Cardano (ADA) On-Chain Activity Spikes: High Volatility Ahead

The bearish momentum has battered Cardano’s native token, ADA, as price trade 90% below previous all-time highs.

Despite the short-term price upticks in the global crypto market cap, Cardano price remained largely unchanged or bearish. ADA traded at $0.31, close to the Jan. 2021 levels from where it made a recovery in 2021.

With Cardano price showing negative ROI on the short-term as well as long-term charts, where will ADA price go?

Old ADA Tokens on the Move

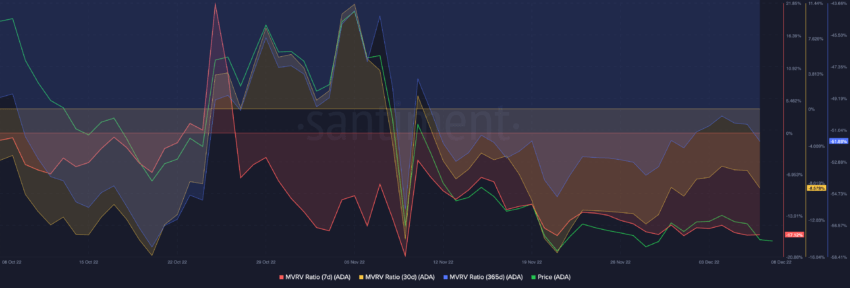

ADA was down over 90% from its all-time high price of $3.10 in Sept. 2021. As price tested the Jan. 2021 levels, a look at the coin’s Market Value to Realized Value (MVRV) suggested heavy losses for long-term holders.

The long-term and short-term MVRVs were negative, showing HODLers in losses. Seven-day, 30-day, and 365-day MVRVs were around -17, -8, and -51, respectively.

Cardano (ADA) MVRVs | Source: Santiment

With the aforementioned MVRVs in the negative territory, investors holding ADA for that amount of time were realizing losses. Notably, long-term holders that held Cardano’s native token for almost a year were in grave losses.

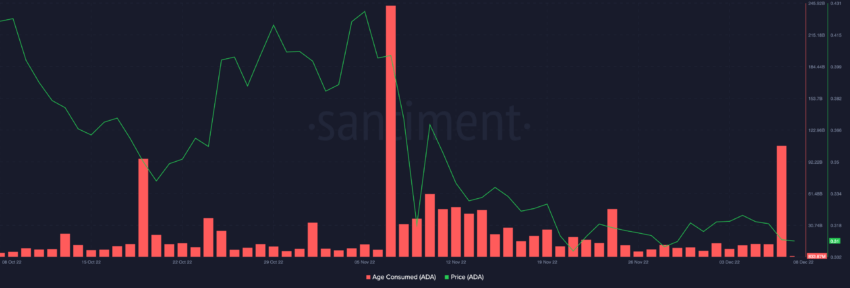

As holders realized losses, a lot of old coins were on the move. The Age Consumed indicator for Cardano showed that over 107 billion ADA were moved on Dec. 7.

Cardano (ADA) Age Consumed | Source: Santiment

The recent spike in Age Consumed could lead to higher market volatility, pushing prices in either direction. Before this surge, ADA saw another Age Consumed spike on Nov. 5, which led to a bearish pullback for ADA price.

Cardano Price Still Bleeding

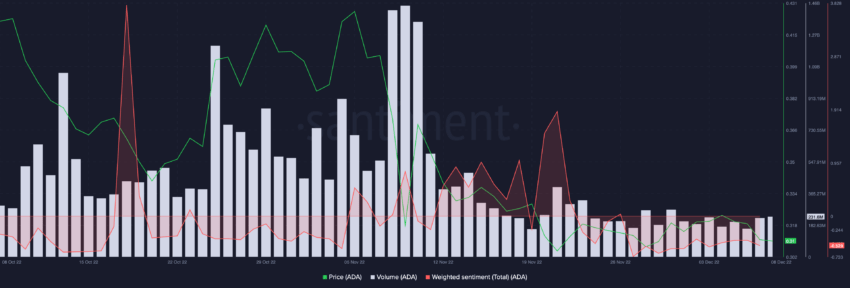

The spot market price action for Cardano is still bearish. Daily trade volumes had flatlined, presenting no major push or interest from retailers. In addition to that, the weighted sentiment is still in the negative territory showing no-to-low demand for Cardano.

ADA Social Metrics | Source: Santiment

With a dull spot market, traders could look at the futures market, but that offered little respite. The futures and perpetual open interest stood at $169.3 million, showing no major uptick.

In addition, long liquidations of around $113,600 dominated the market while only $6,700 worth of ADA shorts were liquidated.

With ADA price still trading near the long-term support at $0.30, price action needs a strong push from bulls and holders to move upward.

In the short-term on-chain metrics for ADA present a slow price growth. If bulls are able to push the price above the $0.34 mark and then $0.36, the same would confirm some sort of reversal. However, if the ADA price falls below the $0.30 mark, the same could lead to major market sell-offs in the short term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stacks

Stacks  Hedera

Hedera  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur