ETH Rejected From $2K, Here’s the Critical Support to Hold (Ethereum Price Analysis)

Ethereum has experienced a 6.6% correction from the daily high it recorded at $2012. The critical support level lies in the price range between $1700 and $1800, and it is very important for ETH to keep above it to prevent any further declines.

Technical Analysis

By Grizzly

The Daily Chart

Ethereum is moving along inside a rising wedge (in yellow), which is technically a bearish pattern. Simultaneously, the trading volume on Binance is decreasing. This suggests that buyers are gradually reducing.

Suppose that the bulls are able to defend the critical support in the $1,700-$1,800 range (in green) and not allow the pair to break below it. In this case, it is expected that the upward trend will continue with the target of $2200 after completing a brief pullback. Conversely, if the price slips below the mentioned support, it gives bears an opportunity to target $1350-1280 (in light blue).

For now, it is better to have patience and see what Ethereum does after hitting this level.

Key Support Levels: $1800 & $1500

Key Resistance Levels: $2000 & $2200

Daily Moving Averages:

MA20: $1753

MA50: $1464

MA100: $1585

MA200: $2253

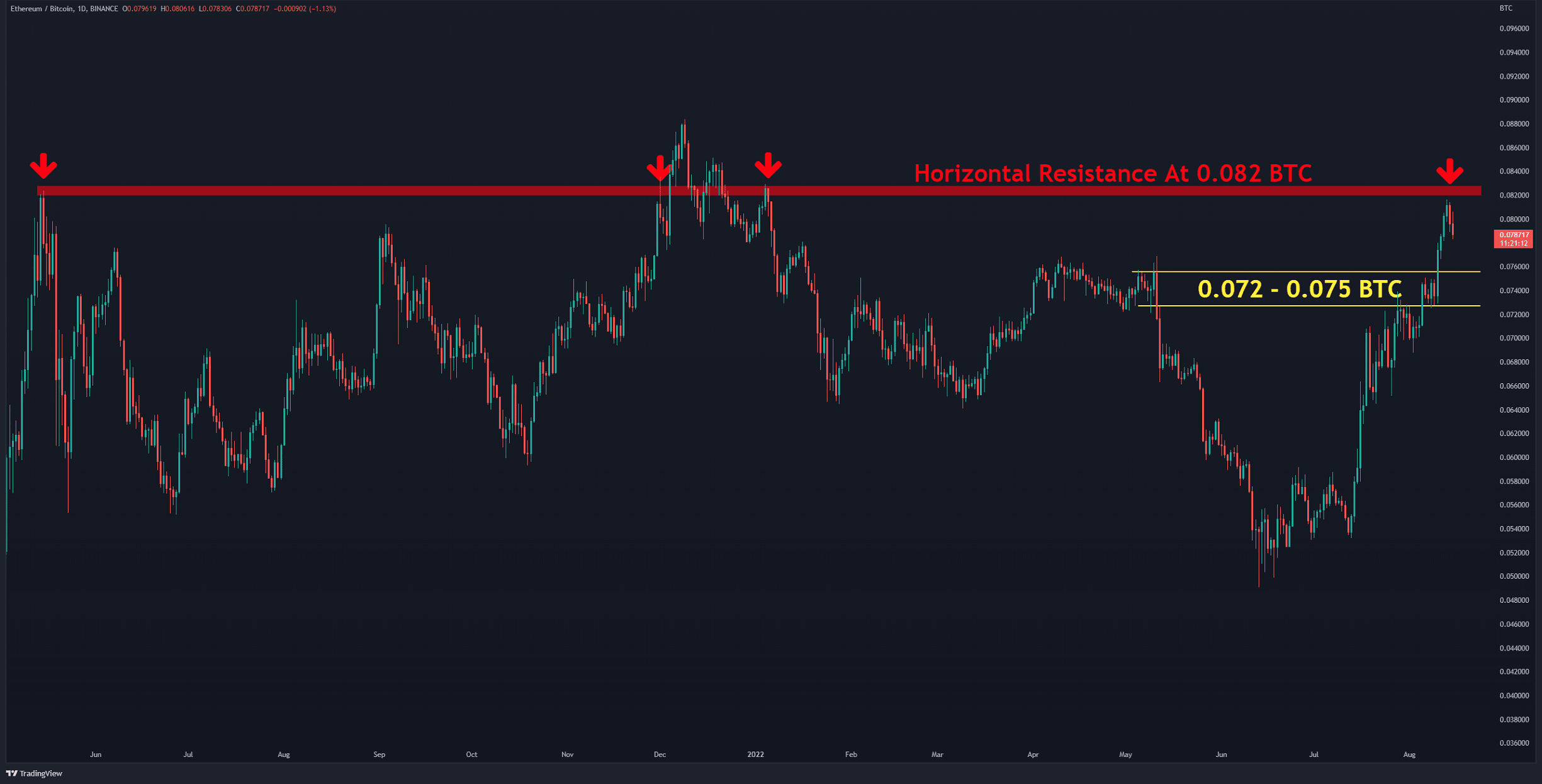

The ETH/BTC Chart

Ethereum’s super bullish trend against Bitcoin stalled when it hit horizontal resistance at 0.082 BTC (in red). Touching this level in the past has been the starting point for deep corrections. But for now, the pair seems likely to retest the upper resistance until the price aims above the support range at 0.072-0.075 BTC (in yellow). As soon as this support cracks, the trend reversal would be confirmed. In this case, the price can decrease down to 0.065 BTC.

Key Support Levels: 0.0.75 & 0.065 BTC

Key Resistance Levels: 0.082 & 0.088 BTC

On-chain Analysis

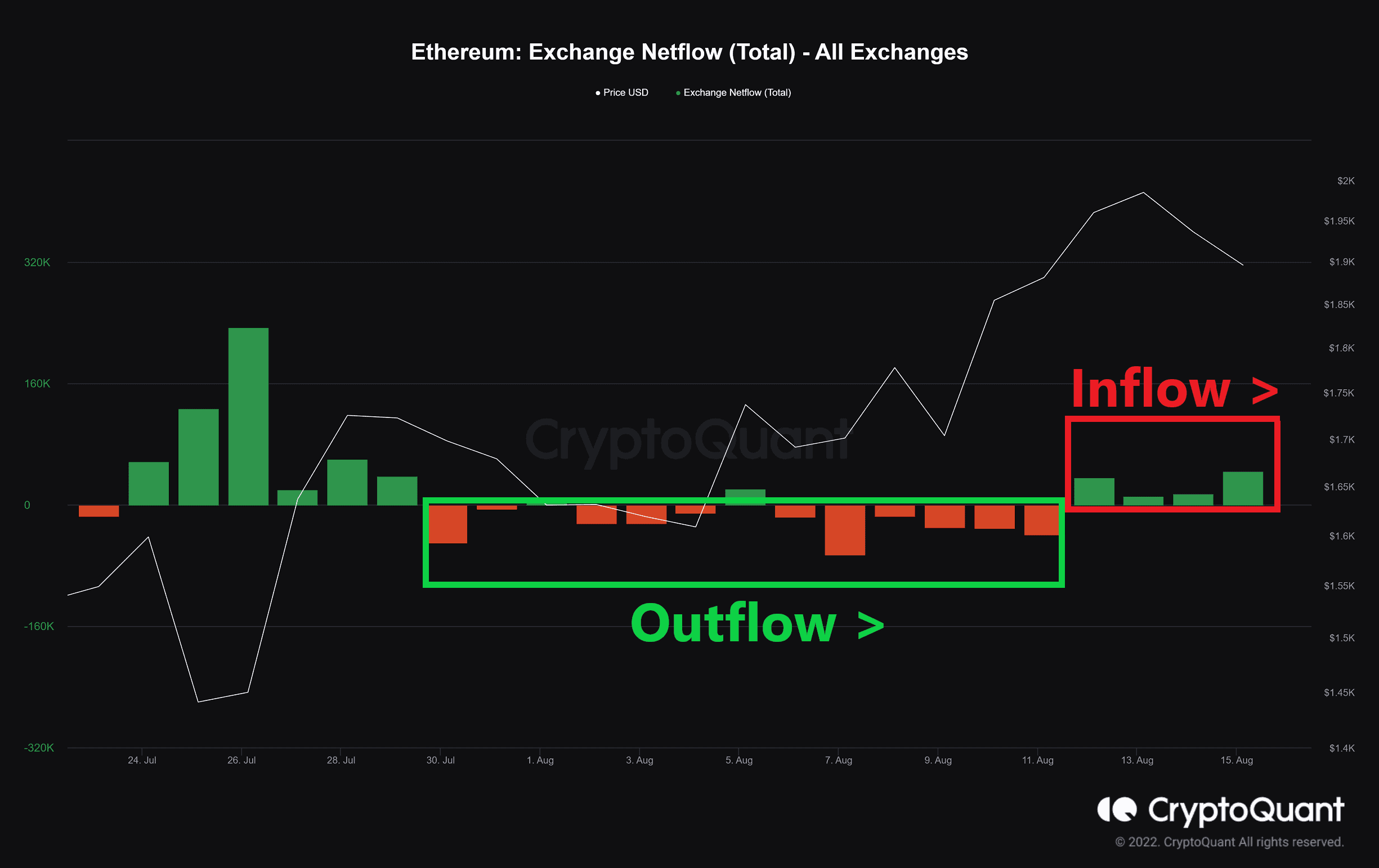

Exchange Netflow

Definition: The difference between coins flowing into and out of the exchange. (Inflow – Outflow = Netflow)

A positive value indicates the reserve is increasing.

As shown below, ETH’s upward trend has been accompanied by a decrease in exchange reserve. Red histogram bars indicate that the outflow is greater than the inflow. In the last four days, the histogram bars have turned green. This indicates that investors deposited their coins in exchange for a possible selloff. It is beneficial to know that this inflow is related to the spot market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur