DeFi Project Popsicle’s ICE Token Triples As Controversial Wonderland Founder Returns

The native token of Popsicle Finance, a decentralized finance (DeFi) market-making and yield-earning protocol, is surging as the controversial yet prolific blockchain developer Daniele Sestagalli said he was returning to the project.

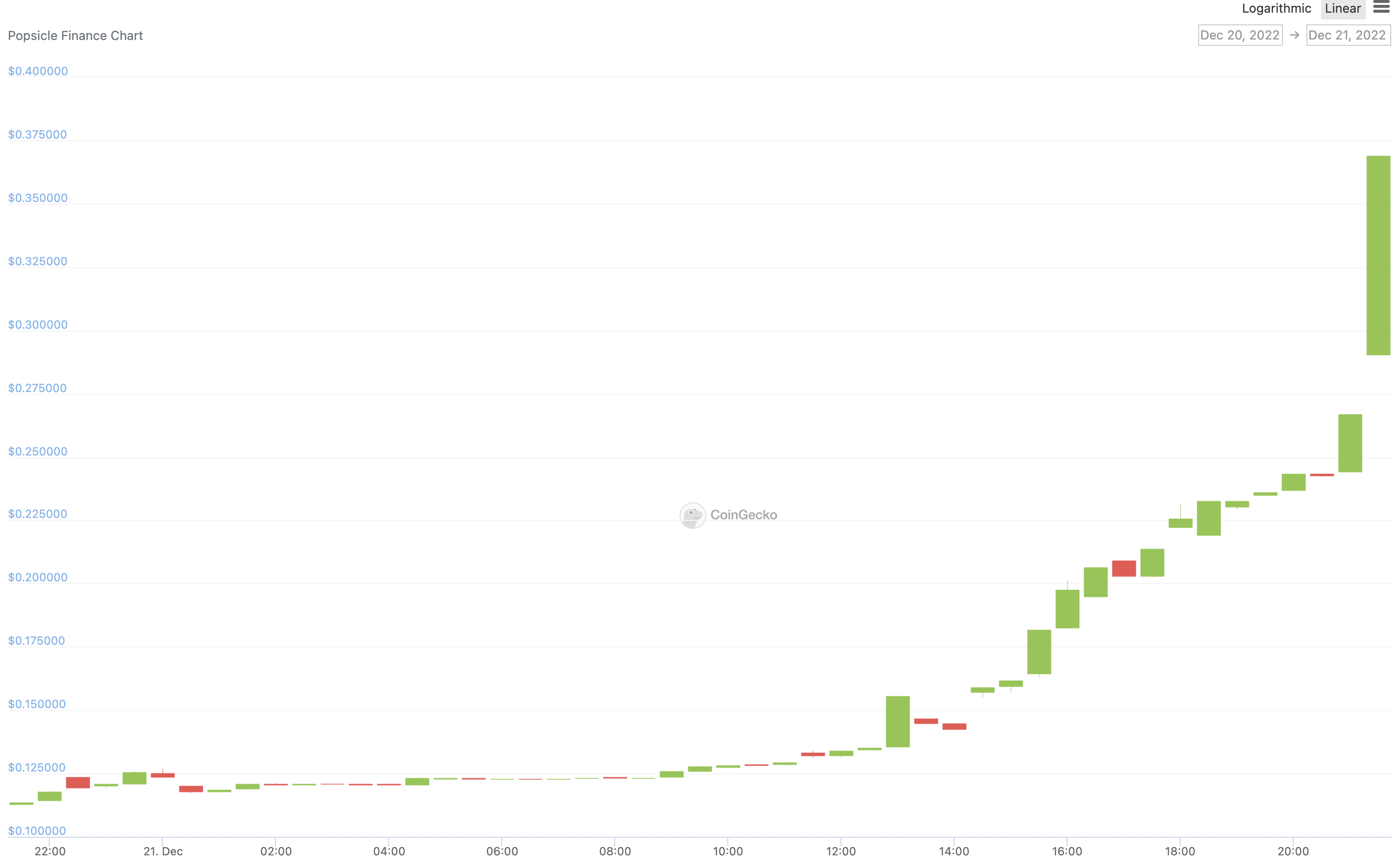

Popsicle’s ICE token’s price jumped some 220% in the last 24 hours, according to cryptocurrency price tracker CoinGecko. The token currently is trading at 36 U.S. cents, only two days after hitting an all-time low of 9 cents.

Popsicle Finance’s native token ICE has quadrupled in price after hitting an all-time low of 9 cents two days before. (CoinGecko)

Popsicle was part of a loose conglomerate of DeFi projects known as «Frog Nation» that were helmed by Sestagalli as recently as January, including Abracadabra.money, whose stablecoin was partly collateralized by the collapsed FTX exchange’s FTT token, and the since-failed Wonderland, a fork of OlympusDAO.

The sudden surge came after Sestagalli tweeted Wednesday that he was “focusing right now on rebuilding the OG Popsicle Finance,” breaking a four-month-long silence on Twitter.

Sestagalli, also known as Dani Sesta in crypto circles, garnered a cult following in crypto due to his community-based approach to building projects, CoinDesk wrote in January.

But his reputation took a hit earlier this year when influential crypto vigilante ZachXBT revealed that Sestagalli was working at Wonderland with an executive of the failed QuadrigaCX exchange, which allegedly defrauded investors of at least $190 million.

Read more: How Did a Former Quadriga Exec End Up Running a DeFi Protocol? Wonderland Founder Explains

After the Wonderland fiasco, Sestagalli appeared around Abracadabra and its magic internet money (MIM) stablecoin this summer.

Traders appeared to welcome Sestagalli’s return to focusing on Popsicle, and users expressed enthusiasm about shaking up the maligned protocol from its downward trajectory.

Popsicle Finance has had an atrocious 2022. Popsicle’s total value locked – a widely used DeFi metric to gauge activity and usage of any protocol – deflated to $1 million from $120 million in November 2021, according to DefiLlama. The ICE token’s price is still down some 98% in a year despite the recent appreciation.

Notably, Popsicle Finance recently deployed a yield optimizer service between blockchains called Limone in test mode on the Avalanche blockchain.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond