Coinbase CEO dumped over 59k COIN shares over past few weeks

Coinbase CEO, Brian Armstrong, has been dumping Coinbase shares (COIN) over the past few weeks.

Coinbase CEO dumps over 59k shares

According to a crypto enthusiast and Twitter user Bitfinex’ed @Bitfinexed, the Coinbase head has recently been dumping tens of thousands of shares.

Apparently, Coinbase CEO Brian Armstrong, isn’t very confident in Coinbase stock.

He’s been dumping tens of thousands of shares.

That’s the nice thing about stocks, unlike crypto, insiders have to tell you when they’re dumping. pic.twitter.com/Yn3pypUF34

— Bitfinex’ed ?? Κασσάνδρα ? (@Bitfinexed) March 21, 2023

The Twitter user posted an image with a detailed analysis of the shares as sold by Armstrong.

The first lot of shares were sold on March 3. The first transaction based on the image is of 11,415 COINs, each at $63.8885, amassing $729,287. On that same date, there were three other large share sales of 14.700, 3.200, and 400, at $64.5, $65.6, and $66.5, respectively.

Later, in mid-March, Armstrong made ten more COIN sales. The total of shares sold by Armstrong since March 3 is 59,500 at an average price of $58.74. As such, Armstrong made about $3.49 million from his stock sales.

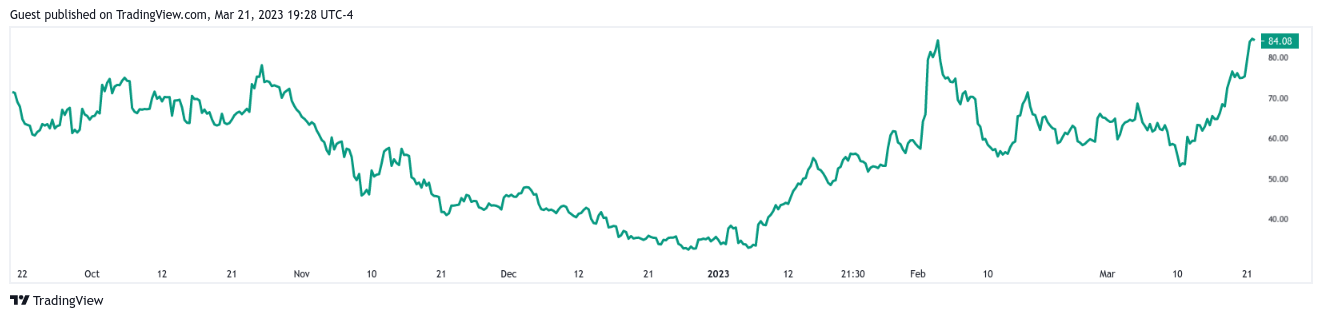

As Armstrong sells massive shares, charts indicate that COIN’s value has recently increased. In less than two weeks, Coinbase stock has surged by over 50%, moving from a low of about $53 to a high value of $83.90.

Coinbase price action | Source: Tradingview

Based on its charts, this stock trades at a six-month high. Tradingview technical analytics indicates that the stock is in a strong buy situation.

The analyst highlighted that the Coinbase CEO might not have enough confidence in the Coinbase stock. He noted that the CEO is aware of the incoming bull market, which will drive shares up, yet he is dumping, probably signaling a lack of confidence in COIN.

Coinbase arbitration dispute decision on hold

Amid the surge of COIN, Coinbase continues with a legal problem of its own. On March 21, U.S. supreme court judges seemed divided on whether to allow Coinbase to pursue a private arbitration of their ongoing disputes with customers.

Coinbase argues that their user agreements demand resolving users’ disputes through arbitration. One of the cases Coinbase faces at the moment is by Abraham Bielski, who complained that about $30,000 was stolen by a scammer from his account.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Chainlink

Chainlink  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Monero

Monero  Maker

Maker  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  Enjin Coin

Enjin Coin  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Zcash

Zcash  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  Ren

Ren  BUSD

BUSD  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Bitcoin Diamond

Bitcoin Diamond  Energi

Energi  Augur

Augur  HUSD

HUSD