Crypto Analyst CryptoCapo Predicts BTC Bottom Could Reach $11.5K

Crypto Analyst CryptoCapo made a succinct statement wherein he pointed out that in the phase where altcoins shred 50-90% of their price, the potential bottom that BTC could reach was in the range between $11,500-$12,000.

A chart is worth a thousand words. pic.twitter.com/bZ2TKpnLFs

— il Capo Of Crypto (@CryptoCapo_) January 3, 2023

He conveyed his message by saying that a chart was worth a thousand words. The analyst made this comment by paraphrasing the saying that goes, “a picture is worth a thousand words”.

BTC opened the market for the past week trading at $16,570 as shown in the chart below. During the first four days of the past week, BTC fluctuated in and out of the red zone, but by the end of the week, BTC recovered. During the last few hours of January 1( the third day of the week), the bulls helped BTC trade above its opening market price.

Since the bulls gave momentum, BTC has been trading in the green zone. Currently, BTC is down 0.07% in the past 24 hours and is trading at $16,844.55.

MANA/USDT 7-day Trading Chart (Source: CoinMarketCap)

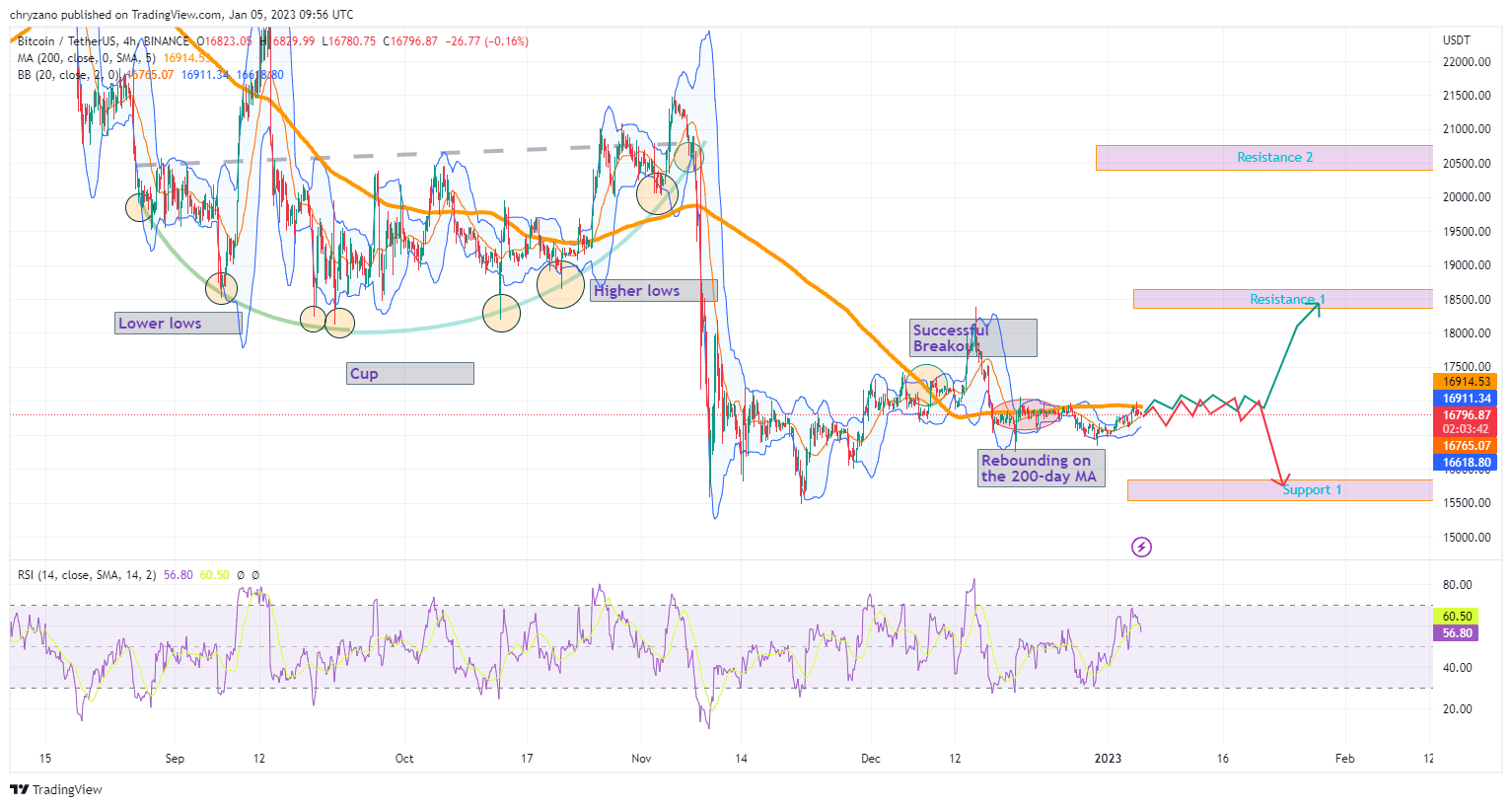

BTC has been forming the shape of a cup since late August, as denoted in the chart below. It made new lower lows from late August to late September. However, since mid-October, BTC has gained some momentum and made higher lows (Circle). Once BTC formed the brim of the cup close to resistance 2, it tumbled.

BTC/USDT 4h Trading Chart (Source: TradingView)

The prices fell from $20,886 to $15,604 within 24 hours. Since this fall, BTC has been fluctuating between Support 1(≈$15,800) and Resistance 1 (≈$18,500). Notably, after this fall, BTC has been trading below the 200-day MA (yellow). BTC tested the 200-day MA recently and broke it.

However, it wasn’t able to keep the position that it gained. And it fell below the 200-day MA shortly after breaking it. After rebounding on the 200-day MA in late December, BTC is testing the 200-day MA again. If the bulls push hard, BTC will be able to break the 200-day MA and reach resistance 1.

However, if the bears take over the market, BTC could land on Support 1. Moreover, the RSI is 56.41, denoting that the trend of sideways movement will continue. Additionally, BTC has touched the upper Bollinger band; hence the market could correct the price.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Theta Network

Theta Network  Decred

Decred  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond