Can ETH Hit $2,000 Before the Shanghai Upgrade on April 12nd? (Ethereum Price Analysis)

Ethereum’s price has finally broken above a key resistance level and continues to rally higher. However, the RSI is presently demonstrating some warning signals.

Technical Analysis

By: Edris

The Daily Chart

On the daily chart, the price is finally clearing the broken $1800 resistance level, following multiple retests. The higher boundary of the large symmetrical triangle has also provided support for the price, pushing it back higher above the $1800 level earlier last week.

Currently, the price could rise toward the $2300 level from a classical price action standpoint. However, the RSI indicator should be monitored closely as it is approaching the overbought zone, which could lead to a correction or reversal.

In the event of a decline, the $1800 level could once again be considered a probable support zone to hold the market.

The 4-Hour Chart

On the 4-hour timeframe, it’s apparent that the price has finally broken out of the tight consolidation zone between the higher boundary of the symmetrical triangle and the $1850 resistance level.

While this is considered a bullish signal as the price is making a new higher high, the RSI is signaling a clear overbought state on this timeframe, which could lead to a pullback or even a reversal in the short term.

Therefore, the $1850 level, followed by the $1800 area and the higher trendline of the triangle pattern, could be the potential targets in the short term if the market corrects.

Sentiment Analysis

Ethereum Taker Buy Sell Ratio (SMA 100)

Ethereum’s price keeps making higher highs and lows, continuing the recent bullish trend. Yet, the futures market is demonstrating a worrying signal that a correction or reversal is not far away.

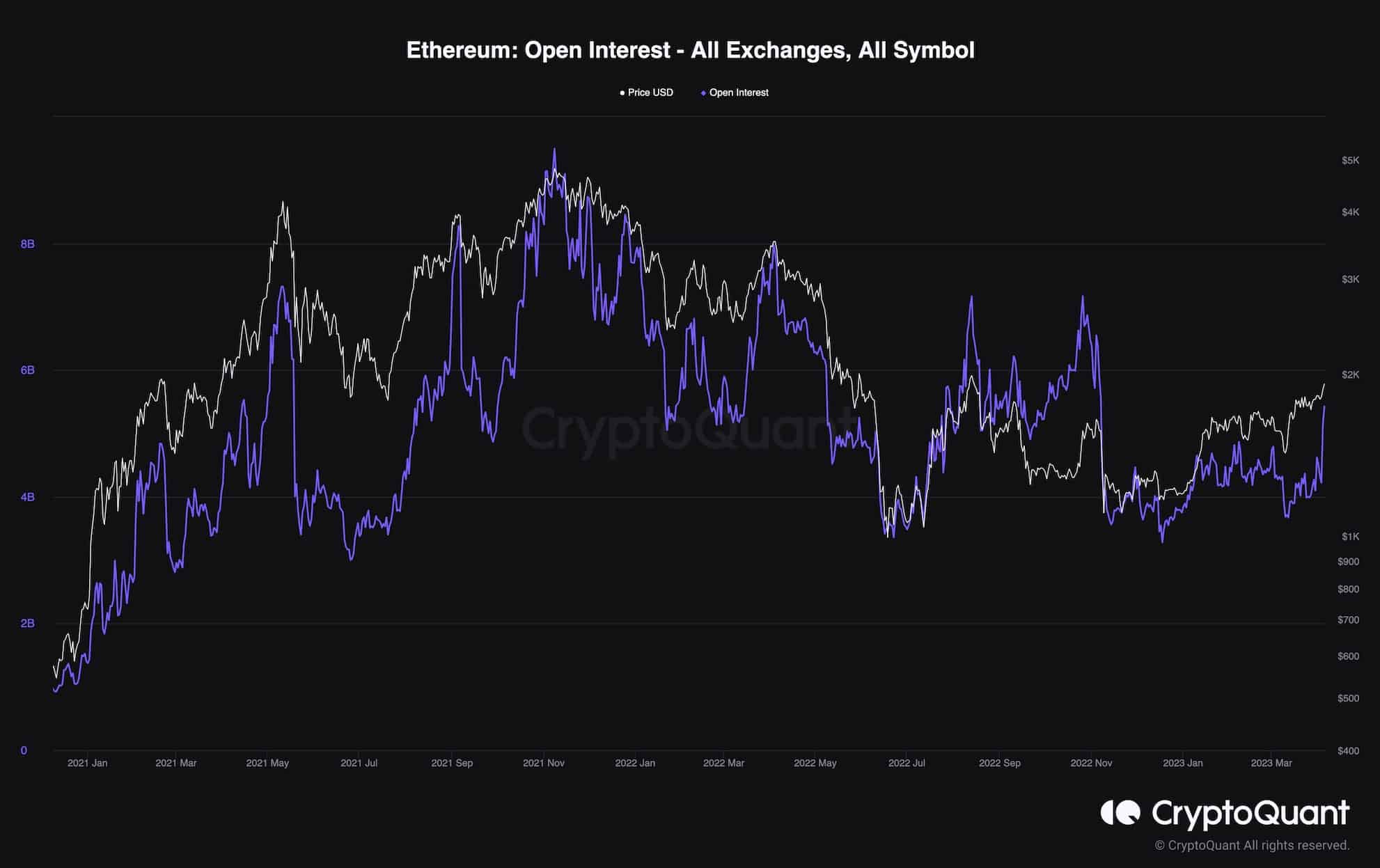

This chart displays Ethereum’s Open Interest, which is a useful metric for futures market sentiment evaluation. High amounts of open interest indicate higher volatility, and conversely, lower open interest is associated with lower volatility and steady price trends.

This metric has spiked significantly over the past couple of days as the price nears the $2,000 mark. Judging by previous instances, significant rises in open interest are typically followed by bearish corrections or entire trend reversals.

Therefore, a price decline is seeming highly probable at the moment, as a slight drop would lead to a long liquidation cascade and likely result in a considerable plunge in price.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur