ETH Maintained Key Support, But the Danger’s Still Not Over: Ethereum Price Analysis

Following the last red days, ETH has hit the support area between the white descending line and the price range at $1,220-$1,280 (in green). So far, the bulls have successfully maintained the high selling pressure; however, the situation is still fragile.

Looking at the bullish case, ETH must close above the key resistance at $1,420 (in red). The first target of such a movement can be considered at $1650. However, the danger is still here, and if the support range at $1220 breaks, ETH is likely going for a retest of around $1K.

Key Support Levels: $1220 & $1000

Key Resistance Levels: $1420 & $1650

Daily Moving Averages:

MA20: $1513

MA50: $1620

MA100: $1472

MA200: $2004

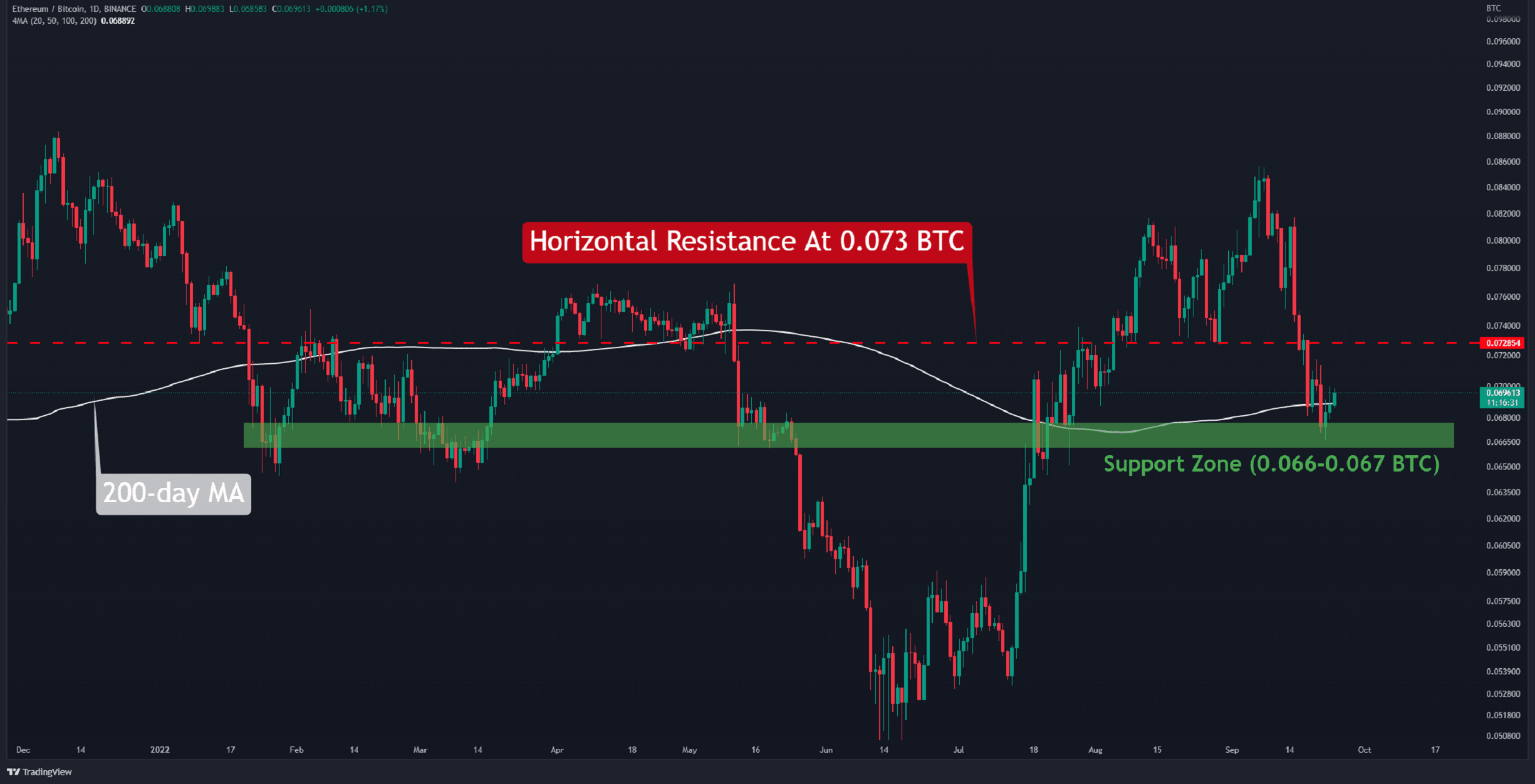

The ETH/BTC Chart

Against BTC, ETH found support amid the 0.067 BTC level (in green) and was able to reclaim the significant 200-day moving average line (in white).

ETH must break above the 0.073 BTC key resistance (in red) to turn back onto the bullish track. Due to Ethereum’s decline below the most recent bottom, both against USD and BTC, a bearish continuation is a more likely scenario right now.

The recovery towards new highs may take some time because of the current negative sentiment.

Key Support Levels: 0.067 & 0.065 BTC

Key Resistance Levels: 0.073 & 0.08 BTC

Technical Analysis By Grizzly

On-chain Analysis

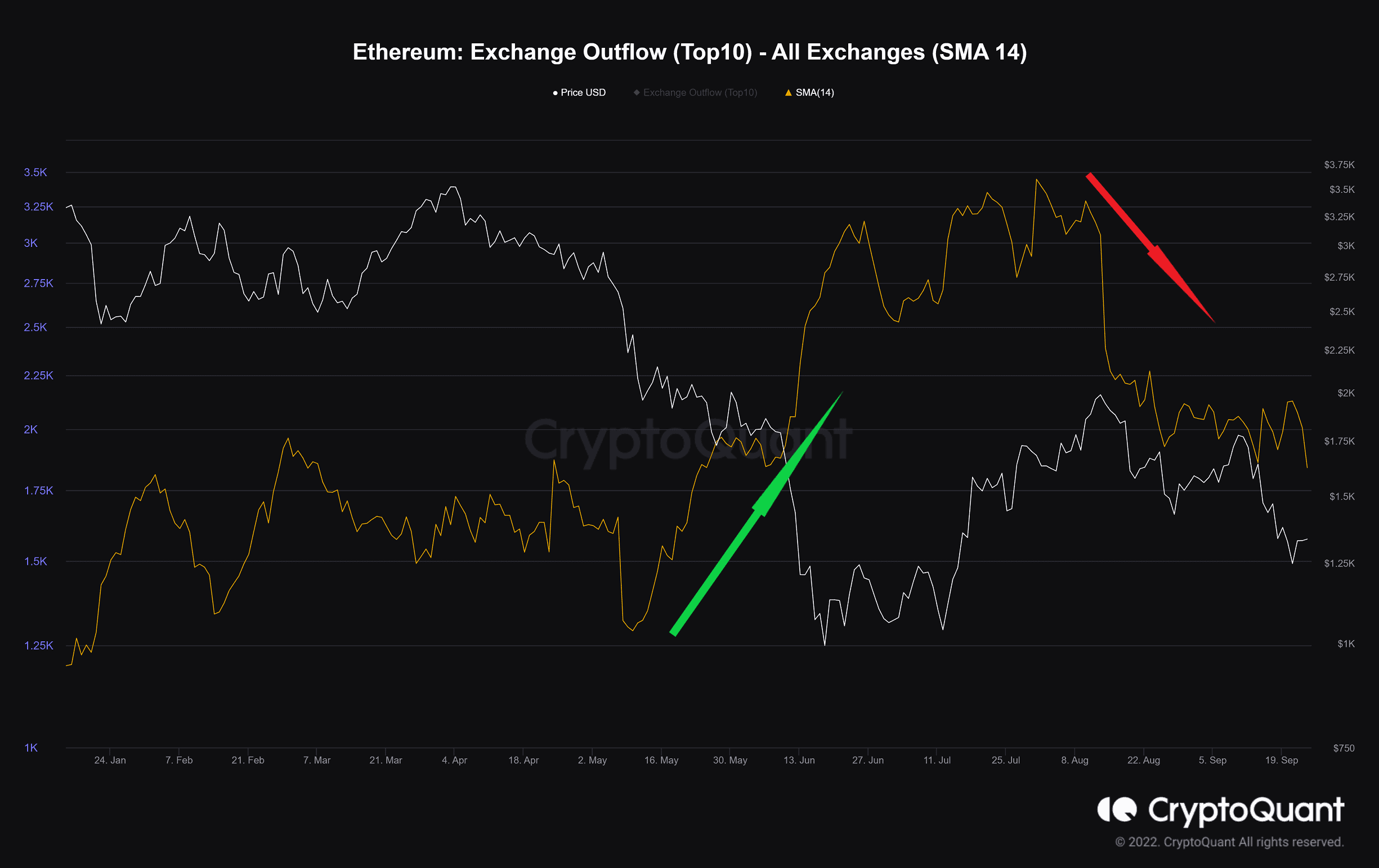

Exchange Outflow (Top10) (SMA 14)

Definition: The total outflow of coins from exchanges – the top 10 transactions.

A high value indicates an increasing number of investors withdrawing large amounts at once. This could suggest a decline in the selling pressure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  Bitcoin Gold

Bitcoin Gold  OMG Network

OMG Network  NEM

NEM  Augur

Augur  Ren

Ren