Crypto market adds nearly 1,000 new coins in 2023 as momentum returns

Although the cryptocurrency industry has been under a lot of regulatory pressure in recent months, it has demonstrated significant resilience, reflected in both the growing prices of its largest assets as well as the number of new cryptocurrencies appearing on the market.

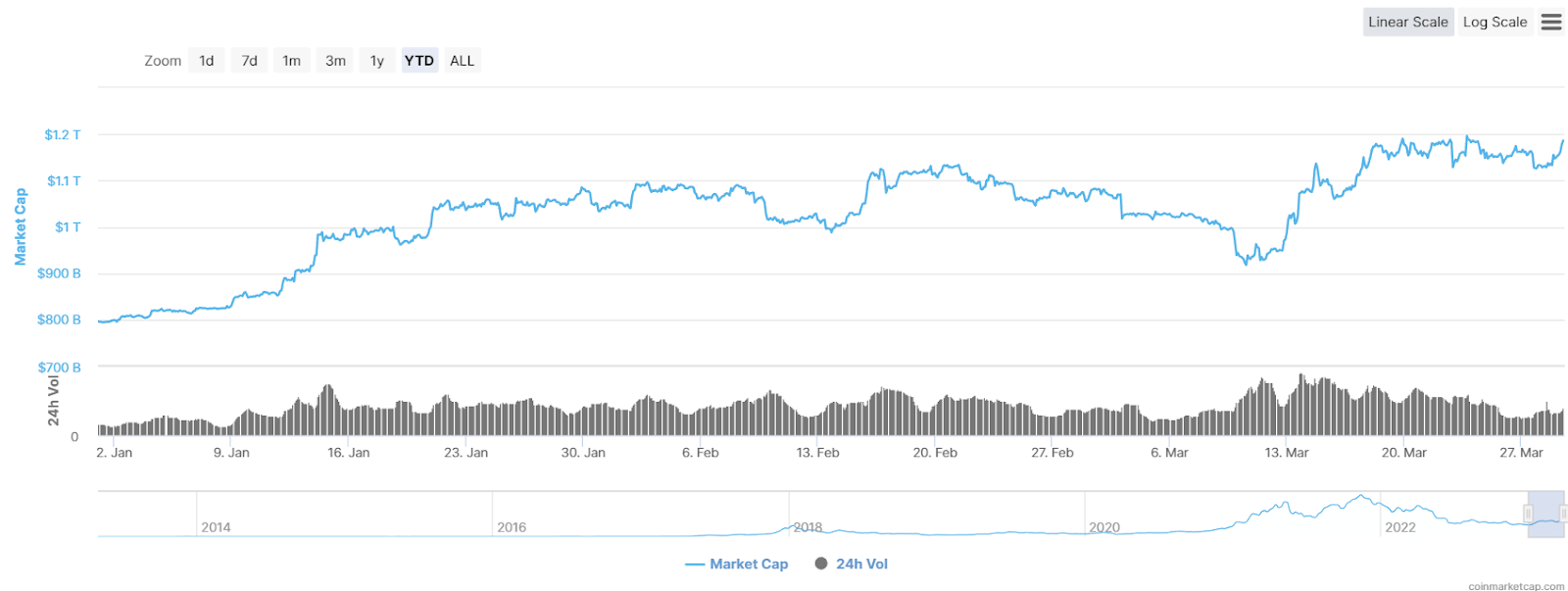

Indeed, the historical data that Finbold retrieved using the Internet Archive’s Wayback Machine indicates that the crypto market had 22,157 digital assets as of January 1, 2023, when its global market cap stood at a mere $795.56 billion, as shown by the crypto tracking platform CoinMarketCap on that date.

Notably, as of March 29, 2023, the number of cryptocurrencies tracked by a largest digital asset market data website stood at 23,095, revealing that 938 new digital assets were added to a global crypto market this year to date with the crypto market cap amounting to a significantly higher at $1.19 trillion, demonstrating that it has regained its bullish momentum.

Interestingly, the figures render a fact that crypto sector has been adding around 10 new cryptocurrencies per day in 2023 despite trials and tribulations caused by the renewed offensive from banking authorities and regulators that have recently culminated with a lawsuit against Binance, the world’s largest crypto exchange.

As a reminder, the number of assets on the crypto market surpassed the 21,000 mark for the first time in history in September 2022, followed by breaking the 22,000 level on December 11, amid a bear market that had seen the sector’s market cap decline from $2.2 trillion on January 1, 2022, to $795.56 billion on January 1, 2023 – or 63.83%.

Crypto market cap rallies

However, the recent advances of the industry’s representatives, including Bitcoin (BTC), which has added $30 billion to its market cap in a day, have pushed the total crypto market cap to the current $1.19 trillion, as it grew by nearly $390 billion or 50% since the beginning of this year, as the CoinMarketCap chart patterns and data indicate.

Meanwhile, the crypto community has not taken the recent blows quietly, as Binance CEO Changpeng Zhao called the lawsuit coming from the United States Commodity Futures Trading Commission (CFTC) “unexpected and disappointing,” whereas law firm Cooper & Kirk wrote a letter to Congress urging it to hold regulatory agencies to account, as shared by Cardano (ADA) founder Charles Hoskinson.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Steem

Steem  Hive

Hive  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur