ETH Struggles at $1.8K But is a Pullback Incoming? (Ethereum Price Analysis)

Ethereum’s overall outlook is bullish, but the price is currently facing significant resistance and struggling to surpass it. Considering the recent action, a short-term rejection is possible before the next trend.

Technical Analysis

By Shayan

The Daily Chart

Ethereum bulls are having trouble pushing the price above the significant resistance region of $1.8K. After reaching this crucial range, Ethereum started consolidating with no clear direction, resulting in dull price action.

This indicates a battle between sellers and buyers, and a breakout from this range will likely determine the short-term direction of ETH. Nevertheless, the clear significant bearish divergence between the price and the RSI indicator suggests that there is a higher possibility of the price experiencing a short-term rejection before initiating the next bullish rally.

The 4-Hour Chart

The future short-term direction of Ethereum’s price remains uncertain, with recent action offering no clear indications. However, there are two crucial levels of support and resistance that Ethereum is facing: the $1.7K level as support and the channel’s upper trendline at $1.9K as resistance.

A break above the channel’s upper trendline would signal a bullish turn in the long-term outlook. Conversely, a sharp decline and a fall below the mid-boundary level could indicate a bearish trend, with the next level of support being the $1.5K mark.

On-chain Analysis

By Shayan

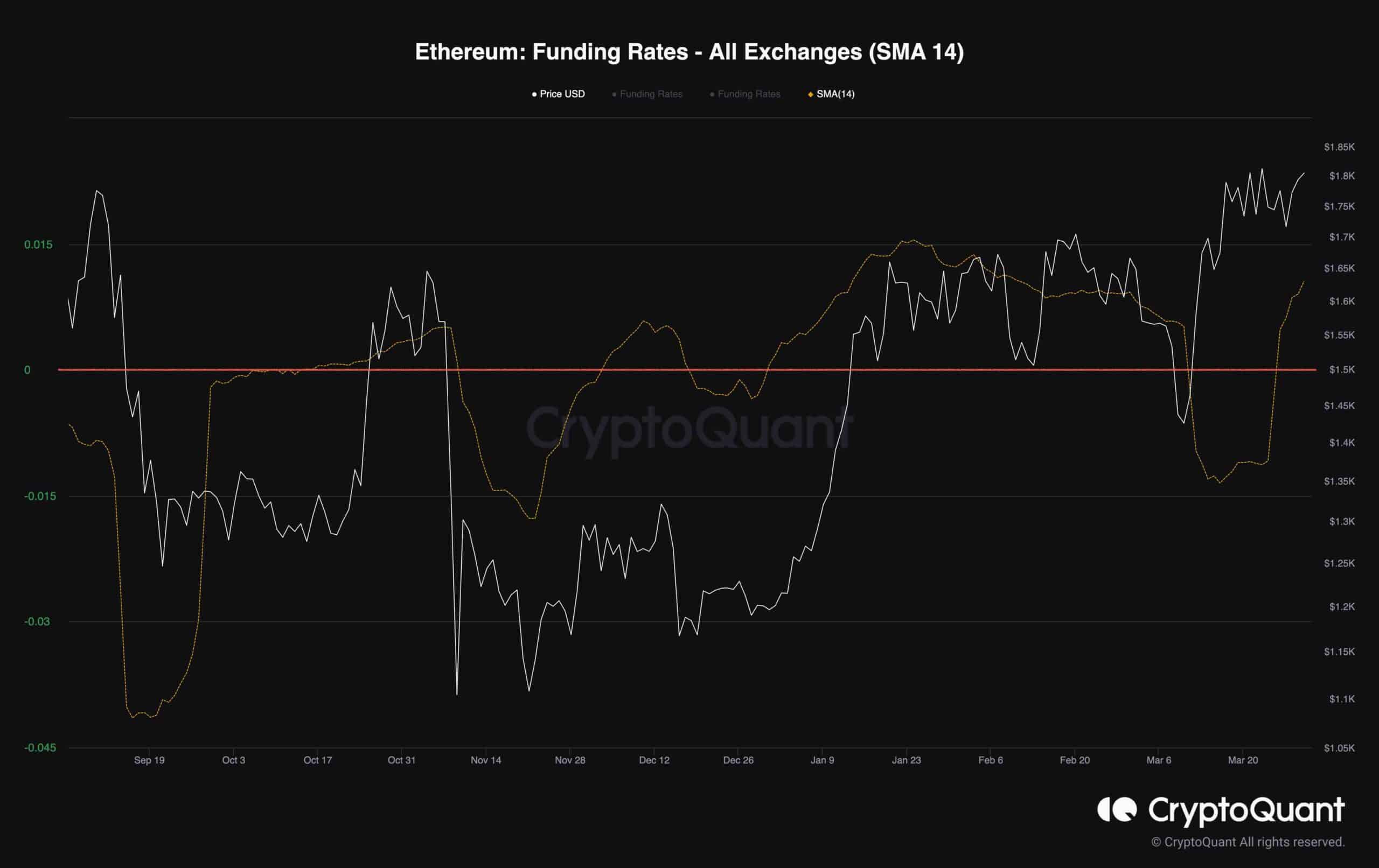

This graph demonstrates the 14-day moving average of the Funding Rates metric alongside Ethereum’s price. Over the past few months, the latter has shown a bullish trend, and the overall market sentiment has turned positive. This shift in sentiment is reflected in the funding rates metric.

However, during a recent shakeout, the funding rate metric also plummeted and dropped below 0 for a short period of time.

Yet, after another bullish price rally, the metric has also reclaimed 0 and turned green, indicating bullish sentiment over the market. Nevertheless, Ethereum’s general bias is bullish for the mid-term, and the metric should be monitored closely to prevent losses due to sudden price drops.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Qtum

Qtum  Synthetix

Synthetix  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Numeraire

Numeraire  Holo

Holo  Siacoin

Siacoin  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren