Crypto Market Sees $510M Futures Flush As Bitcoin Breaks $24.5k

Data shows the crypto futures market has observed more than $500 million in liquidations as Bitcoin has surged above the $24.5k mark.

Crypto Futures Market Has Seen A Flush Of $510 Million In Last 24 Hours

In case anyone is unaware of what a “liquidation” is, it’s best to get a brief understanding of how margin trading on derivatives exchanges works.

When an investor opens a crypto futures trading contract, they have to first put forth some initial collateral, called the margin (which could be both in USD or in a coin like Bitcoin).

Against this margin, holders can choose to take on “leverage,” which is a loan amount often many times the initial position.

The benefit of this leverage is that if the price of the asset the contract is for ends up moving in the direction the user bet on, the profits are as many times more as the leverage.

Related Reading: Bitcoin Market On Verge Of Greed, But Investors Remain Hesitant

However, it’s also true that any losses suffered will also be magnified by the same factor as the leverage. When such losses pile up and eat away a specific portion of the margin, the exchange forcibly closes the position.

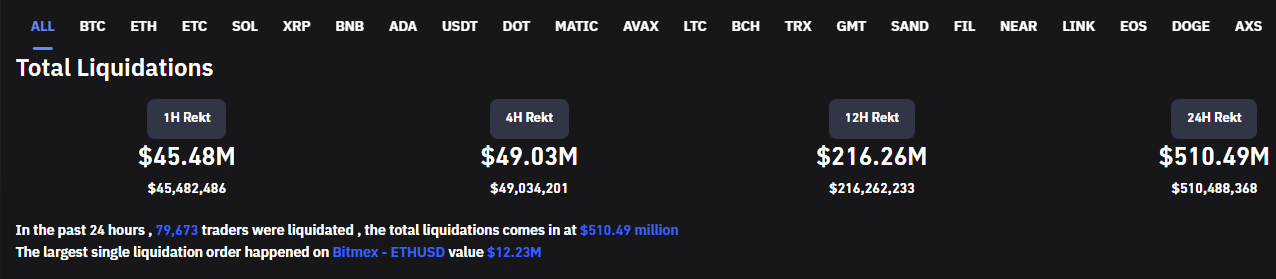

This is precisely what a liquidation is. Below is the data for the liquidations in the crypto futures market over the last 24 hours.

Looks like the cryptocurrency market has seen a large amount of liquidations today | Source: CoinGlass

As you can see above, a little more than $510 million got flushed from the crypto futures market during the past day.

Almost 80k traders were involved in this flush, and around $216M of the total liquidations took place during the last twelve hours alone.

More than 60% of the liquidations came from short contracts, a trend that makes sense as an uplift in the price of Bitcoin and other coins was behind the majority of the flush.

Related Reading: The Next Crypto with Potential to Pump Like Shiba in 2022

Massive liquidation events like today’s aren’t particularly uncommon in the crypto market. The reasons behind that are high volatility among most coins and easy access to huge amounts of leverage (many exchanges offer even 100x the initial position).

Because of these factors, uninformed margin trading in the cryptocurrency sector can prove to be quite risky.

BTC Price

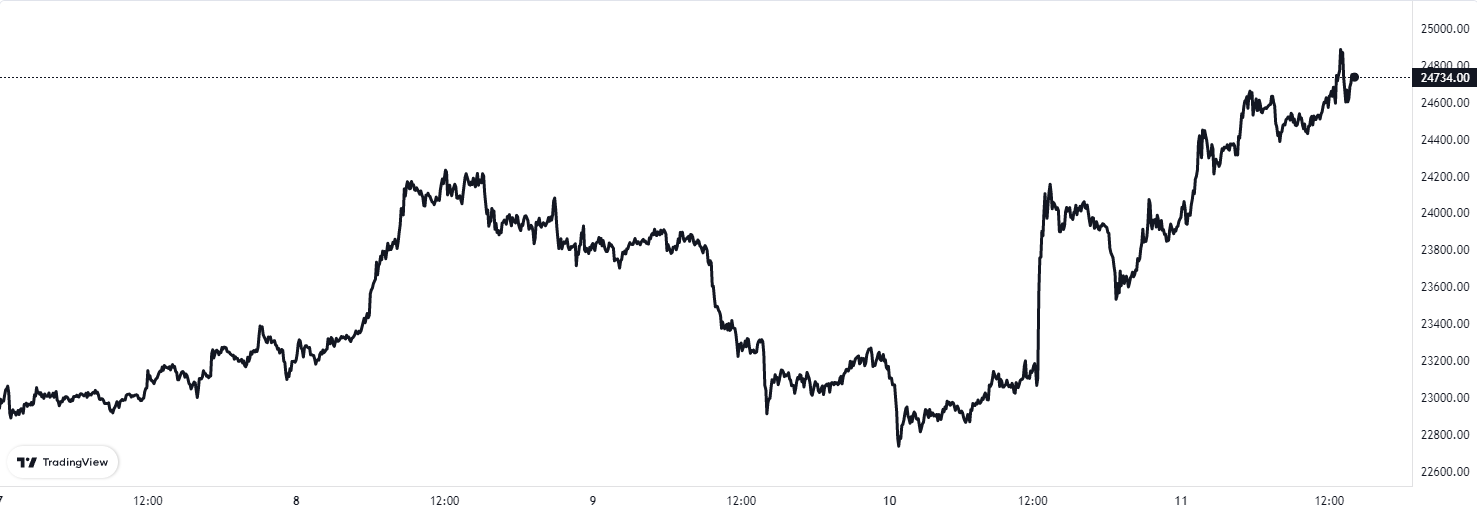

At the time of writing, Bitcoin’s price floats around $24.7k, up 7% in the past week. Over the last month, the crypto has gained 18% in value.

The below chart shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have spiked up during the last couple of days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Enjin Coin

Enjin Coin  Waves

Waves  Ontology

Ontology  Status

Status  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur