ETH With Another Attempt to Reclaim $1.7K, Will it Succeed? (Ethereum Price Analysis)

It appears that Ethereum failed at yet another attempt to convincingly overcome $1,700, showing that the buying pressure is slowly fading. The question is if the momentum will pick up or if the bears will take the opportunity to bring the price lower.

Technical Analysis

By Grizzly

The Daily Chart

The daily chart shows that the firm resistance in the $1,700-$1,800 range is far from over. This resistance zone, which includes the 100-day moving average (in white), is considered the main obstacle for bulls on the way to $2000. A break and close above it would signal the start of a new uptrend with a target of $2,200 (in blue), which overlaps with the 200-day moving average (in purple).

Countering this assumption, if the demand in this area dries up and the bears dominate the market again, the possible decline can extend to the support zone in the range of $1,280-1,350 (in green).

Currently, the structure has not changed, and until the lower highs and lower lows are formed, the bullish sentiment prevails.

Key Support Levels: $1500 & $1350

Key Resistance Levels: $1800 & $2200

Daily Moving Averages

MA20: $1589

MA50: $1323

MA100: $1681

MA200: $2294

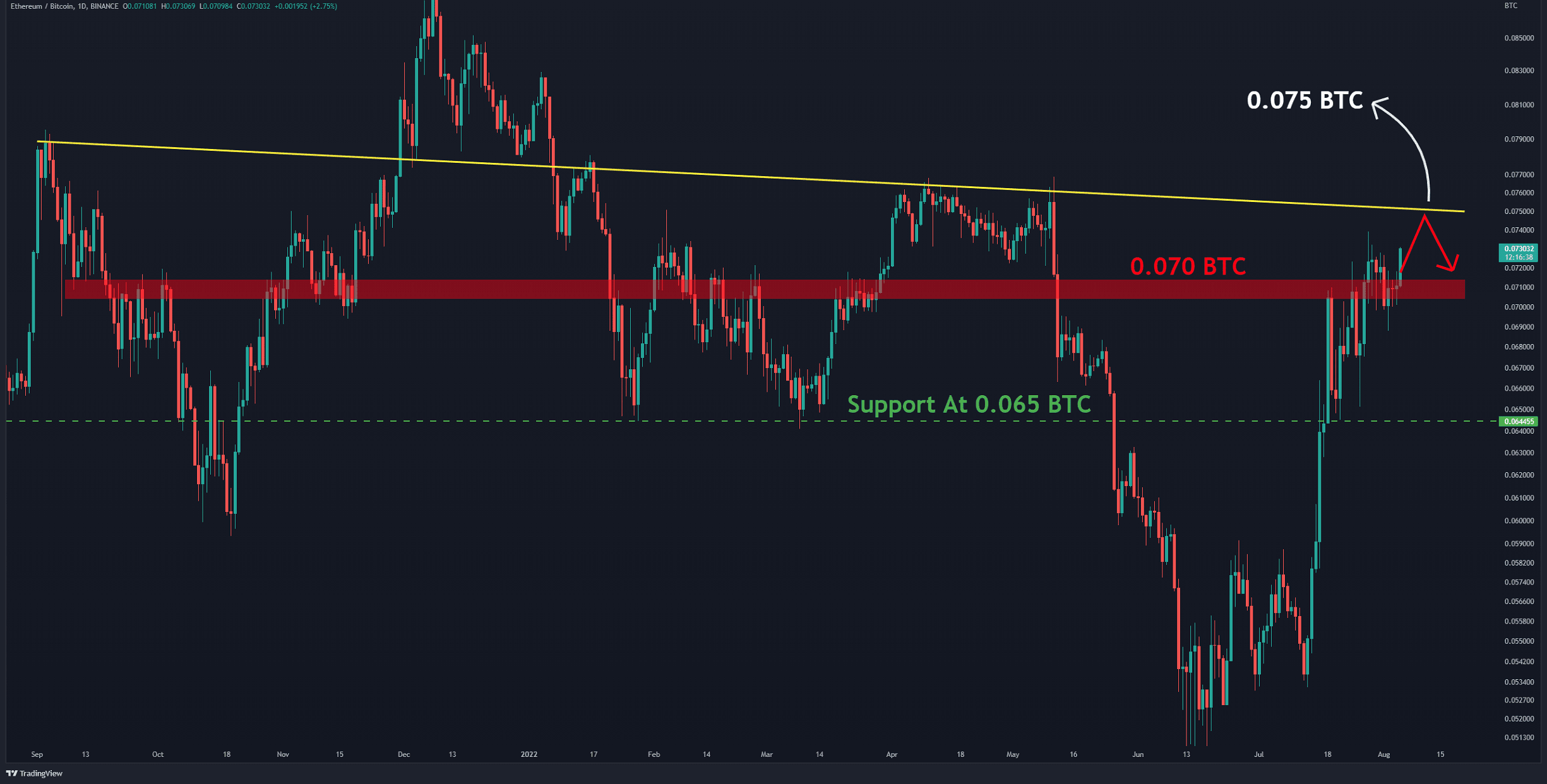

The ETH/BTC Chart

Against Bitcoin, the buyers dominate the market completely. All corrective attempts on the lower time frames are absorbed quickly. The bulls are trying to sustain the price above 0.07 BTC (in red). At this point, it seems more likely that the resistance at 0.75 BTC will be tested. This is where the bears might stage a reappearance. The bullish trend would remain strong as long as ETH is trading above horizontal support at 0.065 BTC (in green).

Key Support Levels: 0.065 & 0.06 BTC

Key Resistance Levels: 0.073 & 0.075 BTC

Sentiment Analysis

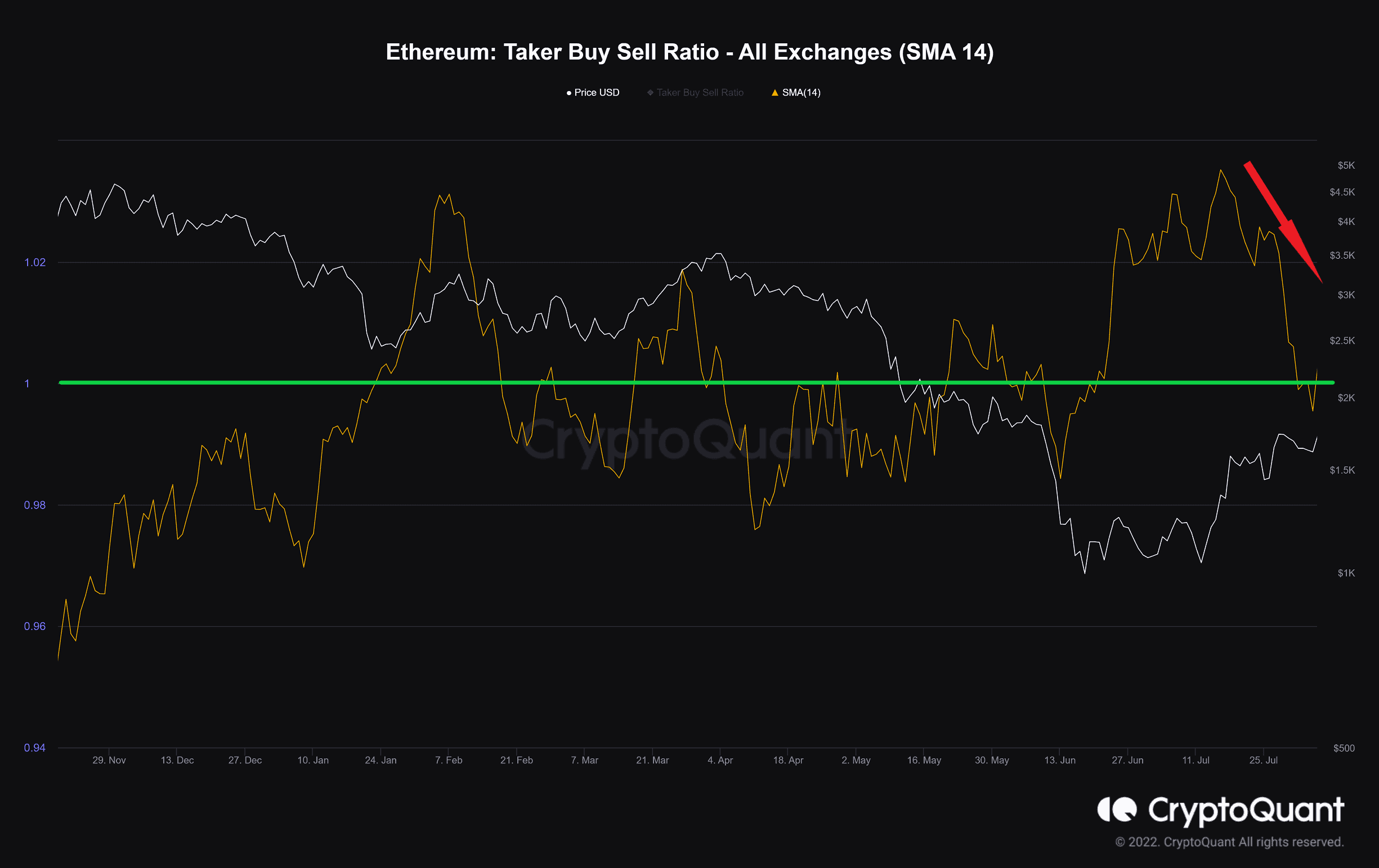

Taker Buy Sell Ratio

Definition: The ratio of buy volume divided by sell volume of takers in perpetual swap trades.

Values over 1 indicate bullish sentiment is dominant.

Values under 1 indicate bearish sentiment is dominant.

Evidently, takers have filled additional buy orders in the last three months. This caused Ethereum to experience a significant price climb. But since July 18, this metric has been moving downwards. Although it is still above the baseline (in green), it suggests that the strength of the takers on the buy side is gradually decreasing. This issue is likely due to profit-taking around the solid resistance by short-term traders.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur