ETH Shoots 16% Above $1650 As Ethereum Active Addresses Surpass 1 Million

The broader cryptocurrency market cheered after the FOMC meeting on Wednesday, July 27, as the Federal Reserve decided to increase the interest rate by 75 basis points, on the expected lines.

More than $100 billion have been added to the broader cryptocurrency market. The world’s second-largest cryptocurrency Ethereum has shot up more than 16% as of press time moving past $1650 levels.

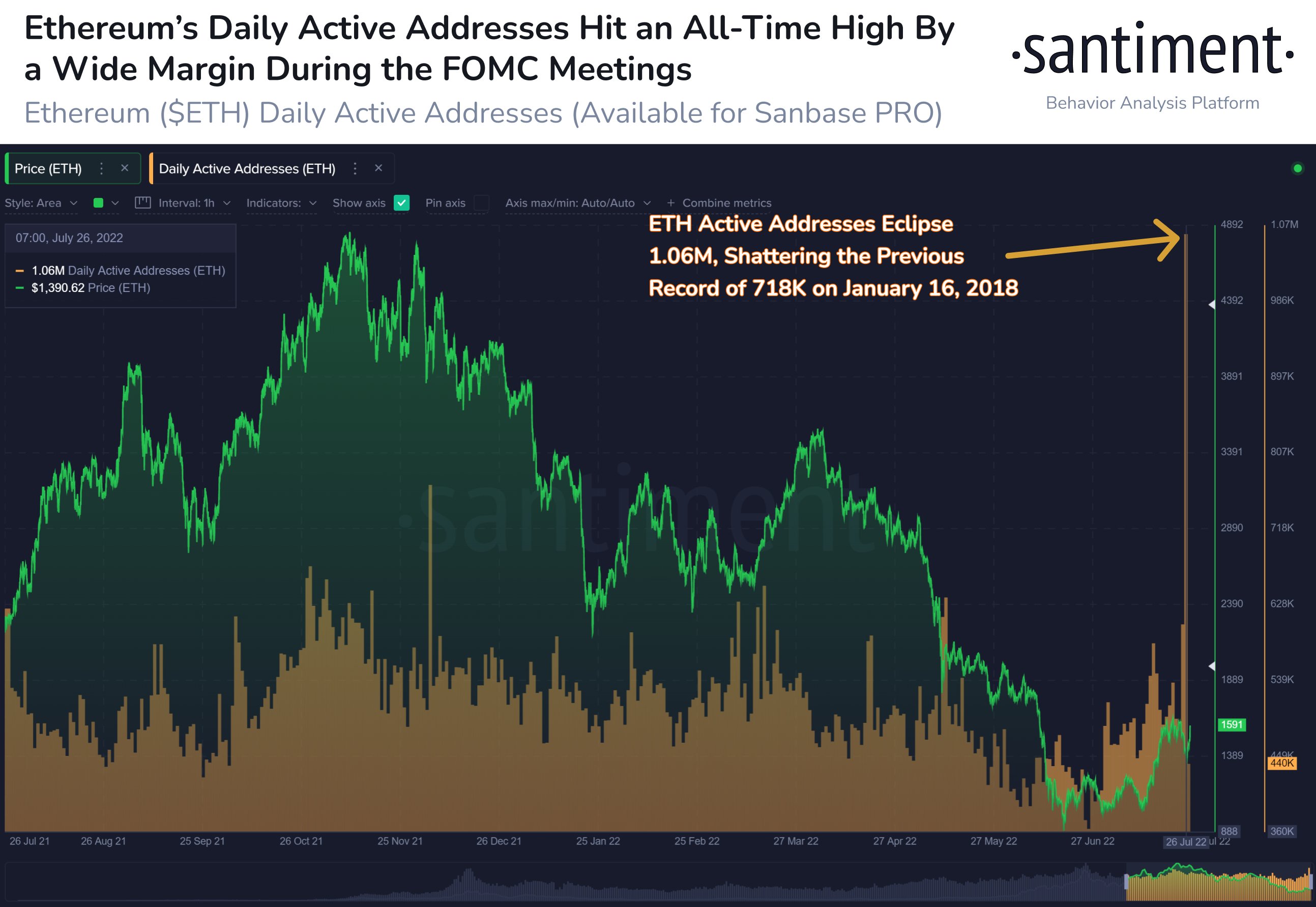

This happened as the Ethereum address activity reached an all-time high of over 1 million. As on-chain data provider Santiment explains:

Ethereum shattered records Tuesday after an incredible surge in address activity broke its #AllTimeHigh by a wide margin. 1.06M $ETH addresses made transactions, & the team is still investigating the cause of the +48% increase over the previous record.

Courtesy: Santiment

A day before, in its report, Santiment noted: “A huge spike in address activity appeared today, the largest one ever in fact, but on lower time frames this activity looks very coordinated, so take this with a grain of salt. This might be some kind of a large-scale airdrop farming operation”.

Ethereum – The Merge Upgrade

In the last two weeks, the ETH price has rallied more than 60% over the flow of positive news in the market. After too much market pessimism, ETH reversed its trajectory from the low of $1,000 over the announcement that the Ethereum Merge upgrade shall happen sometime around mid-September.

Following the success of The Merge upgrade on its testnets, Ethereum developers are confident that the final mainnet launch shall happen in the next two months.

As ETH price rallies hard, one area of concern is that the ETH exchange supply has been increasing very fast. The Santiment report explains: “Notice a sharp spike just recently, which stands for 0.5% of total supply, or approximately 500k ETH added to the exchange wallets. Looks like people are seeking to exit their positions, whether for the reason of price declining, or anticipating the negative data releases”.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Zcash

Zcash  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond