Dogecoin shoots by 115% in a week as bulls push DOGE to reclaim 5-month high

Meme cryptocurrency Dogecoin (DOGE) is recording significant gains in the wake of Twitter’s (NYSE: TWTR) acquisition by Tesla (NASDAQ: TSLA) CEO Elon Musk. The asset is also witnessing increased buying pressure, with investors hoping Musk’s takeover of the social media giant will likely give DOGE more utility.

In particular, by press time on October 29, Dogecoin was trading at $0.12, recording gains of 115.25% from the $0.05 value witnessed on October 23. Furthermore, the DOGE weekly chart shows the price peaked at $0.14 on October 23, representing a five-month high.

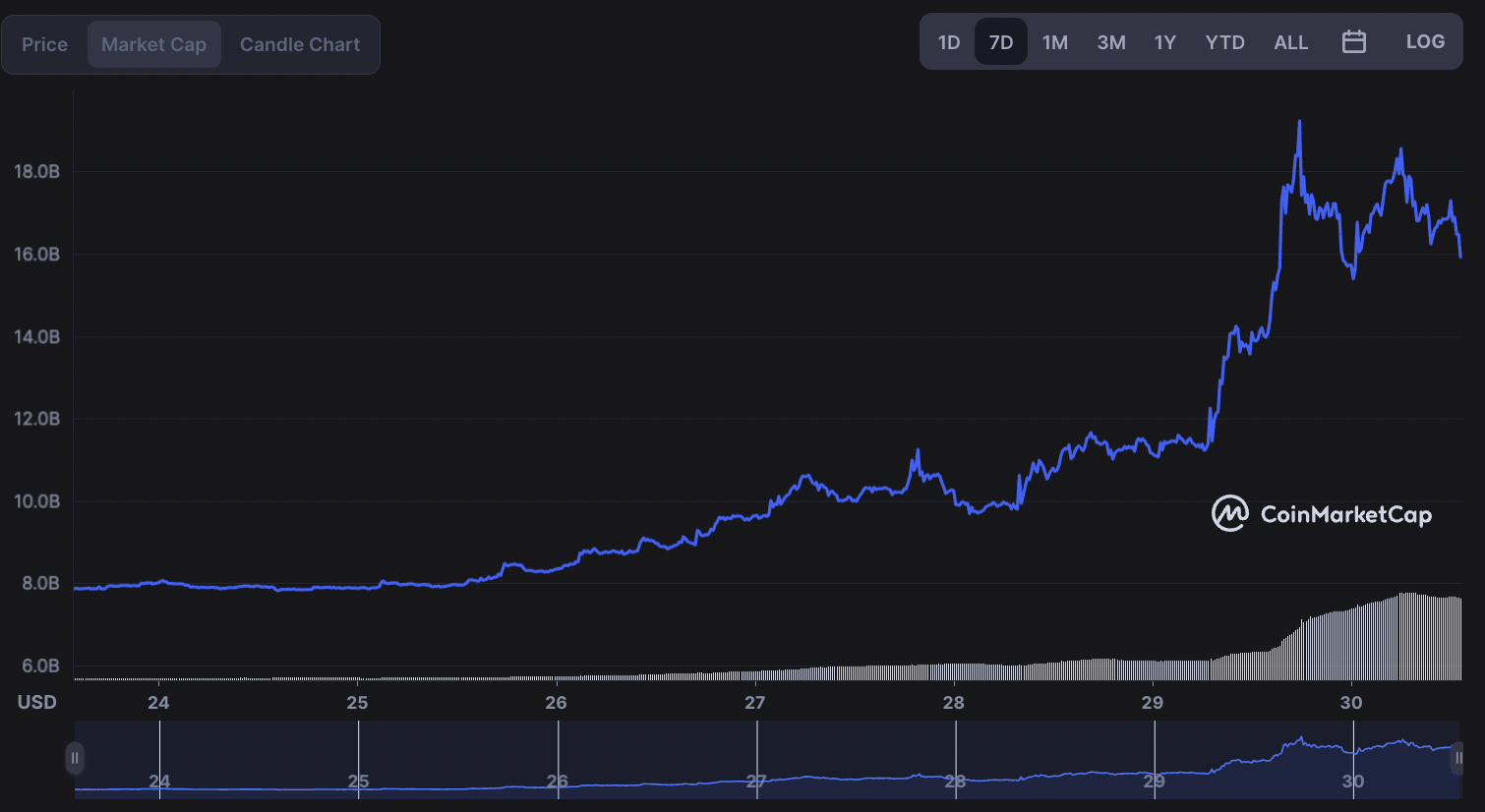

At the same time, the asset is recording a spike in capital inflow. By press time, the token controlled a market cap of $16.86 billion, representing an additional $9.02 billion within a week.

DOGE overtakes ADA

Notably, the capital inflow has pushed DOGE to overtake Cardano (ADA) as the eighth-largest cryptocurrency by market capitalization.

Interestingly, Cardano founder Charles Hoskinson noted that Musk’s takeover of Twitter had increased the potential of DOGE merging with the social media giant. Furthermore, Hoskinson invited Dogecoin to become a sidechain on Cardano amid the increasing asset’s popularity.

DOGE’s price movement

Although the general crypto market correction has weighed down Dogecoin, the asset’s latest resurgence revolves around Elon Musk and Twitter’s takeover. Since Musk began showing support for the token, it has rallied in value. Therefore, there is a widespread notion that DOGE might be added as a means of transaction on Twitter alongside Bitcoin (BTC).

Musk’s support has come from tweeting about DOGE, alongside Tesla’s incorporation of the token as payment means for the company’s merchandise.

Furthermore, despite decreasing interest in meme coins, the Dogecoin community has remained bullish about the token. As reported by Finbold, the cryptocurrency community at CoinMarketCap projected that the asset would trade at an average price of $0.06748 by the end of October 2022.

In the run-up to the Twitter takeover, DOGE witnessed a bullish sentiment, with the asset looking to regain the highs of 2021. Whales increased accumulation of the asset has highlighted the possibility of a rally. As reported by Finbold, as of October 4, Dogecoin recorded 85 whale transactions involving at least $100,000.

DOGE technical analysis

Additionally, DOGE’s technical analysis (TA) projects a positive outlook for the asset. The summary of the technicals aligns with a ‘buy’ sentiment at 15. Elsewhere, moving averages at 14 are for a ‘strong buy. However, the oscillators at three are for selling the token.

Indeed, the focus is whether DOGE will manage to sustain the gains inspired by Musk’s acquisition of Twitter, with the token facing a possible influence from the general market trajectory.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Enjin Coin

Enjin Coin  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD