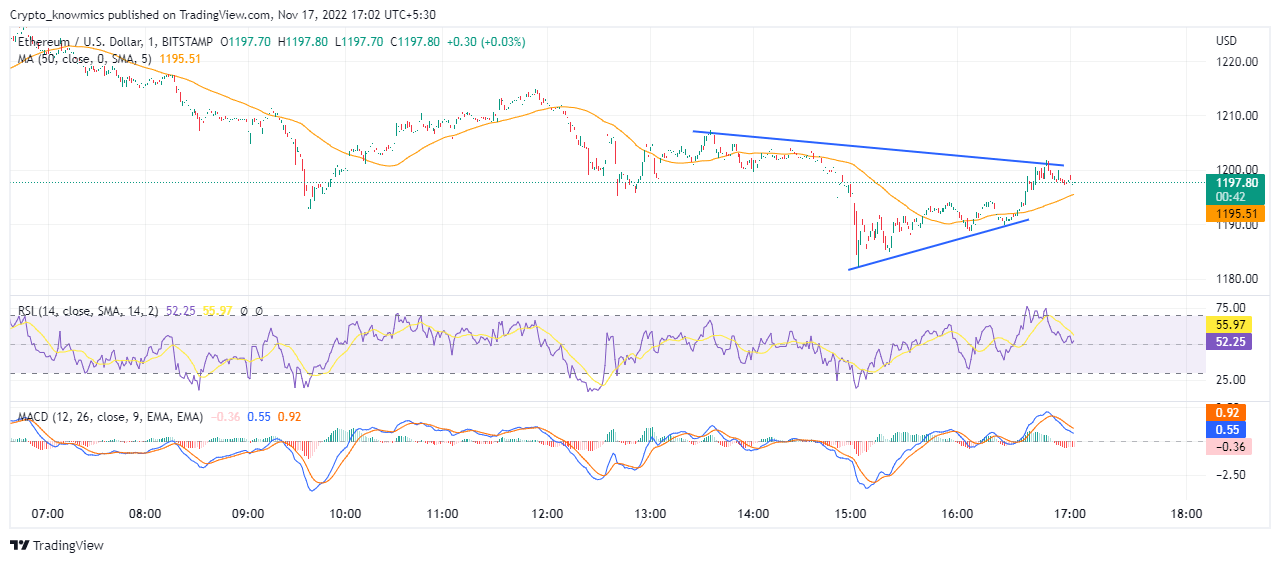

ETH Technical Analysis: Buyers Struggling To Form Reversal Pattern

The ETH technical analysis displays a continuation of bearish momentum as the Ethereum price actions do not show any signs of reversal, despite RSI representing buying opportunities for the traders. While the global cryptocurrency market cap dropped by 1% on Wednesday, Ethereum (ETH), the second-most valuable cryptocurrency, has also been in red due to increasing bearish sentiments. Despite early recovery efforts, ETH has been trading sideways between the range of $1175 and $1227 on Thursday. Currently trading at $1191, the 3.32% drop in the last 24 hours kept ETH under the influence of bearish momentum. At $146.1 billion, the ETH market cap declined by 2.66%, whereas 24-hour trading volume plunged by 2.16% to reach $11.5 billion, supporting the bearish trend in the market due to high selling pressure.

Key Points

- The daily chart shows a downtrend with a reversal possibility due to an increase in demand

- RSI at 52 shows a balance between supply and demand

- The intraday trading volume in ETH is $11.5 billion

Source: Tradingview

ETH Technical Analysis

In the previous analysis, ETH displayed strong recovery signs after a bullish breakout at $1,180 while prices sustained momentum above $1,200. However, ETH failed to maintain the bullish reversal in the following days. ETH has struggled to break the ceiling of $1283 since last one week witnessing a surge of 0.67% over the 7 days. Sideline traders need to wait for another bullish reversal to get an entry opportunity. If ETH can encash the bullish reversal it may break above $1300. Conversely, if the current bear prolongs, the prices may fall below the psychologically important mark of $1000.

Technical Indicators

After making a bearish divergence at the overbought boundary, RSI slid to the midpoint showing a balance in demand and supply, signaling buying opportunity for traders. The bearish crossover made by the MACD line with a bearish histogram signals bearish momentum in the market. Therefore, although the technical indicators do not show an optimistic overview of ETH at the moment, intraday traders may look for buying opportunities at the next major fallout.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD