Do ve(3,3) And veToken Worth See As The Future Of DeFi?

Andre Cronje and Daniele Sestagalli, two of the most powerful individuals in DeFi (decentralized finance), have hinted about the debut of a new product named ve(3,3) on the Fantom blockchain, and its application veToken is also a bright spot.

So, is this project deserving of DeFi’s future? Coincu will supply you with important information about this project in this article.

What is ve(3,3)?

Ve(3,3) is a novel DeFi tokenomics concept presented by Yearn Finance creator Andre Cronje.

It is used in Cronje’s most recent initiative, Solidly Exchange, which continues to run despite the fact that Andre Cronje announced his departure from DeFi on March 6, 2022. The concept combines the Olympus DAO (3,3) architecture with vote escrow tokenomics (“ve”) from protocols like Curve and Convex.

By engaging in DeFi initiatives such as Curve Finance, users are frequently required to lock their assets within the platform in order to engage in transactions. As a result, their tokens are not circulated on the market, causing the token to be restricted and unable to make any additional investments.

As a result, ve(3,3) was created to overcome the liquidity problem in DeFi. The method contributes to the increased liquidity of tokens locked on DeFi by allowing users to freely buy, sell, and trade their tokens on the market.

It is the name of a protocol’s mechanism of action, not a token name, which many people mistakenly believe. Its mechanisms, as mentioned, include:

The mechanism “ve” stands for the voting deposit (Vote Escrow)

This is a system for locking assets in order to get voting rights and prizes; the longer the lock time, the greater the voting rights and benefits. The disadvantage of this technique is its lack of liquidity. Curve Finance has implemented this model.

For example, when you lock the CRV token in the Curve Finance model, you will obtain veCRV. The CRV lock period ranges from one week to four years; the longer the lock time, the more veCRVs received. The veCRVs will let you participate in protocol governance, vote on modifications, get transaction fees, and improve incentives.

Staking/Dilution (3,3)

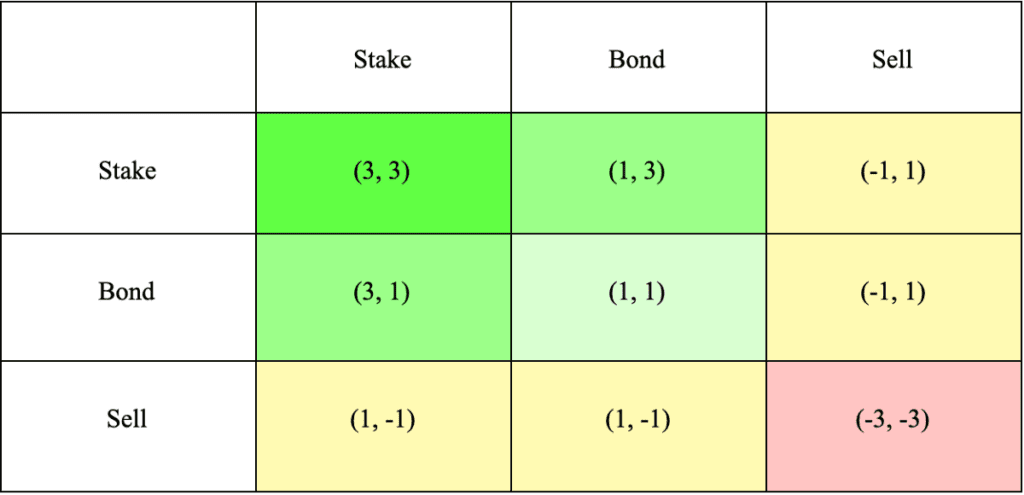

The Olympus DAO project devised this approach to incentivize users to stake as much OHM as possible. The disadvantage of this system is the inflation of token rewards; as more OHMs are produced, the token value declines.

The Olympus DAO Model (3,3) in Game Theory is used in the protocol, which analyzes the behavior and decisions of platform players (staking, bonding, selling). (3,3) denotes optimal behavior where all users stake on the platform and everyone profits.

But, according to Game Theory psychological research, because of the disparity in rewards, not everyone has the same mindset and conduct; therefore (3,3) is only regarded as a temporary equilibrium point. This balance may be disturbed at some moment. Eventually, the goal here is to discover the model’s final equilibrium, where both sides profit.

Based on the models of the previous two methods, Andre Cronje and Daniele Sestagalli devised ve(3,3) with the goal of encouraging users to lock tokens into the pool and profit from that behavior.

Highlights of the mechanism

The purpose of ve(3,3) is to better match token emission to positive behaviors and to address an issue with existing autonomous market maker (AMM) designs in which liquidity provision is temporarily subsidized but fee generation, the more sustainable incentives-generating mechanism, is not.

Current AMMs are primarily intended for LPs, and they promote liquidity deposits into the protocols’ liquidity pools in exchange for a brief issuance of free tokens. Cronje believes that AMMs require a few changes to make it easier for protocols to exploit them:

- Must be able to simply include token incentives into the user’s liquidity.

- Token emissions must be readily bribed upon your liquidity.

- Fees must be able to be accrued from the liquidity you incentivize.

- You must be able to deploy your liquidity without authorization.

And it is at this moment that the above questions have been answered. DeFi’s difficult problem is highlighted in the benefits that ve(3,3) brings, including:

Token holders are incentivized to lock up assets

Rather than providing liquidity, the mechanism incentivizes the collection of transaction fees. This implies that people who lock their funds will get 100% of the transaction fees collected by the pool for which they voted. This is an appealing strategy for luring consumers into locking their assets within the system.

Emission rate

The mechanism has the ability to change the token’s emission rate. The supply in the market will dictate the pace of fresh token production, and the incentive will be bigger if there are fewer tokens locked on the protocol. This helps to balance the token’s supply and demand and boosts the token’s price-holding capacity.

veToken

It is an NFT that may be used as DeFi collateral. This allows the asset to be traded on the secondary market. Moreover, NFTization contributes to greater transparency in asset management on the protocol.

Users can trade their native tokens for non-transferable veTokens and voting privileges. This helps to build a community of active protocol managers while also increasing the security of the DeFi system by lowering the possibility of third-party assaults.

Why is it the future of DeFi?

Protocols are now struggling to strike a balance between their incentive mechanism and producing value for token holders. Furthermore, the tokens have liquidity issues and are not optimal because you cannot generally sell them if you wish to.

Because of this paradigm, veTokens are once again valuable NFTs that can be exchanged on the secondary market. A secondary market for locked governance tokens is established; this market may be thought of as a location to sell voting power.

Couple this with an asset type that offers several benefits, including:

- There has been deflation.

- Has the ability to be freely transferred.

- Direct distribution of transaction fees (fees are delivered straight to the treasury, no buyback/burn/distribution procedure).

- Create a secondary market for political power.

Andre Cronje

If this design is successful, it will fundamentally alter the way protocols operate and potentially significantly contribute to token deflation. This means that ve(3,3) will set the trend, and projects that use it immediately will gain substantially.

Where are the opportunities for investors?

At the moment, IDO will follow the “fair-launch” approach with ve(3,3). The locked number of tokens will be allocated to the top 20 Fantom ecosystem projects with the highest TVL. If it is used correctly, it will entirely alter the present Defi playing field. To obtain the token, we have numerous options, including:

- Buy FTM

- The Fantom ecosystem has the highest TVL of any 20 projects purchased at random.

- Purchase KP3R because it is one of Andre Cronje’s key projects; it is now ERC-20 compliant but will shortly transition to Fantom’s blockchain. Andre verified that the model is being tested for KP3R and will be released shortly. Hence, if this method works, KP3R has enormous development potential.

Conclusion

This is a progression from prior modifications such as veToken or model (3,3). As a result, some restrictions of the old model will remain in this new mechanism.

Although Andre Cronje’s modification is inventive, this concept is restricted since it produces a monopoly system. With a fair-launch mechanism in place, there is a good chance that many major players will buy this gaming table. This issue can be a substantial drawback for AMMs considering using this paradigm.

Yet, as long as Andre’s approach remains a monopoly, projects that use ve(3,3) after Solidly’s introduction can eventually make it more community-driven. That will entice more individuals to participate. It may be an opportunity for investors.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur