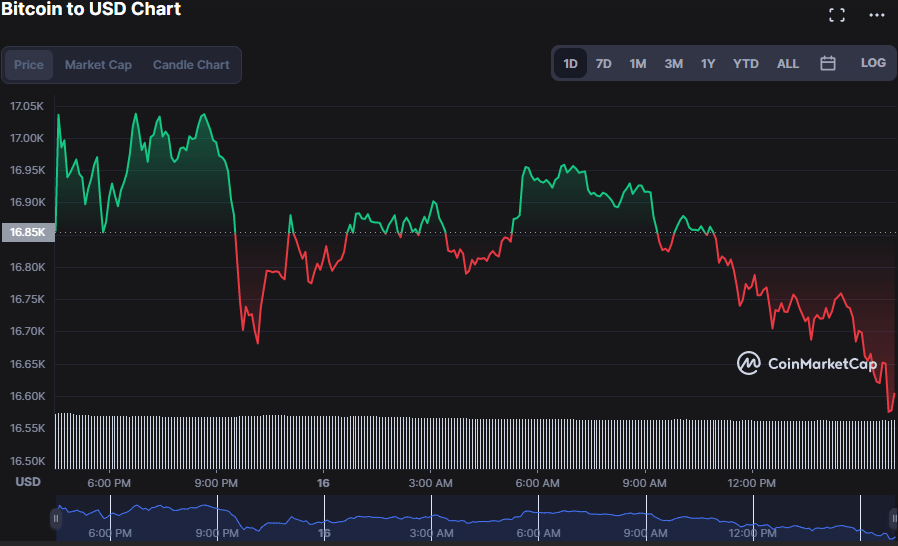

Bitcoin (BTC) has seen an ambivalent market trend as bears and bulls compete to seize market control. However, the bulls were annihilated in recent hours, as prices fell by 2.25% to $16,594.90.

This negative market trend is chalked up to a 1.55% decrement in market capitalization to $318,562,851,315 and a 12.38% drop in 24-hour trading volume to $34,898,693,505.

BTC/USD 24-hour price chart (Source: CoinMarketCap)

The BTC market is experiencing escalating selling pressure, with the Bollinger Bands widening as the upper band touches 17064.52 and the lower band touches 16548.12. The bearish engulfing candlestick pattern gives credence to this bearish trend.

With a reading of -2.56, the Coppock curve is trending south, denoting that bear supremacy is on the form.

Investors are optimistic because a Stoch RSI reading of 0.00 indicates an oversold region and anticipates a bullish reversal in the near term. Still, it is only partially certain that prices will revert higher.

BTC/USD 1-hour price chart (Source: CoinMarketCap)

MACD in the negative territory denotes that the bears have a firmer grip on BTC prices. As of press time, the MACD blue line was moving below the signal line, with a reading of -52.55 propping up this downward trajectory. The histogram trend in the negative territory also reinforces the notion that bear dominance will continue.

On the 1-hour price chart, the Relative Strength Index (RSI) is 33.45 and points south, approaching the oversold region. This RSI trend indicates that bulls are fatigued and that bearish hegemony is expected in the near term.

When the Elder Force Index tumbles below the “0” line, bearish market sentiment is projected, as shown on the BTC chart, where the EFI is -611.755k.

BTC/USD 1-hour price chart (Source: CoinMarketCap)

If the bulls can hold the resistance level despite several indicators pointing to another bear run, the digital currency may see a bullish reversal.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond