Crypto Declared Dead Yet Again As Bitcoin Hits All-Time High In Long-Term Investor Holdings

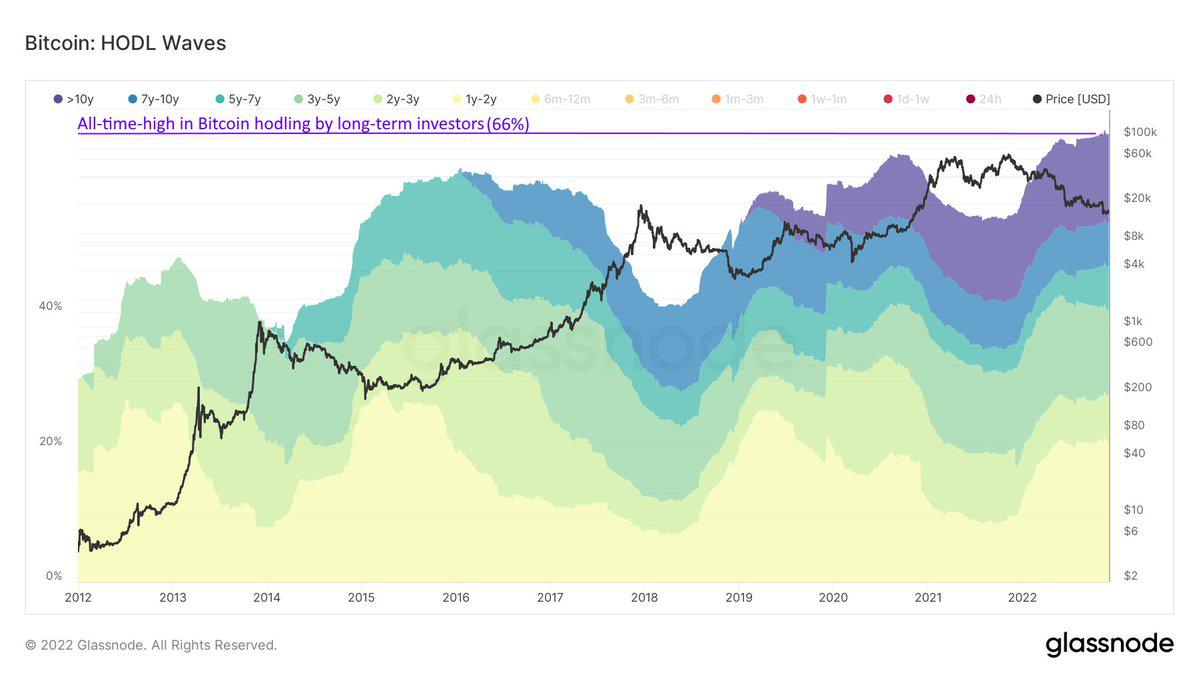

- BTC Conviction is at an all-time high as long-term investors keep adding to their BTC stack unfazed by the recent news and fallouts according to data from Glassnode.

- Crypto has been declared dead quite a few times as Fear and Uncertainty is at highs in the crypto industry.

- Although low conviction holders may have left, sellers may still be here due to miner capitulation, taxes or inflation fears.

We have witnessed one of the most intense months in the crypto industry, with FTX’s fallout and other key players that followed, such as Genesis, Voyager, and BlockFi. Fear, uncertainty, and doubt are at high levels within media outlets as Bitcoin is once again declared dead, and the BTC price dropped to levels as low as $15,700.

“Crypto is now dead: FTX, a cryptocurrency exchange, collapsed last week, proving a lot of cool guys horribly wrong,”. Tweets like this were all over social media when one of the largest crypto exchanges, FTX, collapsed, taking many prominent players with them.

But amid all this uncertainty, long-term Bitcoin holders remain undeterred, and in fact, the pattern is as such that they are currently increasing their long-term Bitcoin holdings.

According to the GlassNodes chart, Bitcoin Hold Waves, this November marked an all-time high of BTC long-term holders, who are now at 66% percentage on the chart. The long-term holders, 3yr to 10 yr, have been holding at a rate like never before, as the percentage of their holdings keeps increasing.

FTX’s fallout did not move the BTC markets as much as expected, and this could be due to the low-conviction holders already selling and leaving the crypto industry. It is yet to be confirmed whether this is the bottom of the markets; however, it appears that “bad news” is not necessarily affecting BTC price as dramatically as before. This could be because there are no low-conviction sellers in the market currently.

This is not to say that sellers won’t be there in a further fallout due to other factors such as miner capitulation, taxes and inflation.

Bitcoin Miners Due Capitulation?

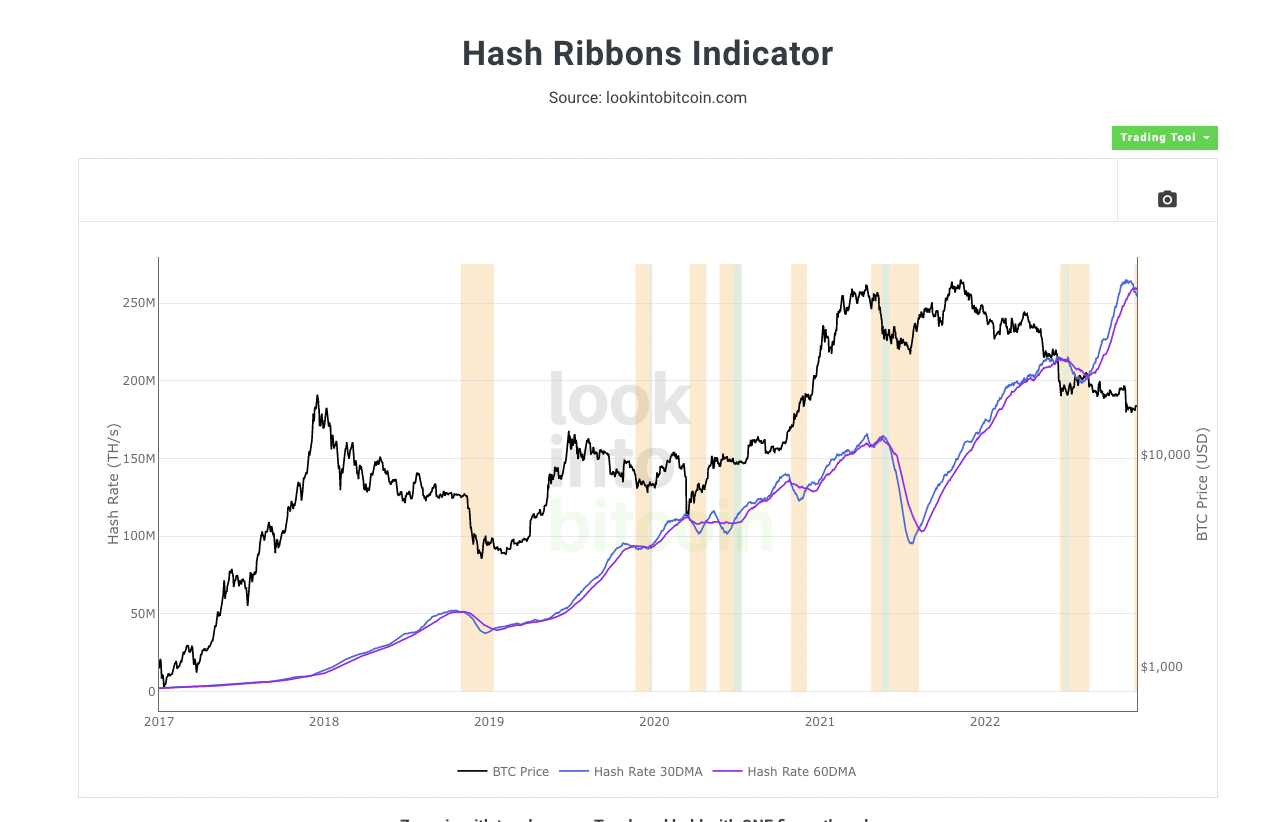

According to CryptoQuant analyst Kripto Mevsimi, a further miner capitulation is due to reappear. Mevsimi posted his last capitulation analysis on 6th of June 2022, when the price of BTC was $31,500 and within 1 to 2 days, the price became $18,000. According to him, hte same setup is now forming on the hash ribbon metric.

“So right now bitcoin difficulty is really high for miners so that means; costs are getting higher and doing business in this kind of environment is getting harder,”

“That’s why miners do not work in full force. If they have efficient- new generation mining machines, they put them into work but that’s all. Inflation is high and people feels effect of living costs, bitcoin price is declining, mining cost and difficulty is getting higher. Tough environment for miners.” wrote Kripto Mevsimi in his most recent blog post.

Kripto Mevsimi confirms that a change in mining difficulty could potentially help the situation.

According to data from BTC.com, mining difficulty is set to drop at 7.08% at the time of writing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond