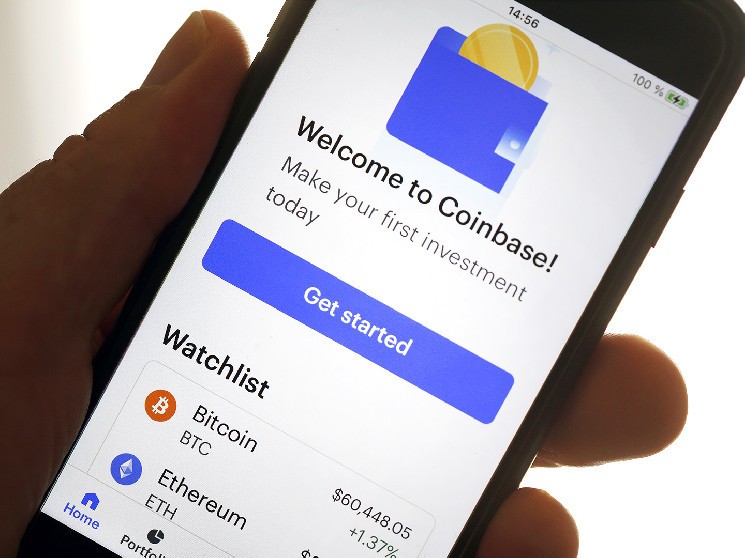

Coinbase Adds Nano Ether Futures to Derivatives Platform For Retail Traders

Crypto exchange Coinbase (COIN) is adding Nano Ether futures contracts (ET) to its derivatives platform on Monday.

«While still in its early stages, we believe that product innovation and an accessible entry point for the retail market have contributed to its success,» Boris Ilyevsky, head of Coinbase’s derivatives exchange, said in a blog post Thursday. “At 1/100th of Bitcoin, our Nano Bitcoin futures contract requires less upfront capital, allowing participants to easily go long or short the price of Bitcoin and manage risk in volatile markets,” he added.

The addition of Nano Ether futures comes just two months after Coinbase began offering Nano Bitcoin futures to its retail clientele.

In addition to expanding retail derivative trading offerings, Coinbase’s move also comes ahead of the Ethereum Merge as traders seek to make bets and manage risk around the event. Derivatives marketplace Chicago Mercantile Exchange (CME) recently said it plans to begin offering options for ether futures on September 12.

Read more: Coinbase Launches First Crypto Derivatives Product Aimed at Retail Traders

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur