Current Bitcoin ($BTC) Rally Is Historically Different; Here’s How

Bitcoin News: The current Bitcoin (BTC) rally could perhaps have been a result of relief from the macroeconomic scenario and resistance to the shock events in crypto market in 2022. However, a steady growth since the beginning of January 2023 raised hopes of a prolonged rally, marking an end to the painful crypto winter of 2022. Despite the bullish atmosphere, the top cryptocurrency is currently below the key indicator of 200 day weekly moving average (WMA). An important observation from on chain data could answer the reason behind this behavior in BTC.

Also Read: Solana ($SOL) Soars As Helium Sets Migration Date; Here’s More

The 200 WMA is key for traders as the indicator is generally a sign of change in direction for the asset. When there is a clear signal from this indicator, it is believed that there will be a long term change. This behavior of BTC trading below the 200 WMA was observed quite often throughout 2022.

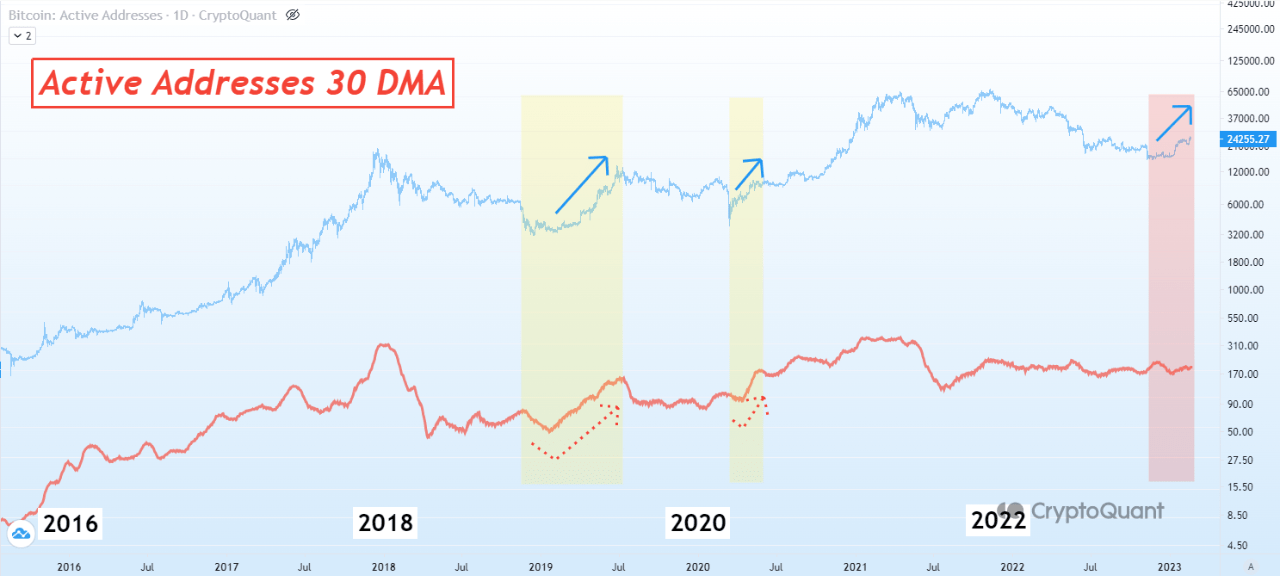

Bitcoin Active Addresses

In what could be a sign of lack of strength for next Bitcoin bull pattern, on chain data reveals an interesting comparison from previous BTC breakouts. Unlike the beginning of previous bull cycles, the current cycle does not actually have enough active addresses based on 30 day moving average, or a rise in them, to justify a price movement in upward curve. As per Crypto Quant data, there is no real growth in the number of active Bitcoin addresses.

Currently, the BTC price is fluctuating around the $25,000 milestone but still fails to rise above the 200WMA. As of writing, BTC price stands at $24,783, down 1.09% in the last 24 hours, according to CoinGape price tracker.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond