$ETH: Where Analysts Are Expecting Ethereum Price to Go in Short to Medium Term

There is no denying that Fed Chair Jerome Powell’s speech about inflation on Friday (August 26) brought major pain to both U.S. stocks and crypto. The question is how much are his comments going to going the affect the $ETH price in the coming days/weeks.

On Friday, Federal Reserve Chair Jerome Powell give an important speech at the 2022 Economic Policy Symposium (in Jackson Hole, Wyoming), which was hosted by the Federal Reserve Bank of Kansas City.

In a speech titled “Monetary Policy and Price Stability”, Powell said:

“The Federal Open Market Committee’s (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone…

“Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

“July’s increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook. At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.“

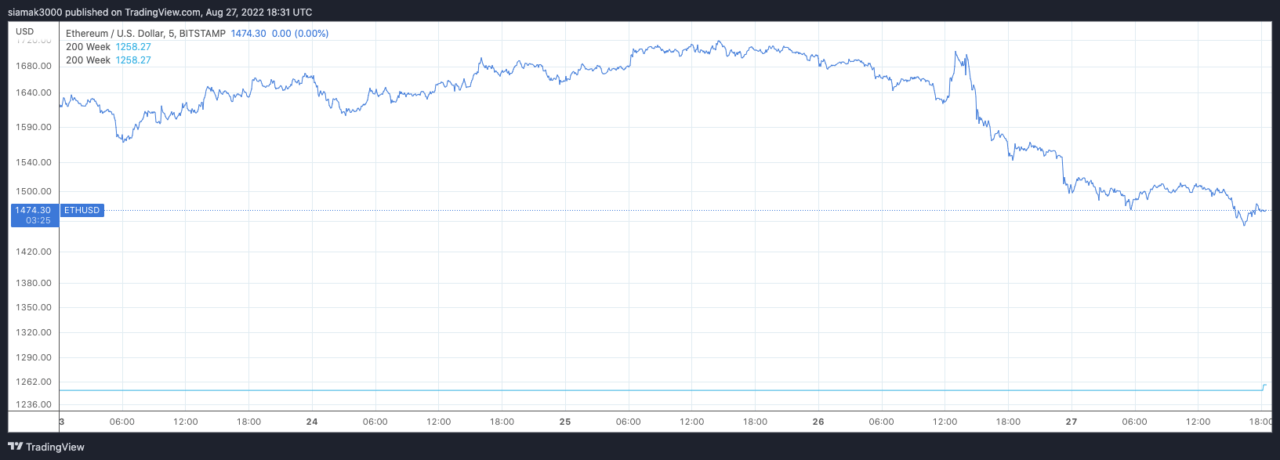

Naturally, Powell’s hawkish tone made investors and traders nervous, leading to a sell-off in both U.S. stocks and cryptocurrencies.

Source: TradingView (5-Day ETH-USD Chart)

Concern about what Powell would say on August 26 started around August 14, when $ETH had an intraday high of $2,002 (which was the top of an $ETH rally that started on June 18, when the price got as low as $902).

Here is what some popular crypto analysts and traders saying now — post Powell’s Jackson Hole speech — about the short to medium term prospects for the $ETH price:

$ETH

Short squeeze to 1800 is still likely. Then new lows. pic.twitter.com/Z9TJfvVLem

— il Capo Of Crypto (@CryptoCapo_) August 27, 2022

Likely premature to buy the dip. Equities after such a large event triggered move, particularly on a Friday, tend to continue lower. Think early next week will be bloody, and there’s payrolls data next Friday to trigger a reversal.

— Alex Krüger (@krugermacro) August 27, 2022

Please stop assuming that the $ETH merge or #crypto adoption will prevent more downside if the global macro environment continues to deteriorate.

Valuations rarely run parallel to growth, and global macro trumps crypto macro.

— Justin Bennett (@JustinBennettFX) August 27, 2022

Image Credit

Featured Image via Unsplash

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur